Bitcoin Price Prediction: the risks of BTC/USD collapse below $9,000 are growing — Bitcoin confluence

- BTC/USD bears try to push their agenda and threaten $9,000.

- The downside is a path of the least resistance at this stage.

Bitcoin (BTC) tested the intraday low of $9,076 amid massive sell-off on the cryptocurrency market and recovered to $9,1120 by press time. The first digital coin has been drifting lower since the start of the day amid global sell-off on the cryptocurrency market. Currently, BTC/USD is moving within a short-term bearish trend, the volatility is high.

BTC/USD 1-hour chart

BTC/USD may be vulnerable to further losses as the RSI on the intraday charts points downwards. However, from the longer-term point of view, BTC is still in the range as long as the lower boundary of the recent consolidation channel $9,000 remains unbroken.

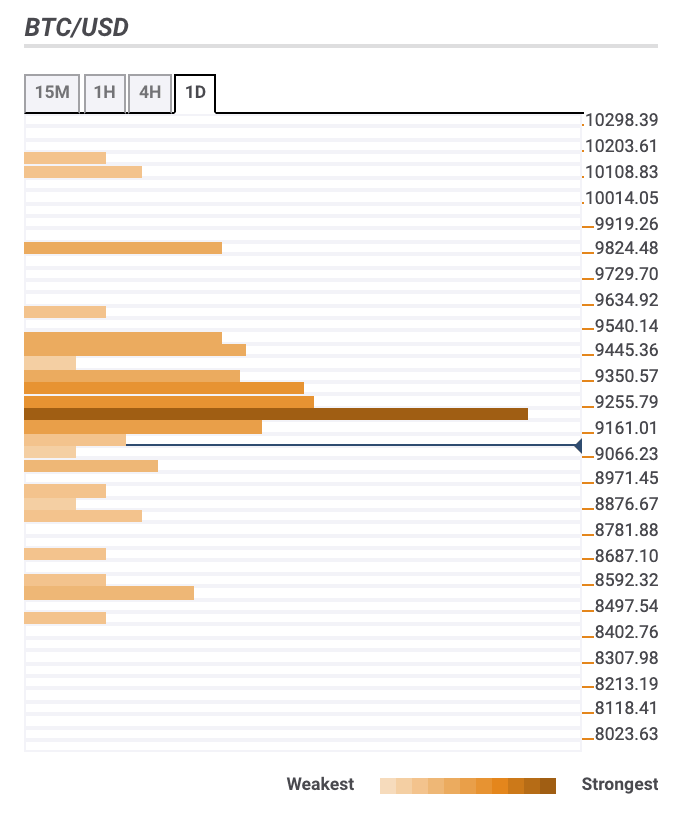

Bitcoin confluence levels

There are a few technical barriers clustered above the current price, while a road to the South is practically clear. It means Bitcoin may be vulnerable to further losses at this stage, while the bulls may have a hard time building momentum.

Resistance levels

$9,200 — 4-hour SMA100, the middle line of the 1-hour and the daily Bollinger Bands, 38.2% Fibo retracement daily and daily, 23.6% Fibo retracement monthly

$9,300 — the highest level of the previous day, 1-hour and 4-hour SMA200

$9,500 — the highest level of the previous week

Support levels

$9,000 — Pivot Point 1-week Support 1, the lower line of the daily Bollinger Band

$8,870 — daily SMA100, the lowest level of the previous month

$8,500 — daily SMA200, Pivot Point 1-month Support 2

BTC/USD, 1-day

Author

Tanya Abrosimova

Independent Analyst

-637304863395187174.png&w=1536&q=95)