Bitcoin Price Prediction: Can 200-week moving average bring support BTC desperately needs?

- Bitcoin price losing 13% on Monday, breaks below $25,000 for the first time since December 2020.

- Crypto analyst Justin Bennett predicted a significant pullback in Bitcoin price as crypto market capitalization takes a hit.

- Bennett argues Bitcoin is in the middle of a breakdown from a bearish continuation pattern.

- The analyst sets a downside target of $23,500, a 15% decline from the current price level for Bitcoin.

UPDATE: The most pessimistic Bitcoin price predictions are turning into fulfilled prophecies as the whole crypto market is continuing to see aggravated losses on Monday after an abysmal weekend. BTC price has just broken below $25,000 for the first time since reaching this level back in the huge rally of December 2020. Several reasons are adding up to the major risk-off sentiment dominating most financial markets to put pressure on the cryptocurrency market, including highly leveraged markets, scams and collapses like the Terra one, and other stablecoin pegs under pressure like Tron's USDD. Therefore, the unwinding of such a historic rally continues and the big question is where will Bitcoin and the crypto market bottom out? Popular crypto twitter analyst and trader @RektCapital has a potential answer: the 200-week moving average.

#BTC has broken down from the ~$29000 Monthly support (green)

— Rekt Capital (@rektcapital) June 13, 2022

Next major Monthly level below is the ~$20000 level (orange)

However in between these two major Monthly levels is the 200-week MA which has a good historical track record of marking out bottoms$BTC #Crypto #Bitcoin https://t.co/m76RppBF0T pic.twitter.com/c5dEAt7Ru1

Bitcoin price continues to bleed as crypto market capitalization declines. Analysts believe Bitcoin and altcoins could witness further pullback in the short term.

Bitcoin price is in the midst of a breakdown

Justin Bennett, a leading crypto market analyst, told over 100,000 Twitter followers that the ecosystem could witness significant pullback, wherein Bitcoin and altcoins lose a massive chunk of their value.

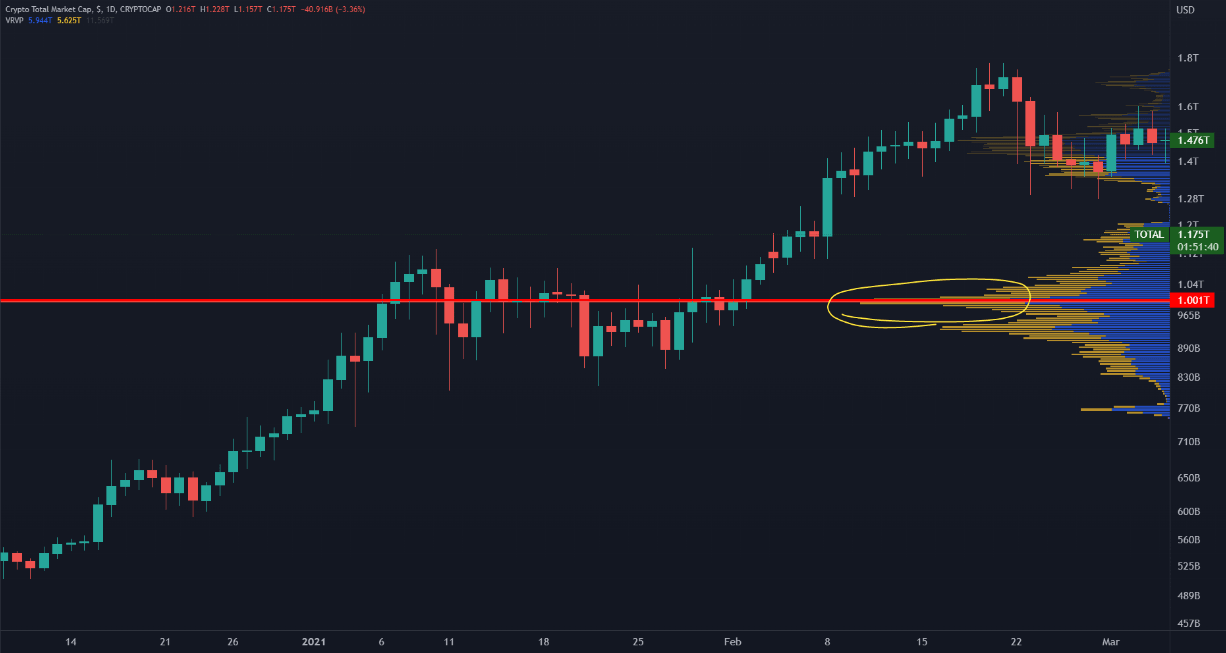

Bennett believes the Bitcoin price is in the midst of a breakdown from a bearish continuation pattern, and $1 trillion is a psychological level for the crypto community. The breakdown occurred today, where over 5% of the crypto market’s capitalization was wiped out, and nearly $950 billion was drained out of the ecosystem.

Bennett argues that $1 trillion is the area that offers a crucial support level for the entire crypto market. He was quoted as saying:

[The] $1 trillion [level] was also the most heavily traded level during the early 2021 consolidation.

Crypto market capitalization in USD

Bennett argues that altcoins will take the brunt of the correction.

Bottom line: another 15% lower from the entire crypto market seems likely before we can start talking about the potential for relief. Remember that BTC will be the closest to that -15% mark. Alts, especially lower caps, will probably outpace it by 1.5-2x.

Bennett has predicted a 15% correction in Bitcoin price, where the asset hits a fresh yearly low of $23,500. Altcoins could lose 22.5% to 30% of their value.

Analysts believe Bitcoin price could witness further correction

@BigCheds, a pseudonymous crypto analyst, evaluated the Bitcoin price chart and identified an inverted hammer. The analyst concluded that the pattern is bearish for Bitcoin price and expects a decline in BTC.

BTC-USD chart

FXStreet analysts believe Bitcoin price could decline to the $12,000 level; for more information, watch this video:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.