Bitcoin price eyes a bounce to $42,000 as BTC bulls stop the bleeding

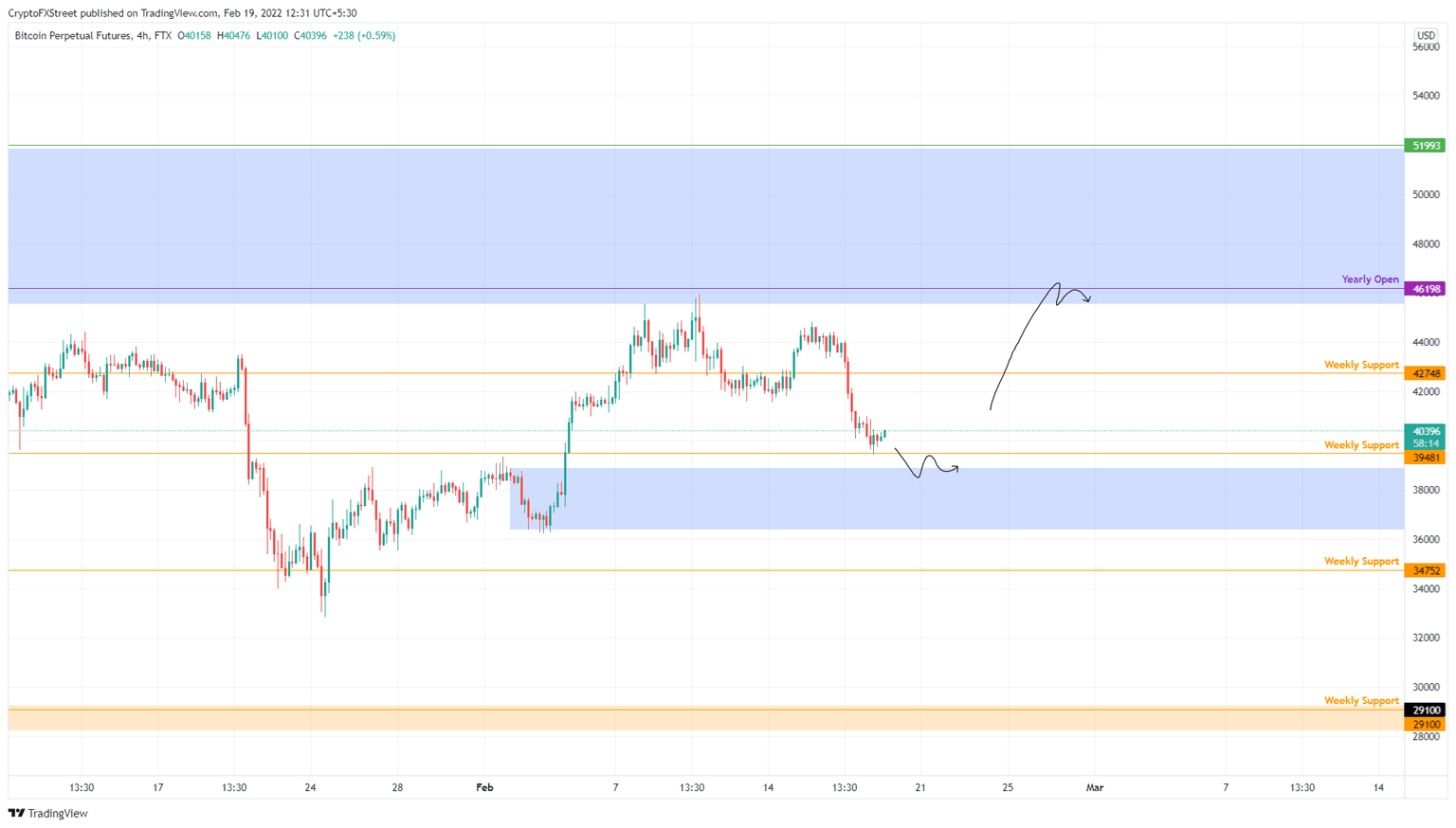

- Bitcoin price dropped 9% as it failed to pierce the weekly supply zone, ranging from $45,550 to $51,860.

- The downswing is bouncing off the weekly support level at $39,481 and shows promise of heading back to $42,748.

- In some cases, BTC could retest the $36,398 to $38,895 demand zone before triggering a retaliation.

Bitcoin price rallied exponentially from February 3 to 10, piercing a critical resistance barrier. However, this uptrend failed to sustain after a second attempt, leading to a downswing. Going forward, BTC might head toward a stable support level before triggering a brief throwback.

Bitcoin price approaches a midway point

Bitcoin price began its rally on February 3 and gained 26% in just a week. This uptrend pierced the weekly supply zone, extending from $45,550 to $51,860. This attempt was foiled as bulls failed to sustain, leading to a minor retracement below the immediate support level at $39,481.

The recovery from this correction fell short, leading to a 10% crash that occurred over the past three days. As Bitcoin price bounces off the weekly support level at $39,481, there is a good chance a new throwback to $42,748 could begin.

If the buyers continue to build up bid orders, there is a good chance Bitcoin price could revisit the weekly supply zone’s lower limit at $45,550.

While this scenario is optimistic, an alternative outlook would suggest that BTC might revisit the daily demand zone, extending from $36,398 to $38,895 before triggering the run-up to $42,748. Either way, investors can expect a minor uptrend to begin anytime soon.

BTC/USDT 4-hour chart

Things could change drastically for Bitcoin price if BTC slices through the daily demand zone’s lower limit at $36,398. This move would set up a lower low, signaling a further downtrend is likely.

In this situation, BTC bulls have one chance to recover as it tags the $34,752 support level. Failing to hold above this barrier will invalidate the bullish thesis and trigger a potential crash to $29,100 or lower.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.