Bitcoin is more popular than gold on Wall Street

- Large investors turn to Bitcoin amid growing inflation fears.

- Bitcoin is regarded as a better investment opportunity than gold.

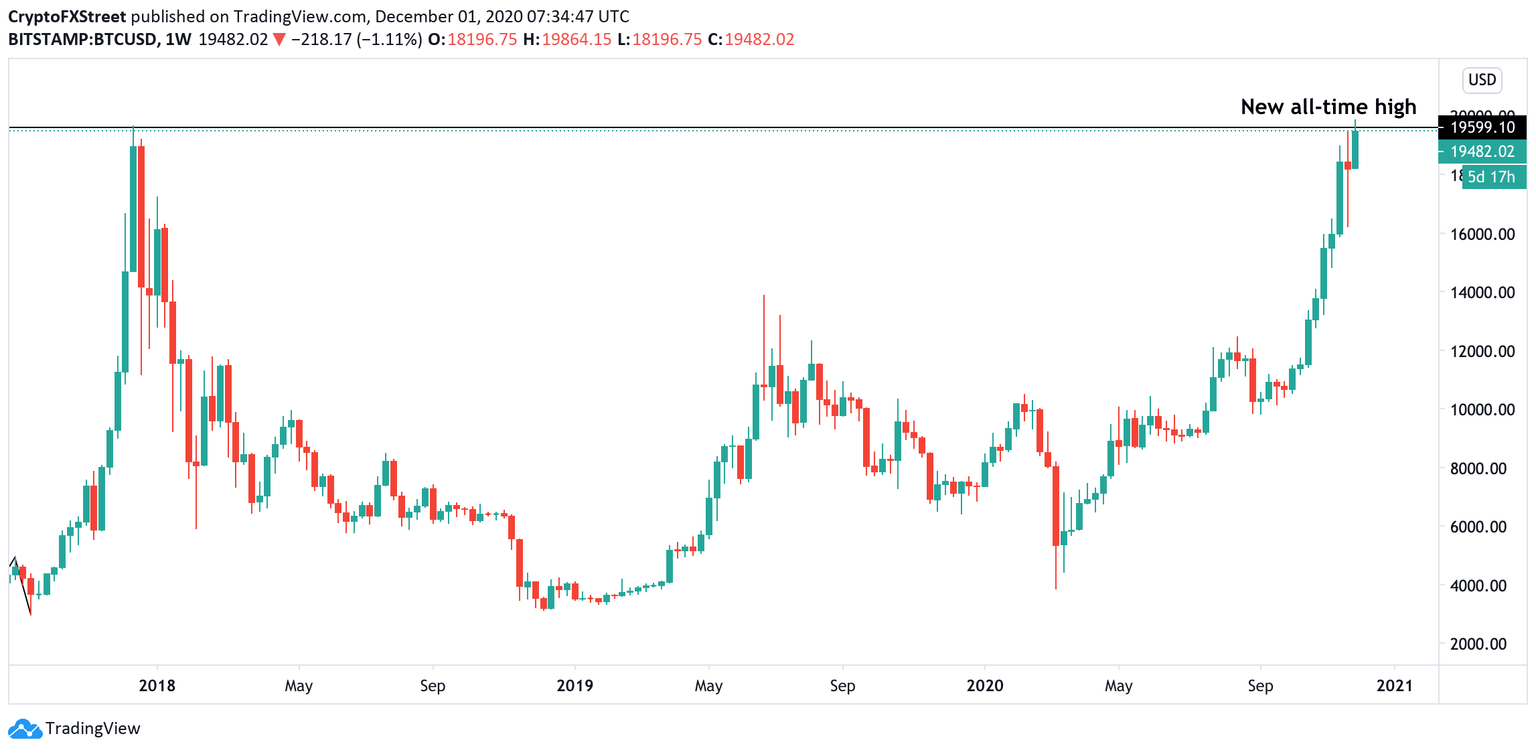

Bitcoin celebrated the last day of November with a new all-time high. The pioneer digital currency hit $19,864 on Bithumb, extending the year-to-date gains to 177%. At the time of writing, BTC/USD is changing hands at $19,500 amid a strong bullish bias. The market is ripe for smashing $20,000 at any minute, gripped by an acute sense of FOMO (fear of missing out).

Bitcoin's all-time high

Wall Street starts taking Bitcoin seriously

Meanwhile, the traditional financial markets undergo seismic shifts in attitude towards Bitcoin, which is often referred to as Digital Gold. As BTC hit a hew record high, just a stone throw from a psychological barrier of $20,000, the debate on whether the cryptographic asset is a better inflation hedge and a store of value is heating up.

Multiple Wall Street behemoths have been diving into the new market to diversify their portfolios and be better prepared for the potential economic woes caused by the COVID-19 pandemic. As FXStreet previously reported, Guggenheim Partners LLC, an investment company with over $200 billion of assets under management, joined the likes of Paul Tudor Jones, Stan Druckenmiller, MicroStrategy and Bill Miller in investing on the popular cryptocurrency. The company announced the decision to gain indirect exposure to Bitcoin via purchasing Grayscale's products.

Moreover, the growing interest in Bitcoin coincides with the investment outflows from Gold. According to JPMorgan Chase & Co analysts, since November 6, the investments in their gold-backed fund decreased by some $5 billion, the equivalent of 93 tons of metal. Meanwhile, Grayscale Bitcoin Trust enjoyed a steady flow of capital. Since the beginning of August, the investments in this vehicle doubled in dollar terms.

Why Bitcoin outshines Gold

First, there is a generational factor. Bitcoin is a new type of asset driven by demand from millennials, while gold is a darling of baby boomers. Speaking in an interview with Bloomberg, Jean-Marc Bonnefous, a former commodities hedge fund manager, mentioned:

Gold was really the safe asset of the past world and baby boomer generation. Now it's being replaced by automated assets like Bitcoin.

Considering that the share of millennials and Zoomers (another name for Generation Z) is set to grow, while the old guard will be leaving the game, Bitcoin's share in the investment portfolios will increase over time.

Second, Bitcoin proved its credibility as a store of value. A Bitcoin's price increased by over 170% since the beginning of the year, even despite pandemic woes. Many investors start to regard it as an appealing sore of value during periods of economic uncertainty and unprecedented loose monetary policy.

Unlike gold, it is driven both by inflation fears and risk rallies. If the precious metal tends to retreat when the demand for safe-haven subsides, Bitcoin continues growing.

Third, it's a matter of transparency. All Bitcoin transactions are registered on the public blockchain and can be reviewed by anyone at any time. On the other hand, gold is traded over-the-counter on the London Exchange with much less data publicly available.

Lyle Pratt, an independent Bitcoin investor, explained to Bloomberg:

The transparency in Bitcoin is helping drive a lot of interest. Gold is kind of like a black box, you have to trust the custodians to tell you about any flows in the market.

Bitcoin and Gold monthly charts

Gold hit the all-time high at $2074 at the beginning of August and has been losing ground ever since. At the time of writing, it is trading at $1,788. Meanwhile, Bitcoin nearly doubled its value during the same timeframe.

Author

Tanya Abrosimova

Independent Analyst