Bitcoin price collapses as Putin declares war on Ukraine and explosions reported in Kyiv

- Bitcoin price has significantly declined following media reports of explosions in Ukraine.

- In the past 24 hours, the total cryptocurrency market capitalization has declined by 5%.

- Bitcoin price plummeted below $35,000, dropping into bearish territory as US stock markets follows suit.

Russia recently announced that it would launch military action in Ukraine. Several media reports have noted that explosions were heard in Kyiv, the capital of Ukraine. Bitcoin price has dropped below $35,000, in tandem with the stock markets in the United States.

Bitcoin price slumps as tensions rise

Bitcoin price witnessed a sharp decline after Russian President Vladimir Putin officially announced a “special military operation” to complete the “demilitarization” of Ukraine.

Media outlets have reported explosions in the capital of Kyiv after Putin declared war on Ukraine. There have also been reports of a series of blasts heard in the city of Kharkiv, around 480 km to the east of the Ukrainian capital.

The total cryptocurrency market capitalization has fallen nearly 5% in the past 24 hours. US stock markets have tumbled, with the Dow Jones Industrial Average plummeting 1.38%.

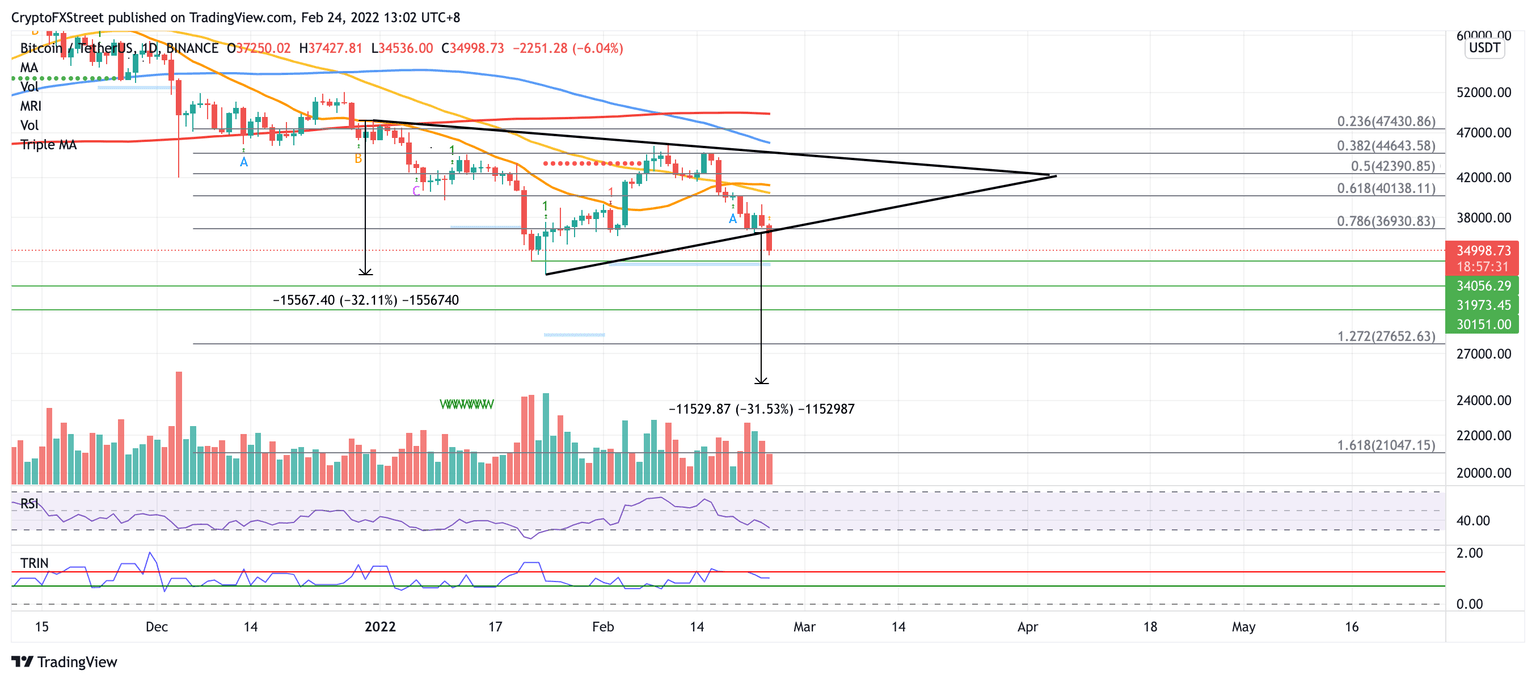

Bitcoin price dropped 7% in the past 12 hours to under $35,000, falling below the lower boundary of the symmetrical triangle pattern at $36,673, putting a further 32% collapse toward $25,039 on the radar.

Bitcoin price may fall toward the nearest level of support at the January 22 low at $34,056, before dropping toward the June 27 low at $31,973.

BTC/USDT daily chart

Additional lines of defense may emerge at the June 26 low at $30,151 before reaching the 127.2% Fibonacci extension level at $27,652.

However, if buying pressure increases, Bitcoin bulls may attempt to reach the lower boundary of the prevailing chart pattern at $36,930, coinciding with the 78.6% Fibonacci retracement level next.

Bigger aspirations will target the 50-day Simple Moving Average (SMA) at $40,138 next.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.