Binance Coin traders urgently need to identify this long-term bearish pattern

- Binance Coin is set to drop significantly because of current worsening market conditions and tail risks.

- BNB price could drop as much as 30% and see all its gains for the summer erased.

- The risk could be that even the low of this year gets tested.

Binance Coin (BNB) price is getting hammered as some cryptocurrencies are trying to put up a fight against the bears. With the summer rally on its final legs, traders are coming back into the office and are picking up where they left off, with plenty of tail risks and issues looking forward. To make matters worse, a textbook technical charting pattern agrees with the souring turn in market sentiment and hints at more losses to come.

BNB price is under pressure from inverted cup and handle pattern

Binance Coin has been having issues since it tried to break above the 200-day Simple Moving Average (SMA) at the beginning of August, unable to recover since then from the firm rejection it underwent.

With already over 10% lost currently to date, unfortunately, the pain is not over yet for BNB bulls, as more and more geopolitical issues and tensions are rising. The USdollar strength is adding more risk. That means that any upside in BNB price action will be limited for now and rather looks to take another step back towards the lower end of $200.

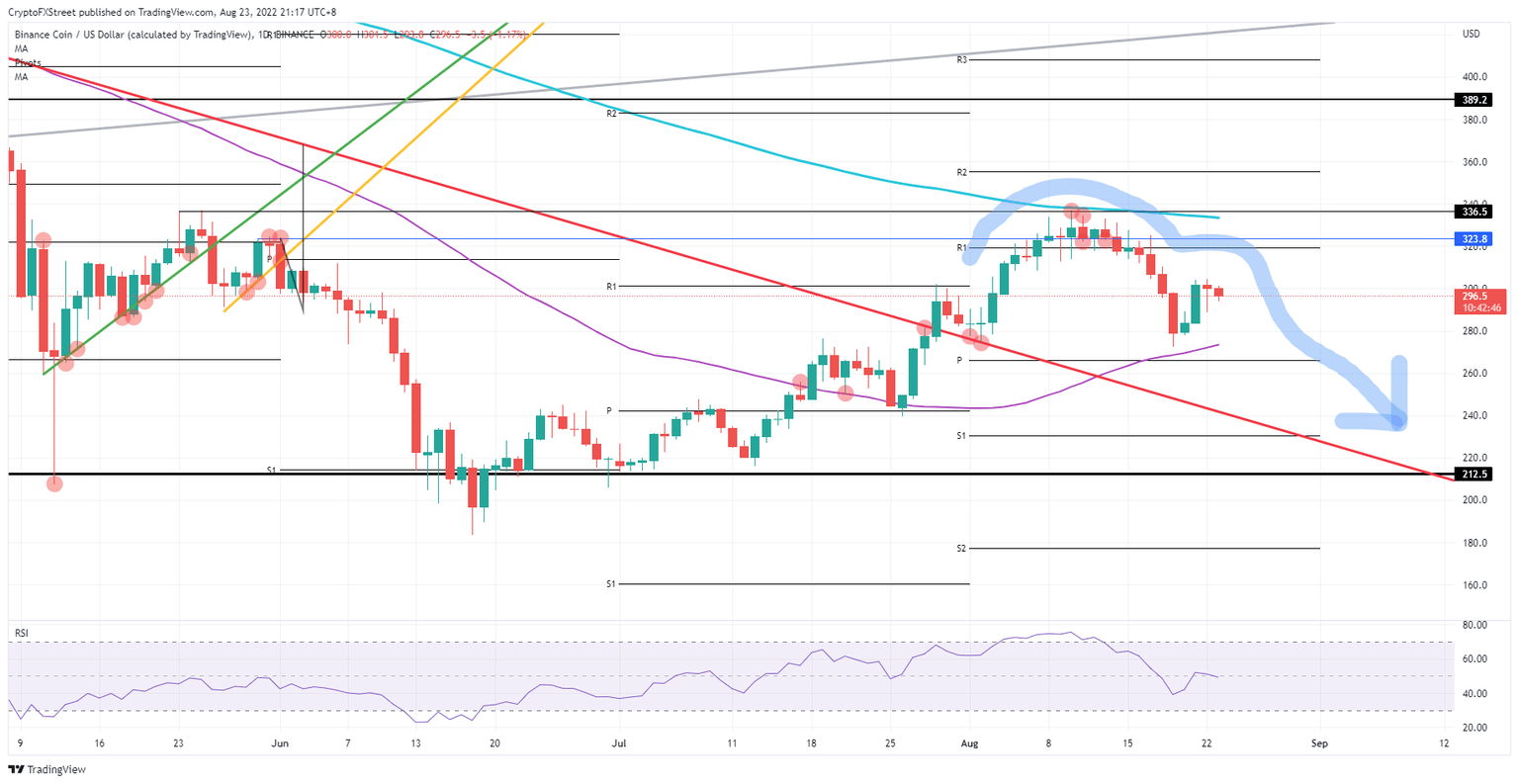

BNB price is nearby that round level in a bearish technical setup called the inverted cup and handle pattern. On the graph below, you can see in blow drawing how that technical setup can be identified and which way it will go. It boils down to bulls being trapped in the handle on the idea that recovery with new highs above the cup is on its way. Instead, BNB bulls are set to be washed out and squeezed out of their positions with price action running into the ground and bears pushing to hit $212 as a target, with the risk of overshooting towards $180 in case losses get eeked out even further should a perfect storm occur.

BNB/USD Daily chart

However, price action is still underpinned in Binance Coin, with the 55-day SMA still hovering below the lows of the past few days or weeks. This means that bulls still have a fail-safe element that is trading alongside them to catch and support any slippages along the way higher. Should that 55-day SMA prove strong enough to break the bearish pattern, expect to see a BNB rally towards $340 by retesting and breaking the 200-day SMA to the upside.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.