- Bitcoin Cash has the capability to achieve “as many transactions as Visa does in one second” according to Amaury Sechet.

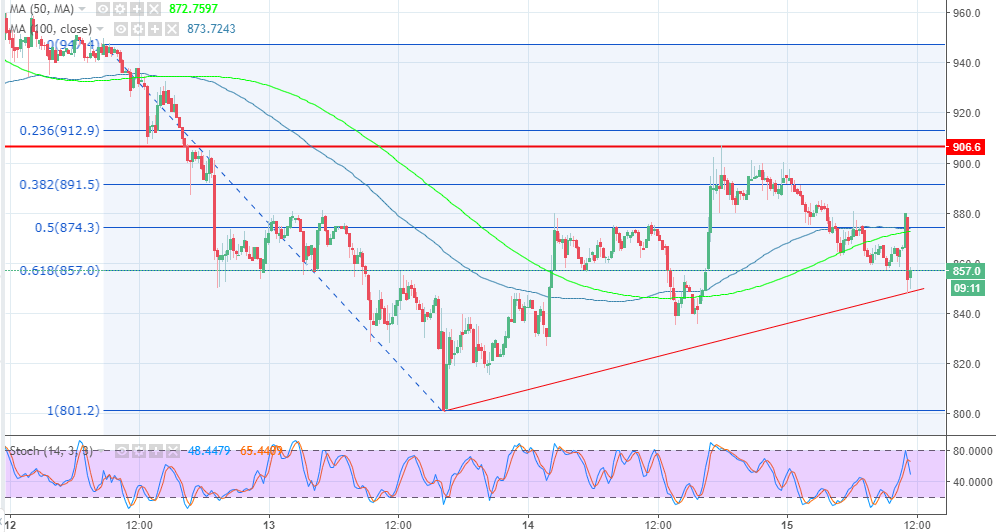

- BCH/USD is flirting with the 61.8% Fibo after attempts to recoil above $880 were unsuccessful.

Bitcoin Cash was hard forked from Bitcoin Core in August 2017 and the main reason for the fork was because the Bitcoin community could not come to a consensus on the parameters to alter in order to reduce transaction processing time and the costs that kept on rising.

Amaury Sechet said during the CoinGeek conference on June 10 this year that they decided on a block interval for BCH to be at least 2 minutes. This gives the miners ample time to validate transactions as well as have them uploaded on the ledger. Basing on this parameters, Amaury Sechet said that Bitcoin Cash has the capability to achieve “as many transactions as Visa does in one second.” The developer said, as opposed to Bitcoin which has chosen to remain rigid, Bitcoin Cash team will continue making the network better for sending and receiving funds. He also added that they continuously listen to the suggestions that come from the community.

Bitcoin Cash price analysis

Bitcoin Cash price, while using $840 as a support zone, sharply ascended during the trading session on Thursday. It traded above the 38.2% Fib retracement level with the last high leg of $947 and a low of $801. However, the bears entered and stopped the gains slightly below the supply zone $900. At the moment, BCH/USD is flirting with the 61.8% Fibo after attempts to recoil above $880 were unsuccessful.

A bullish trend has returned, although it is weak. The 50 SMA is nearing to cross above the 100 SMA. Trading above $880, on the other hand, will pave the way for Bitcoin Cash to approach $900. On the flipside, the stochastic shows bearish signals in the near-term. The bullish trendline offers immediate support above the stronger support area at $840 (yesterday’s key support).

BCH/USD 15-minutes chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Coinbase lists WIF perpetual futures contract as it unveils plans for Aevo, Ethena, and Etherfi

Dogwifhat perpetual futures began trading on Coinbase International Exchange and Coinbase Advanced on Thursday. However, the futures contract failed to trigger a rally for the popular meme coin.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Ethereum cancels rally expectations as Consensys sues SEC over ETH security status

Ethereum (ETH) appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the Securities & Exchange Commission (SEC) and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US Federal Bureau of Investigations (FBI) has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission (SEC) is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?