Bitcoin Price Prediction: BTC bulls target $54,500 next

- BTC/USD bulls catch a breather around record top, keeps upside break of six-week-old resistance marked Wednesday.

- Bullish MACD, sustained trading above 10-day SMA, FE 61.8% also favor the buyers.

- Early January top restricts bear’s entry, $55,000 adds to the upside filter.

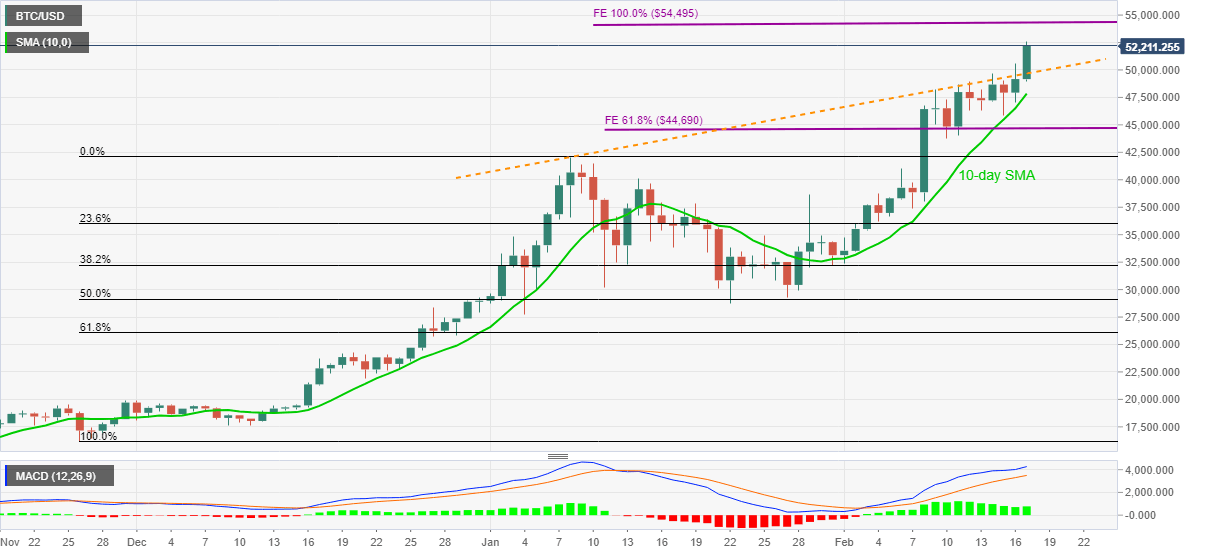

Bitcoin remains on the front foot despite the latest dribbling around the record top of $52.638 during early Thursday. In doing so, the BTC/USD pair keeps the previous day’s upside break of short-term key resistance line while extending run-up beyond 61.8% Fibonacci Expansion (FE) of November 26, 2020, to January 08, 2021, upside and the following pullback to $28,768 on January 22, 2021.

Also favoring the cryptocurrency buyers is the quote’s successful run-up beyond 10-day SMA amid the bullish MACD.

As a result, the BTC/USD prices are well directed towards the next FE resistance level of 100% around $54,500 ahead of targeting the $55,000 round-figure.

Meanwhile, the $50,000 psychological magnet precedes the previous resistance line, at $49,700, to restrict the short-term downside moves.

Even if the BTC/USD sellers dominate past-$49,700, 10-day SMA and the early January 2021 top, respectively around 47,850 and $42,000, will add filters during the further declines.

Overall, the bitcoin bull-run has a long way to go before hitting the wall wherein the $54,500 hurdle can satisfy buyers for now.

BTC/USD daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.