Bitcoin price underpinned as markets search for direction

- Bitcoin price was primed to book nearly 10% on Monday.

- BTC price left traders behind with only a 2% slim gain for the day as markets remained nervous.

- Several geopolitical comments are having an impact on the markets but await a catalyst.

Bitcoin (BTC) price action had a choppy start to the week as markets were on edge in early trading on the Biden-Xi meeting. However, the meeting did not amount to much importance, and markets only saw the dollar going one way as stocks were being thrown left and right between losses and profit. Expect to see markets searching for direction on Tuesday with Bitcoin price poised to jump back to $18,000.

BTC price to use calmness to advance

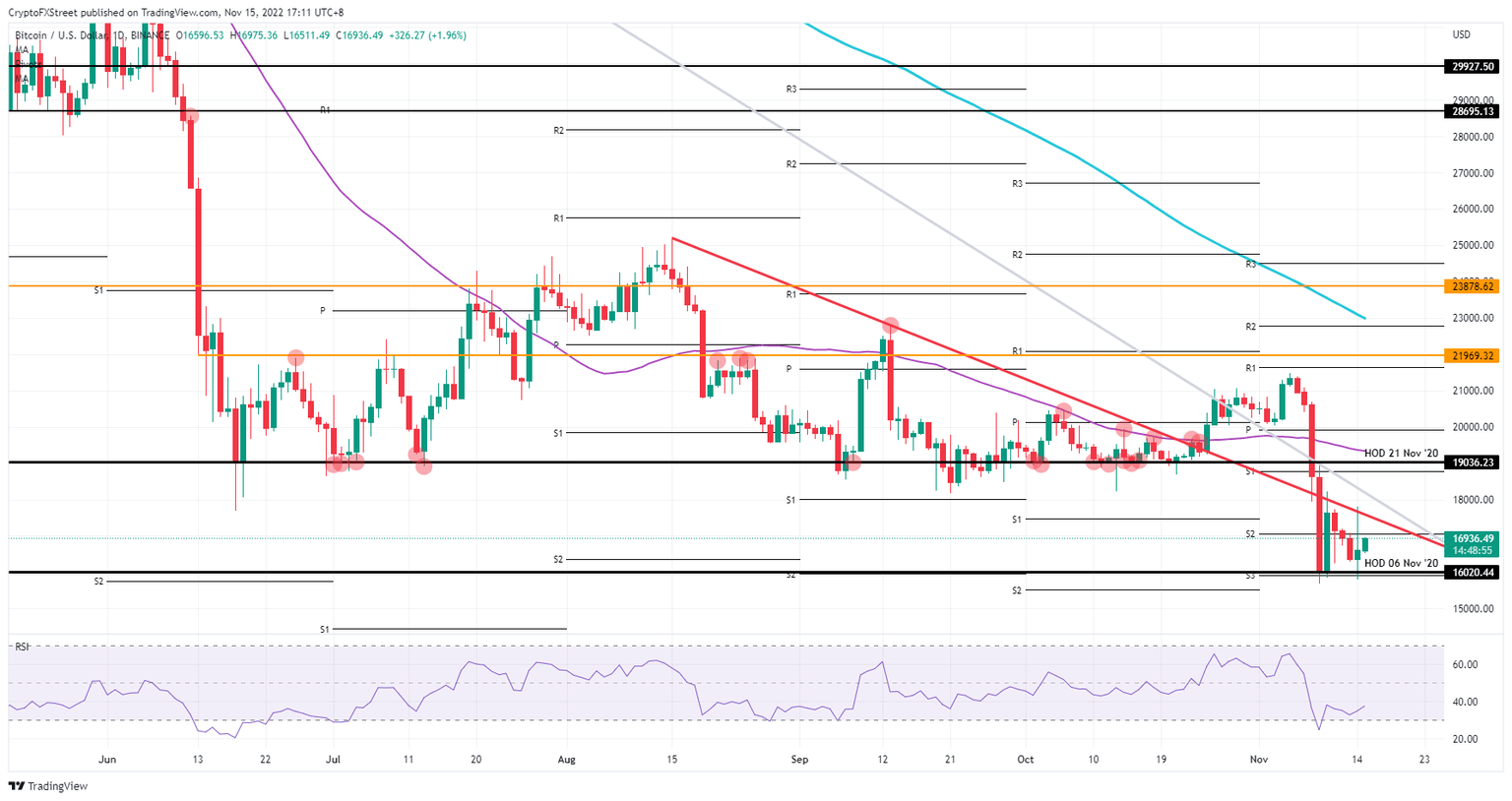

Bitcoin price action currently has two elements: that calmness in the markets after the whipsaw price action of last week and the fact that price action in BTC itself is being underpinned. That level comes at $16,000, where $16,020 sees some good support for a second week. Ideally, it would be good for Bitcoin price to close above the close from Monday, which does look too hard to get done.

BTC price is set to get pumped as supportive elements are present, and the current calmness in the markets could see Bitcoin jump toward $18,000. That would mean that the red descending trend line is losing interest again. Should the calmness continue with markets getting a bit of geopolitical fatigue, even $19,036 could be in the cards for the end of November.

BTC/USD daily chart

As Zelensky alluded to in his speech on Monday after visiting Chesson, peace talks could get underway. However, the devil is in the details here. The US has been holding high-level talks with Russia already, and a clear impasse has emerged. Russia could still re-escalate the situation and still holds quite a lot of nuclear options to retaliate, which would mean that BTC price is still at risk of breaking below $16,020 and hitting $15,000 in the wake of that escalating event taking place.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.