Binance Coin Technical Analysis: BNB rally intact as $100 beckons

- Binance Coin recovers lost ground above $70 as buyers look toward $100.

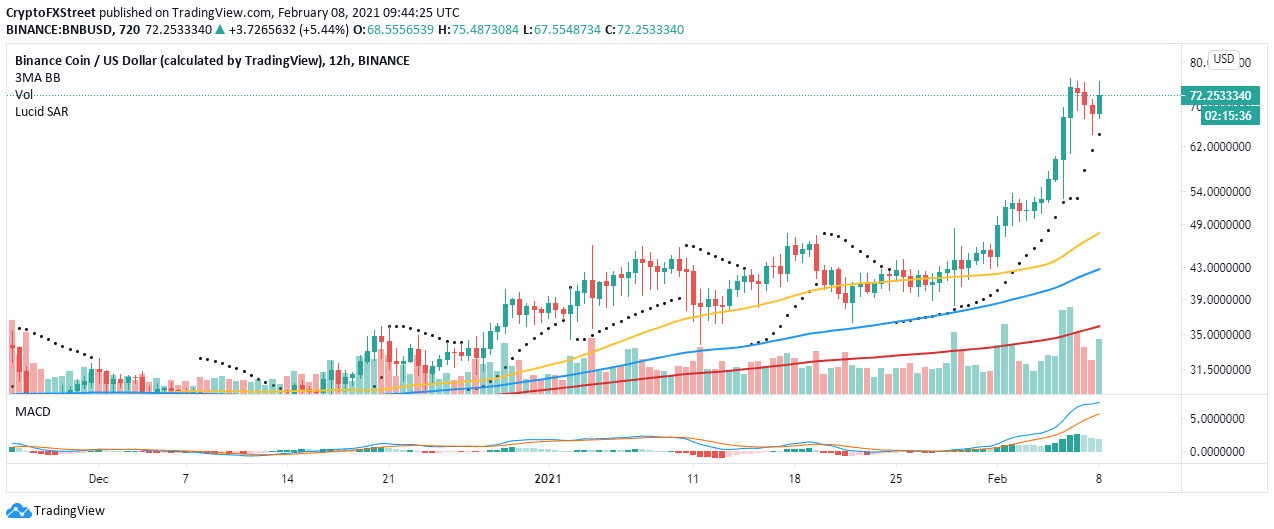

- The Parabolic SAR and the MACD are reinforcing the uptrend.

- The MVRV ratio is at the highest level in history, which calls for caution among investors.

Binance Coin is among the digital assets that have outperformed themselves in the market this year. Recently, BNB achieved a new all-time high of $76, but it looks primed to rally toward $100.

Binance Coin uptrend resumes

The 12-hour chart shows BNB trading at $71 after rebounding from the most recent support at $64. Closing the day above $70 was particularly very bullish and seemed to have called buyers back into the market. For now, bulls aim to overcome the resistance at $76 and push for gains heading to $100.

Binance Coin is currently trading above the Parabolic SAR points, which is a bullish signal that the uptrend is bound to continue. The Moving Average Convergence Divergence (MACD) in the same timeframe has also reinforced the bullish outlook as it moves higher above the midline. Besides, the MACD line (blue) is also widening the divergence from the signal line.

BNB/USD 12-hour chart

Looking at the other side of the fence

It is interesting to realize that as Binance Coin's value soars, some whales are offloading. This shows that all of the Binance Coin holders are perhaps in profit, and therefore, it makes sense to sell. However, if the selling pressure continues, it would be an uphill task to swing to $100.

Santiment's holder distribution shows that addresses between 100,000 and 10 million BNB topped out at 34 on January 26. Over the last week or so, these addresses have decreased to 30, representing an 11.8% decline.

Binance Coin holder distribution

The MVRV model by Santiment also brings to light the possibility of a retreat. This on-chain metric tracks the average profit or loss incurred by the holders of BNB. The ratio is arrived at by narrowing down on the tokens moved over the last 30 days compared to the tokens' price when they last moved.

Binance Coin MVRV model

It is worth mentioning that the MVRV is showing a reading of more than 50% (the highest in the history of the BNB). This calls for caution among investors because a price reversal is possible in the near term, as shown by the MVRV ratio.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B12.53.18%2C%252008%2520Feb%2C%25202021%5D-637483765503742985.png&w=1536&q=95)

%2520%5B13.03.02%2C%252008%2520Feb%2C%25202021%5D-637483765649420778.png&w=1536&q=95)