CAKE price bottoms out as PancakeSwap announces $25 million burn

- PancakeSwap burned over 8.9 million CAKE tokens early on Monday.

- The $25 million token burn likely helped CAKE price recover from recent losses.

- CAKE added nearly 3% to its value on Monday, but then retraced to $2.733, posting mild gains.

PancakeSwap’s (CAKE) price increased nearly 3% on Monday after the decentralized exchange platform on the Binance Smart Chain (BSC) announced a token burn of more than 8.9 million CAKE tokens, collected from trading fees across Automated Market Makers (AMM) Version 2 and 3 of the platform.

CAKE token burn likely catalyst for recent gains

PancakeSwap’s native token CAKE’s price rose nearly 3% early on Monday. The DeFi token hit a high of $2.808, up nearly 3% on the day after the announcement, although the token has pared some of these early gains and it retraced to $2.733 at the time of writing.

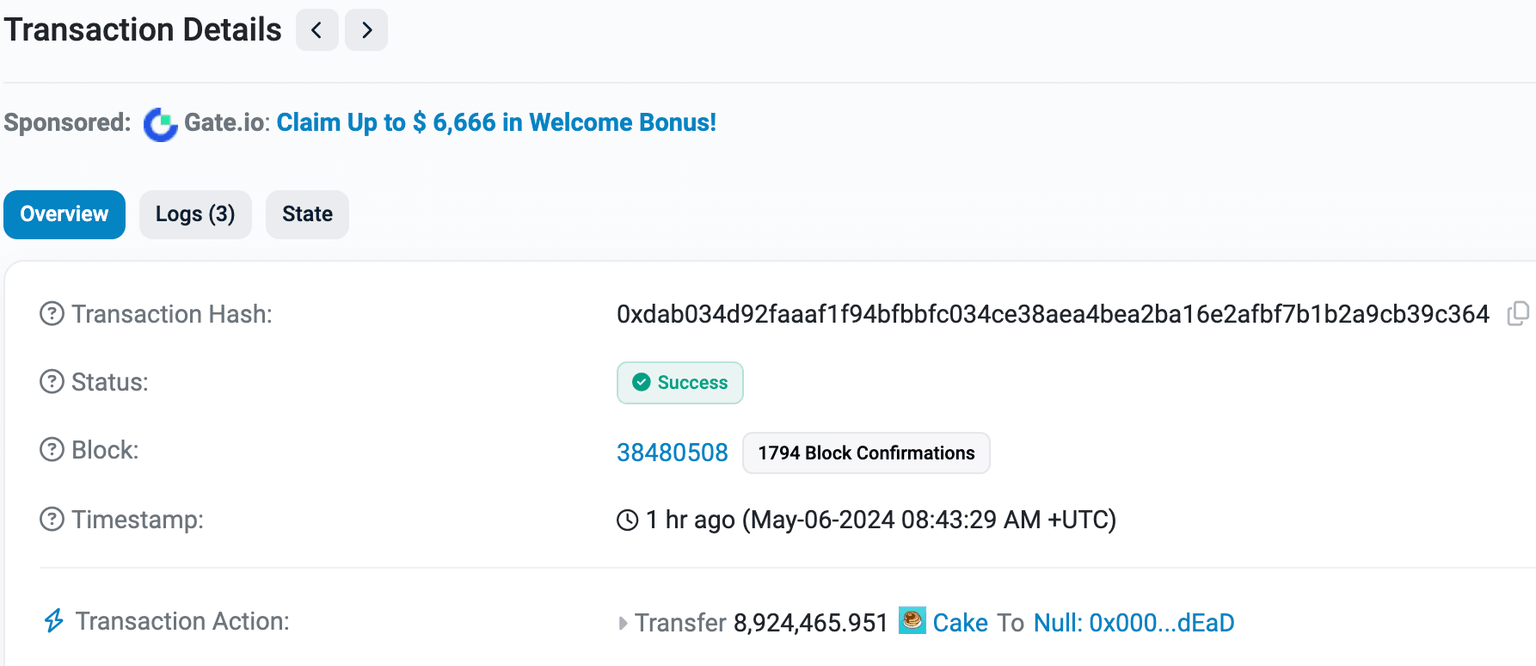

The DEX burned 8,924,466 CAKE tokens worth nearly $25 million, per the latest tweet on X.

8,924,466 $CAKE just burned - that’s $25M!

— PancakeSwap v4 (@PancakeSwap) May 6, 2024

Trading fees (AMM V2): 119k CAKE ($332k) -31%

Trading fees (AMM V3): 160k CAKE ($448k) +78%

Trading fees (Non-AMM like Perpetual, Position manager etc): 0.2k CAKE ($1k) -29%

Prediction: 52k CAKE ($145k) +17%

️ Lottery:… pic.twitter.com/wNWNTp2mrt

PancakeSwap had collected 119,000 CAKE worth $332,000 as trading fees for its AMM Version 2, and 160,000 CAKE worth $448,000 for its AMM Version 3. The DEX is integrated with market makers on Ethereum and Binance Smart Chain to help traders execute their trades at a relatively low cost. The fees collected by the AMMs are then burnt, to reduce the supply of CAKE tokens in circulation.

Proof of token burn

The DEX recently announced its plans to redirect CAKE emissions from farming pools to bribe locker protocols and boost the liquidity of the DeFi token for users. This move has no impact on CAKE supply since it simply redirects emissions to liquidity pools.

The proposal to reallocate CAKE emissions to the veCAKE locker ecosystem has been approved.

— PancakeSwap v4 (@PancakeSwap) May 3, 2024

We're now strategically deploying bribes across CakePie, StakeDAO, & Hidden Hand to enhance liquidity in these pools: BNB-USDT, USDT-BNB, CAKE-BNB, & CAKE-USDT.

This strategic…

Find out more about it here.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.