Bitcoin Price Forecast: BTC holds above $100K following Fed’s Michael Barr resignation

Bitcoin price today: $101,300

- Bitcoin price edges slightly down around $101,300 on Tuesday after rallying almost 4% the previous day.

- The announcement of Michael S. Barr’s resignation as Fed Vice Chair for Supervision on Monday has pushed BTC above the $100K mark.

- Bitfinex report highlights that Bitcoin continues to look robust; however, a deeper pullback in the first quarter remains possible.

Bitcoin (BTC) edges slightly down to around $101,300 on Tuesday after rallying almost 4% the previous day. The announcement of Michael S. Barr’s resignation as Federal Reserve (Fed) Vice Chair for Supervision on Monday has pushed BTC above the $100K mark. A Bitfinex report highlights that Bitcoin continues to look robust; however, a deeper pullback in the first quarter of the year remains possible.

Bitcoin closed above $102,000 following Fed’s Michael Barr resign

Bitcoin price claimed its $100K mark and closed above $102,000 on Monday following the Federal Reserve Board announcement that Michael S. Barr will step down from his position as Fed Vice Chair for Supervision. This announcement positively impacted the overall crypto market as Barr is known for his stringent regulatory approach towards banks engaging with and custodying cryptocurrencies. His departure is expected to ease concerns over potential harsh regulatory changes during President Biden’s final days in office.

“Barr’s resignation will officially be effective on February 28 or earlier as a successor is confirmed but will continue to serve as a member of the Federal Reserve Board of Governors,” says the Fed’s press release post.

The “Bitfinex Alpha 2025” report on Monday highlights that Bitcoin continues to look robust; however, a deeper pullback in the first quarter of 2025 remains possible.

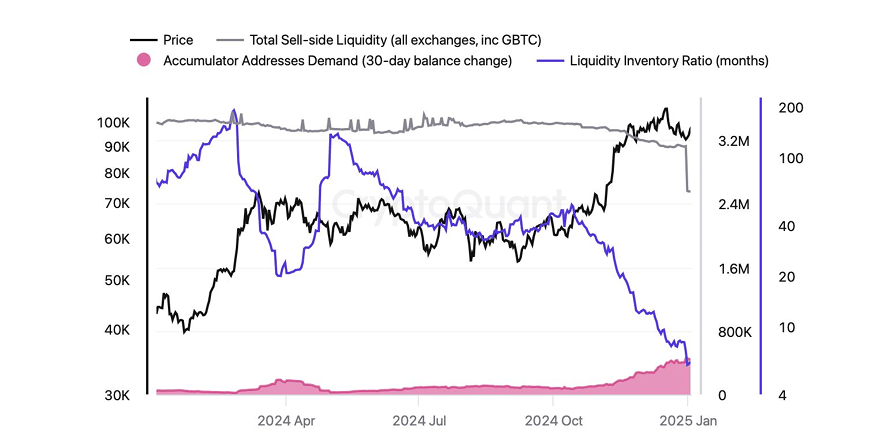

The report explains that Bitcoin’s sell-side liquidity is shrinking rapidly, as shown in the figure below. The Liquidity Inventory Ratio (represented by the blue line), which measures how long the current supply can meet demand, has dropped sharply from 41 months in October to 6.6 months in January. This significant decline aligns with the rally observed in Q4 of 2024, indicating a tightening of available liquidity during periods of strong market activity.

Bitcoin Price vs Sell-Side Liquidity chart. Source: CryptoQuant

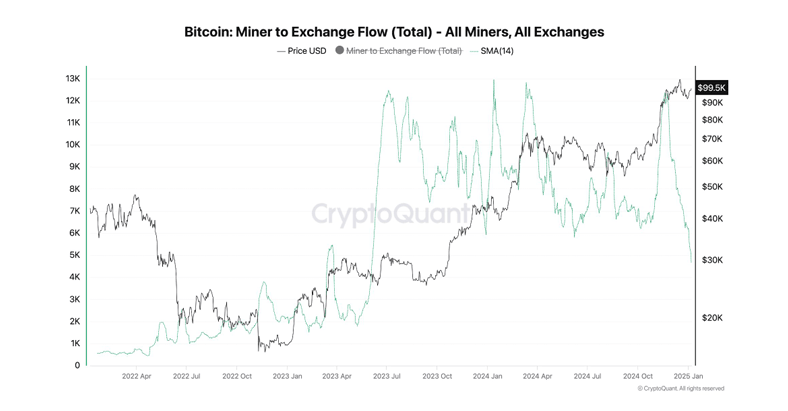

Moreover, according to the report, this tightening supply aligns with data seen from Bitcoin mining activity. Since the Bitcoin Halving event in April 2024, the miners’ selling activity, which is necessary rather than profit-taking to maintain profitable operations, has declined rapidly in early 2025, signaling reduced selling pressure.

Bitcoin Miners to Exchange Flow chart. Source: CryptoQuant

In exclusive comments from Bitfinex, analysts told FXStreet that “Miners are currently in profit, and the prevailing bullish market trend allows them to operate with greater ease. As a result, they have largely chosen to hold onto their BTC rather than sell.”

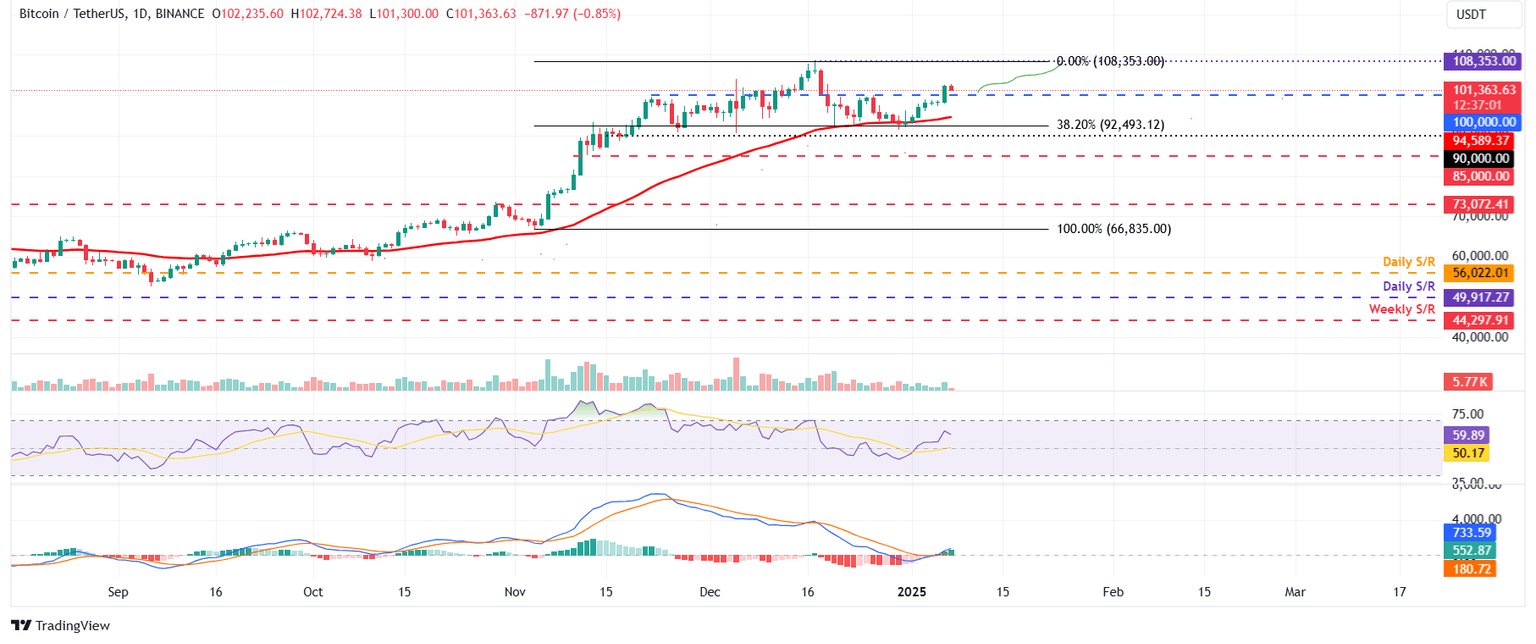

Bitcoin Price Forecast: BTC bulls eyes for all-time highs of $108,000

Bitcoin price surpassed the $100K mark and closed above $102,000 on Monday. When writing on Tuesday, it trades slightly down to around $101,300.

If the $100K level holds as support, BTC could extend the rally to retest its December 17, 2024, all-time high of $108,353.

The Relative Strength Index (RSI) on the daily chart reads 59, above its neutral value of 50, suggesting bullish momentum is gaining traction. Additionally, the Moving Average Convergence Divergence (MACD) indicator on the daily chart flipped a bullish crossover on Sunday, signaling a buy signal and continuation of the uptrend.

BTC/USDT daily chart

However, if BTC closes below the $100K mark, it could extend the decline to test its 38.2% Fibonacci retracement level at $92,493 (drawn from the November 4 low of $66,835 to the December 17 high of $108,353).

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.