Bitcoin Flat, Cryptocurrencies on a Positive Tone

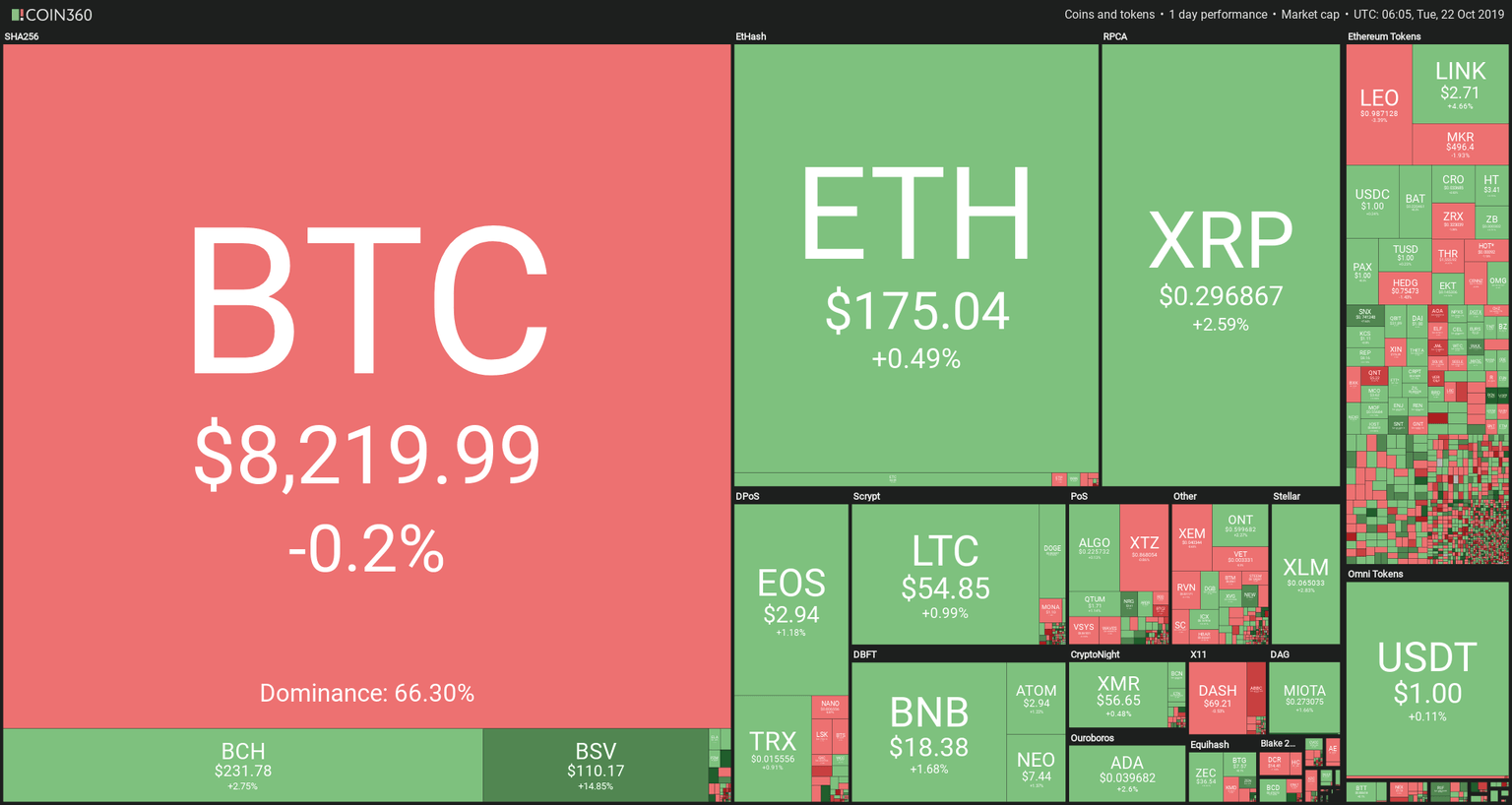

Cryptocurrencies were slightly positive during the last 24 hours, except for Bitcoin, who failed to cross the $8,300 level and created a large candle down to $8.150, tho, then, move back to the $8,200 range. The star of the day was Bitcoin SV, which is gaining 18% in the last 24 hours. Also, Bitcoin Cash (+3.14%) and Ripple (+2.13%) moved on positive territory. Among the Ethereum tokens, LAMB (+38.3%), DIP (+36%), RCN (+32.1%), and HYN (+22%) were the movement leaders on the positive side.

Fig 1 - 24 Hour Crypto Heat Map.

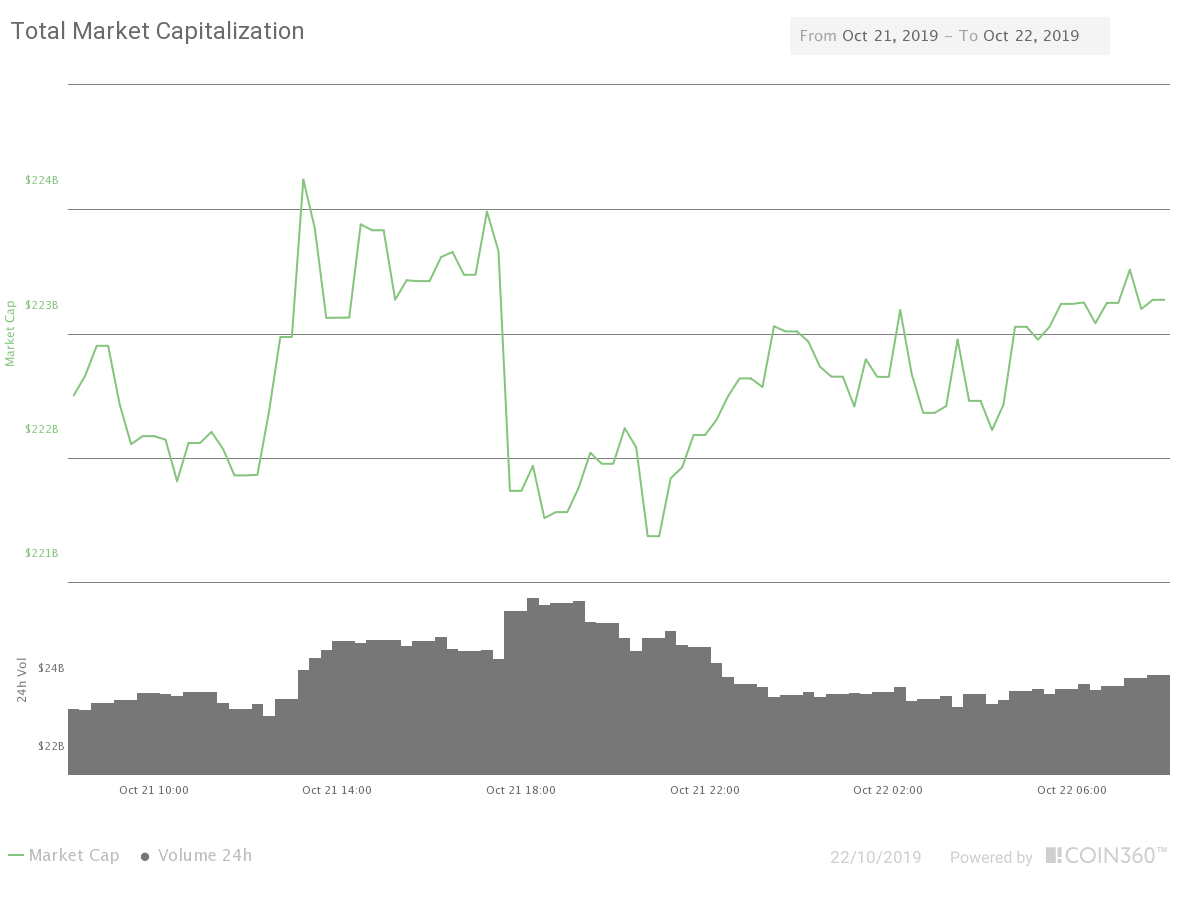

The market cap of the sector moved slightly up, to $223.27 billion, (+0.48%) on a somewhat increased 24H volume of $24.5 billion (+2.88%). The dominance of Bitcoin decreased a bit to 66.6%.

Fig 2 - 24H Crypto Market Cap Chart

Hot News

Peter Thiel, an early bitcoin bull, thinks the Chinese dominance on Bitcoin mining should be challenged. With that goal in mind, he is founding San Francisco-based Layer1 intending to create in the US an environmentally friendly mining facility.

Japan's third-biggest bank - Sumitomo Mitsui Banking Corporation (SMBC) - said on Friday last week that they have completed a cross-border Blockchain-based Trade and FInance test. The tested platform allows participants to handle purchase orders, shipping schedules, invoiced, logistic info, and all related information.

Heath Heath, US CFTC Chairman, is optimistic about the Launch of Ethereum Futures, although he thinks more regulation is needed.

Technical Analysis

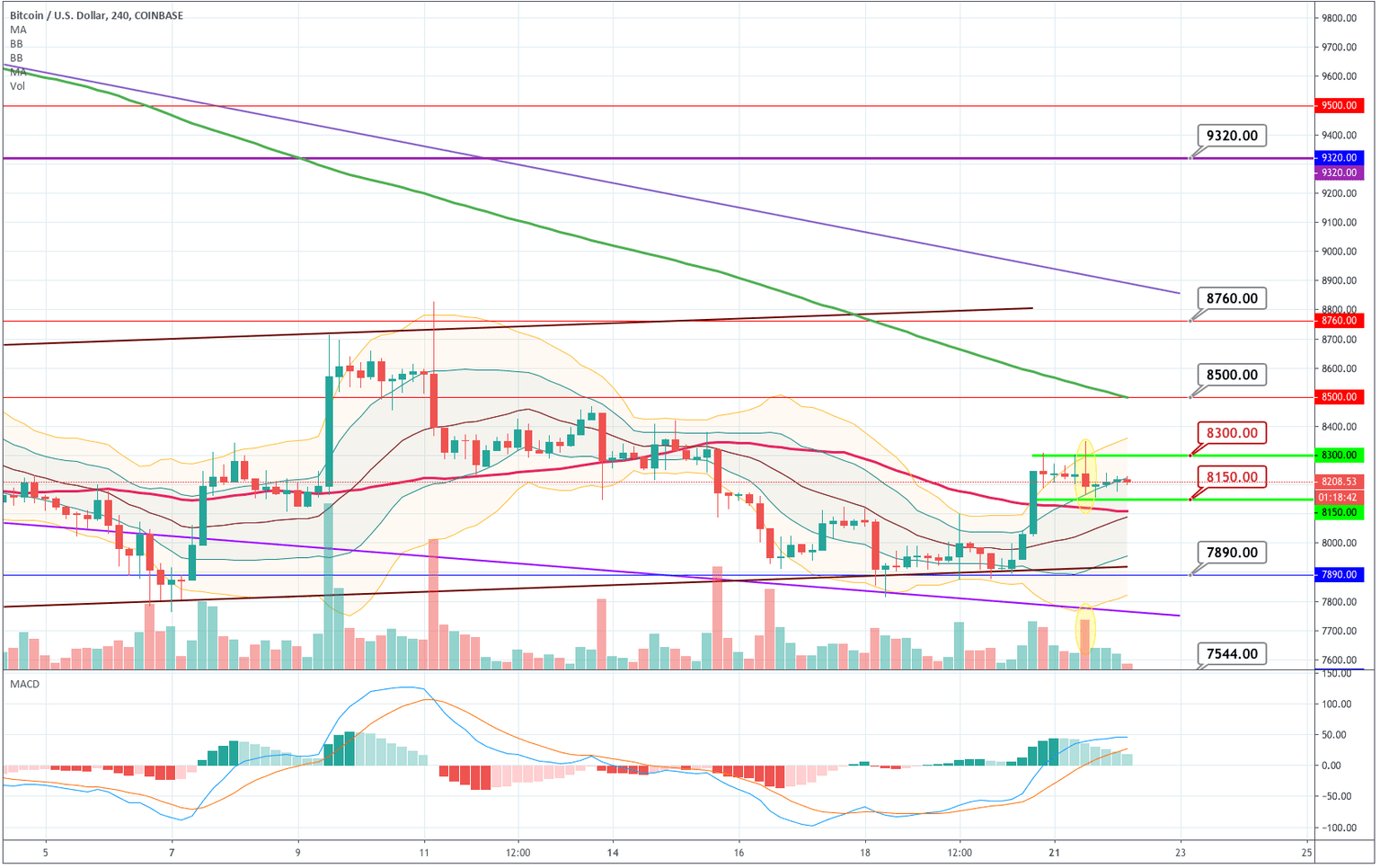

Bitcoin

During the last 24 hours, Bitcoin moves in a tight range between $8,150 and $8,300. Yesterday, buyers tried to push the price above the $8300 level, but sellers came in and pulled it down in a significant volume spike. Since then, it continued moving sideways with shrinking volume.

MACD is still bullish, although its histogram is showing a decrease in the short-term bullishness. The Bollinger bands show the price is sitting in the +1SD line, which usually is bullish.

Overall, we need to wait and see. The critical levels are indicated in red on the chart: 8,300 has to be successfully crossed to attract more buyers. On the lower side, a breakdown of $8,150 would mean an end to the bounce that started on Sunday.

| Supports | Pivot | Resistances |

| S1 $7,890 | $8,150 | R1: $8,500 |

| S2 $7,544 | R2: $8,760 | |

| S3 $7,280 | R3: $9,100 |

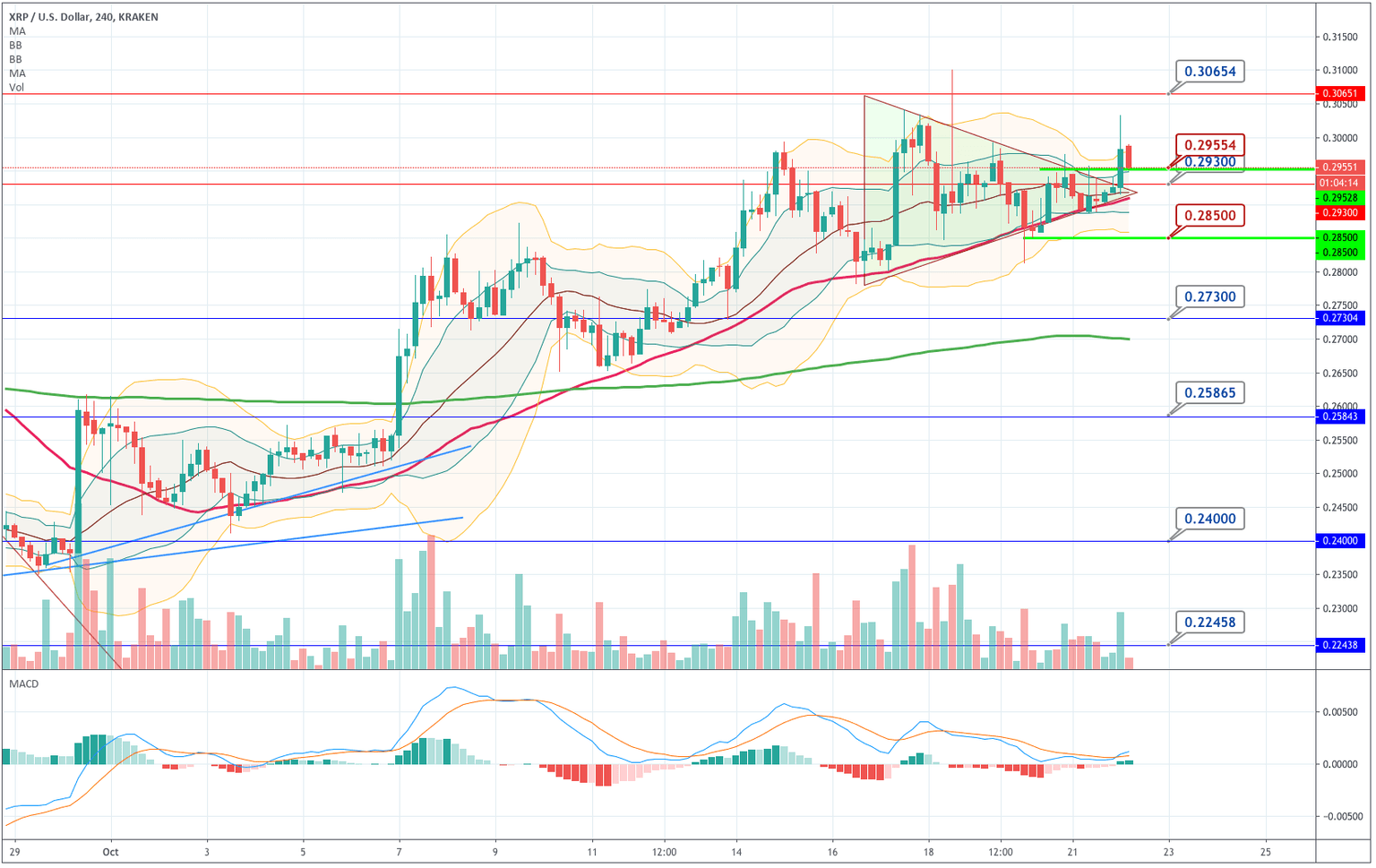

Ripple

Ripple has broken the triangular formation to the upside in a good-looking candlestick with high volume. Currently, it is retracing from a bounce of the 0.3035 level and is touching our trigger level, which now should act as support for the price. MACD moved back to bullish, and the price is also above the +1SD line. Therefore the bias for its price is still bullish.

| Supports | Pivot | Resistances |

| S1 $0.277 | $0.293 | R1: $0.306 |

| S2 $0.260 | R2: $0.325 | |

| S3 $0.245 | R3: $0.345 |

Ethereum

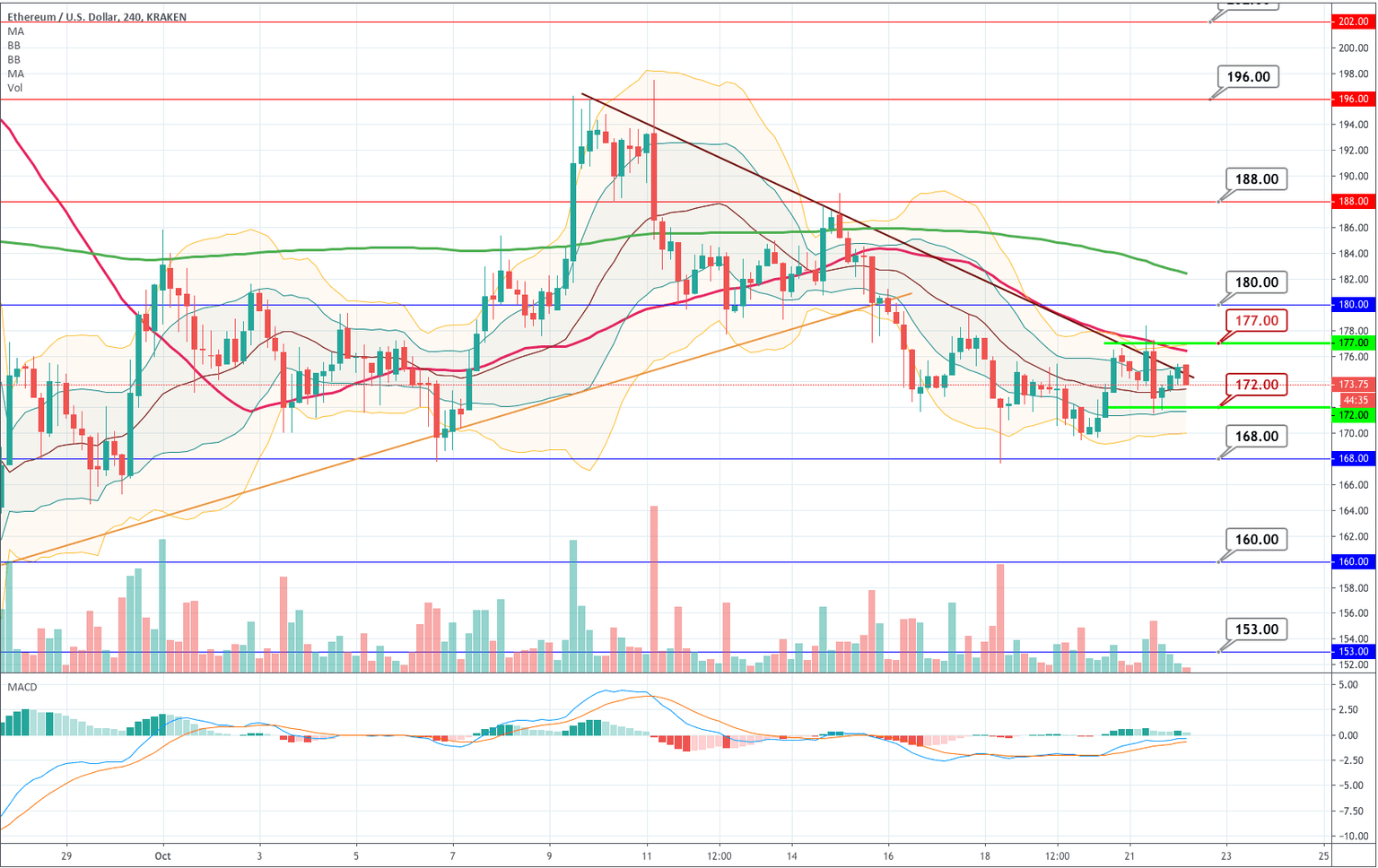

Ethereum's price is still following the downward trendline, although it seems constrained inside the range between $172 and $177. MACD is still positive, and the price moves on the upper side of the Bollinger bands. The bands themselves move horizontally and slightly shrunk, which is another indication for a sideways movement. Finally, we see that the price is below its 50-period MA, which is below the 200-period MA and both with a negative slope. This means, there is a negative bias currently.

The most critical levels to watch are the mentioned limits of this range: $177 and $172. A break of any of these levels would attract the buyers or the sellers.

| Supports | Pivot | Resistances |

| S1 $166 | $177 | R1: $187 |

| S2 $156 | R2: $198 | |

| S3 $145 | R3: $208 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and