Bitcoin (BTC) miners may have already sparked a “capitulation event,” fresh analysis has concluded.

In an update on June 24, Julio Moreno, senior analyst at on-chain data firm CryptoQuant, hinted that the BTC price bottom could now be due.

BTC price bottom “typically” follows miner capitulation

Miners have seen a dramatic change in circumstances since March 2020, going from unprecedented profitability to seeing their margins squeezed.

The dip to $17,600 — 70% below November’s all-time highs for BTC/USD — has hit some players hard, data now shows, with miner wallets sending large amounts of coins to exchanges.

This, CryptoQuant suggests, precedes the final stages of the Bitcoin sell-off more broadly in line with historical precedent.

“Our data demonstrate a miner capitulation event that has occurred, which has typically preceded market bottoms in previous cycles,” Moreno summarized.

Miner sales have been keenly tracked this month, with the Bitcoin Twitter account even describing the situation as miners “being drained of their coins.”

“For miners, it's time to decide to stay or leave,” CryptoQuant CEO, Ki Young Ju, added in a Twitter thread last week.

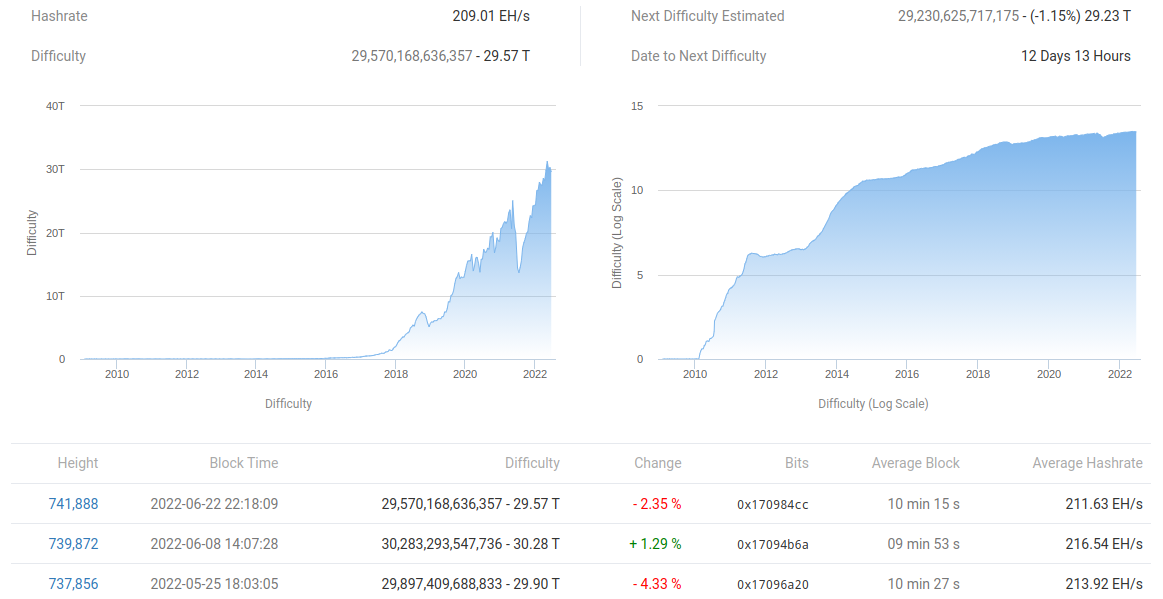

The situation is tenuous, but the majority of miners remain active, as witnessed by network fundamentals dropping only slightly from all-time highs of over 30 trillion.

Bitcoin network fundamentals overview (screenshot). Source: BTC.com

Mixed signals over buyer interest

When it comes to other large BTC holders, however, the picture appears less clear.

After whales bought up liquidity near $19,000, CryptoQuant’s Ki this week heralded the arrival of “new” large-volume entities.

Outflows from major United States exchange Coinbase, he noted, reached their highest since 2013.

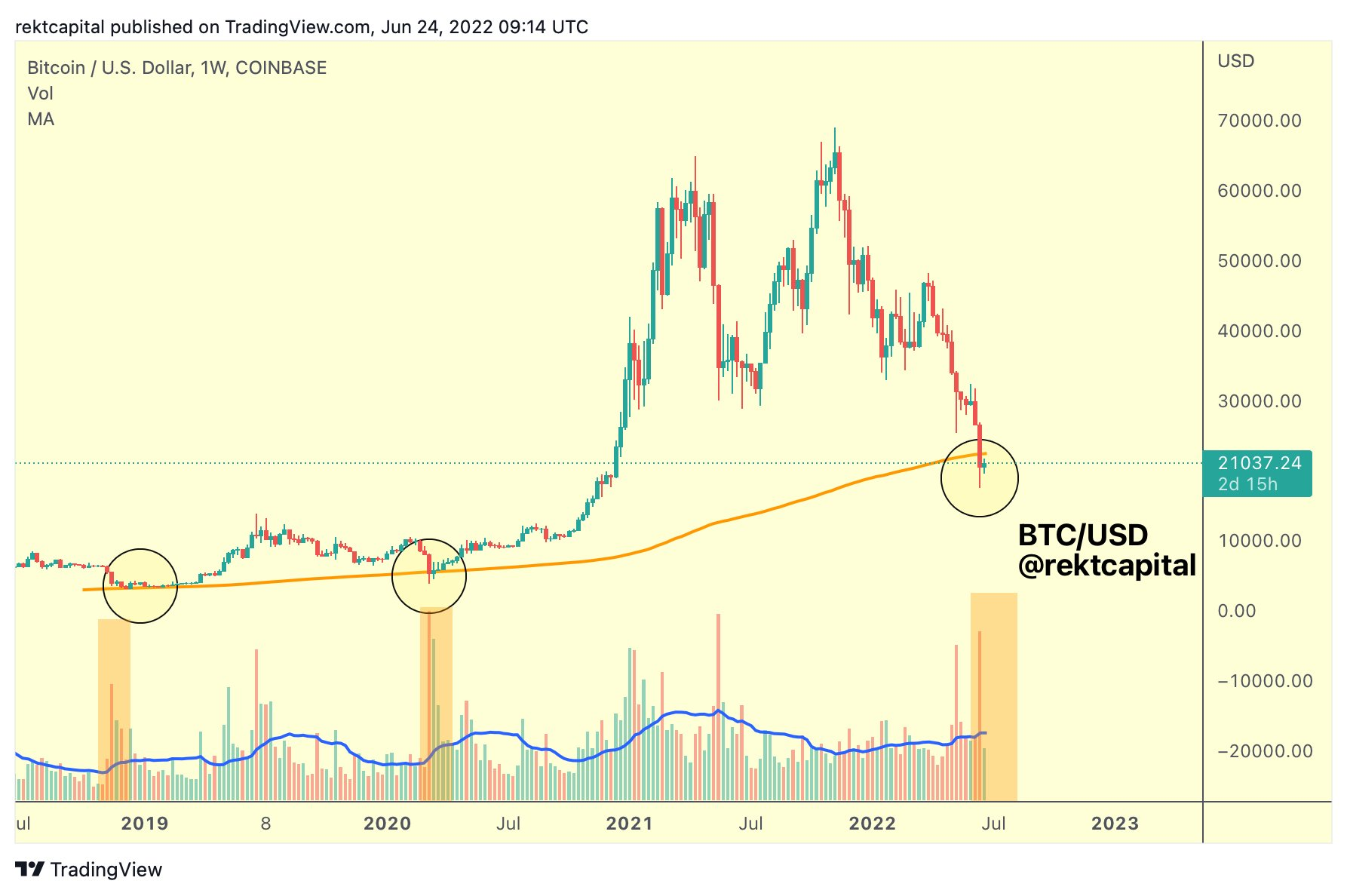

Trader and analyst Rekt Capital, nonetheless, reiterated doubts about the strength of overall buyer volume, arguing that sellers were conversely still directing market movements.

Bitcoin’s 200-week moving average (MA), a key support level during previous bear markets, has yet to see significant interest from buyers despite the spot price being around $2,000 below it.

“Current BTC buy-side volume following the extreme sell volume spike is still lower than the 2018 Bear Market buyer follow-through volume levels at the 200-week MA. Let alone March 2020 buy-side follow-through,” he told Twitter followers.

BTC/USD annotated chart. Source: Rekt Capital/ Twitter

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Coinbase lists WIF perpetual futures contract as it unveils plans for Aevo, Ethena, and Etherfi

Dogwifhat perpetual futures began trading on Coinbase International Exchange and Coinbase Advanced on Thursday. However, the futures contract failed to trigger a rally for the popular meme coin.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Ethereum cancels rally expectations as Consensys sues SEC over ETH security status

Ethereum (ETH) appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the Securities & Exchange Commission (SEC) and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US Federal Bureau of Investigations (FBI) has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission (SEC) is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?