Bitcoin Price Prediction: BTC’s next stop is $22,000 if...

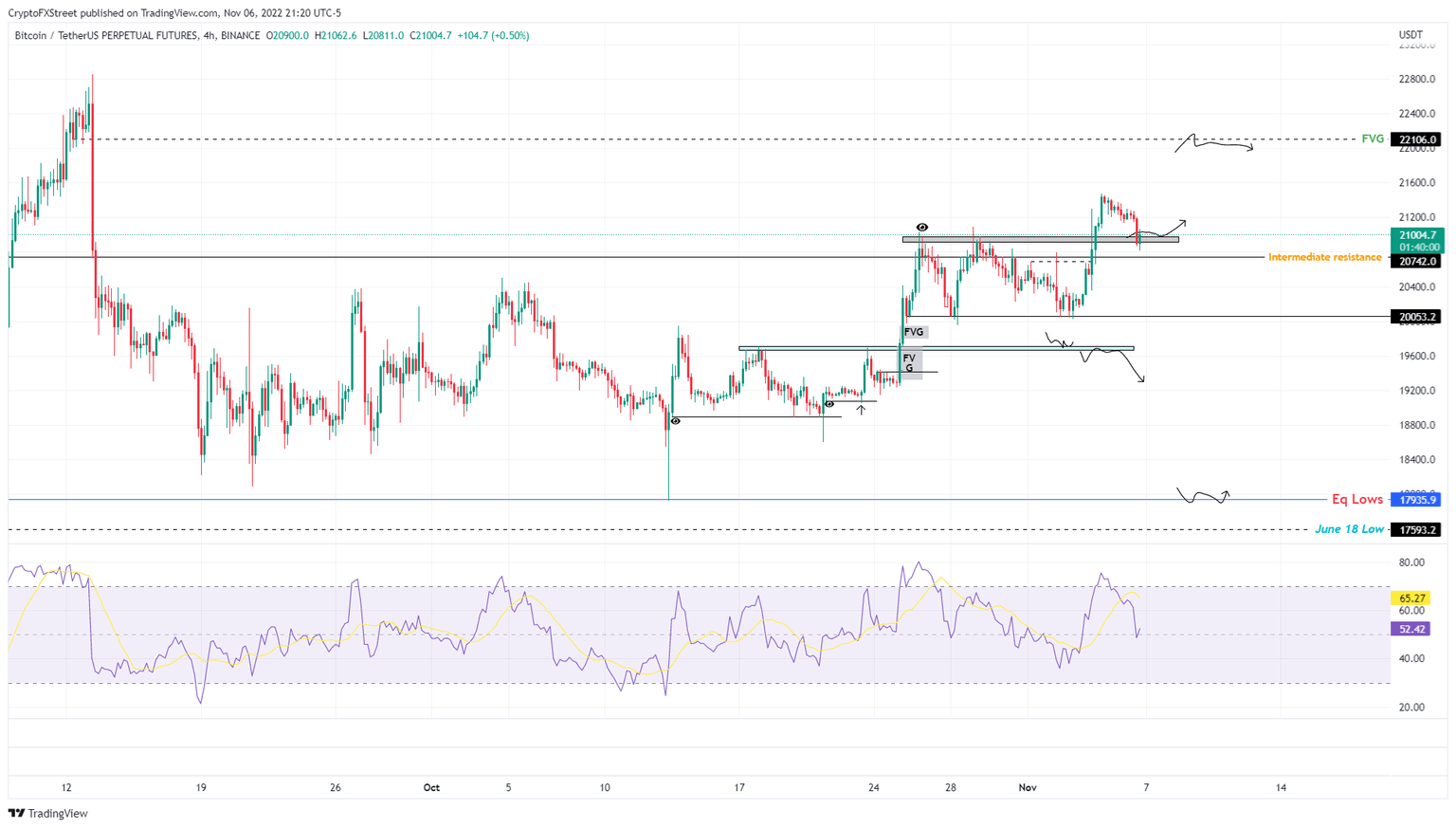

- Bitcoin price retests the $20,970 support level, hinting at a reset before the next leg.

- If the existing support structure holds, investors can expect BTC to trigger a run-up beyond $22,000.

- A daily candlestick close below $20,742 will invalidate this short-term bullish structure and forecast losses.

Bitcoin price shows a clear retest of the immediate support level, allowing buyers to regroup and prepare for the next leg. This development has bullish implications, especially if the current foothold does not give in.

Bitcoin price eyes a higher level

Bitcoin price slipped 3% after setting up a local top at $21,473. This downswing was necessary to blow off steam after last week’s impressive upswing. As BTC retests the $20,970 support structure, investors can expect a resurgence in buying pressure that pushes it higher.

Supporting this move for the big crypto is the Relative Strength Index (RSI), which is hovering around the midpoint at 50. This position for RSI indicates that the bullish and bearish momentums have reset, allowing both camps an opportunity to take over.

Due to the aforementioned support level, there is a high chance Bitcoin price will bounce higher and target the inefficiency at $22,106. In a highly bullish case, BTC could attempt a retest of the $25,000 psychological level.

BTCUSDT 4-hour chart

While things are particularly in favor of bulls, Bitcoin price needs to hold the $20,970 support structure for a further move north. In case the sellers flip the $20,742 foothold into a resistance level, it will invalidate the bullish outlook and trigger a sell-off.

The spike in selling pressure could knock Bitcoin price to $20,053 and the sell-stop liquidity resting below this level. A stable support level that could absorb this incoming bearish momentum would be $19,706.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.