Binance Coin Price Forecast: BNB hits new all-time highs while technicals spell trouble

- Binance Coin price has hit a new all-time high at $53 on February 2.

- The digital asset had a massive 22% breakout in the past 24 hours but might be poised for a correction.

- Several metrics show BNB price is overextended and needs to cool off.

Binance Coin was trading sideways for the last three months of 2020 and started a bull rally at the beginning of 2021, climbing from $36 to an all-time high of $53 in just one month. The digital asset is slightly overextended now and needs to see a healthy pullback in order to resume the uptrend.

Binance Coin price needs a healthy correction to maintain the uptrend

The trading volume of Binance Coin has hit an all-time high of $1.4 billion in the past 24 hours. This massive spike is a bearish sign as in the past, significant increases in trading volume have led Binance Coin price to a correction as it happened on September 14, 2020, or November 24, 2020.

BNB trading volume chart

Additionally, the MVRV (30d) has spiked above 10% into the risk area, which often signifies BNB is about to see a significant pullback in the short-term.

BNB MVRV (30d) chart

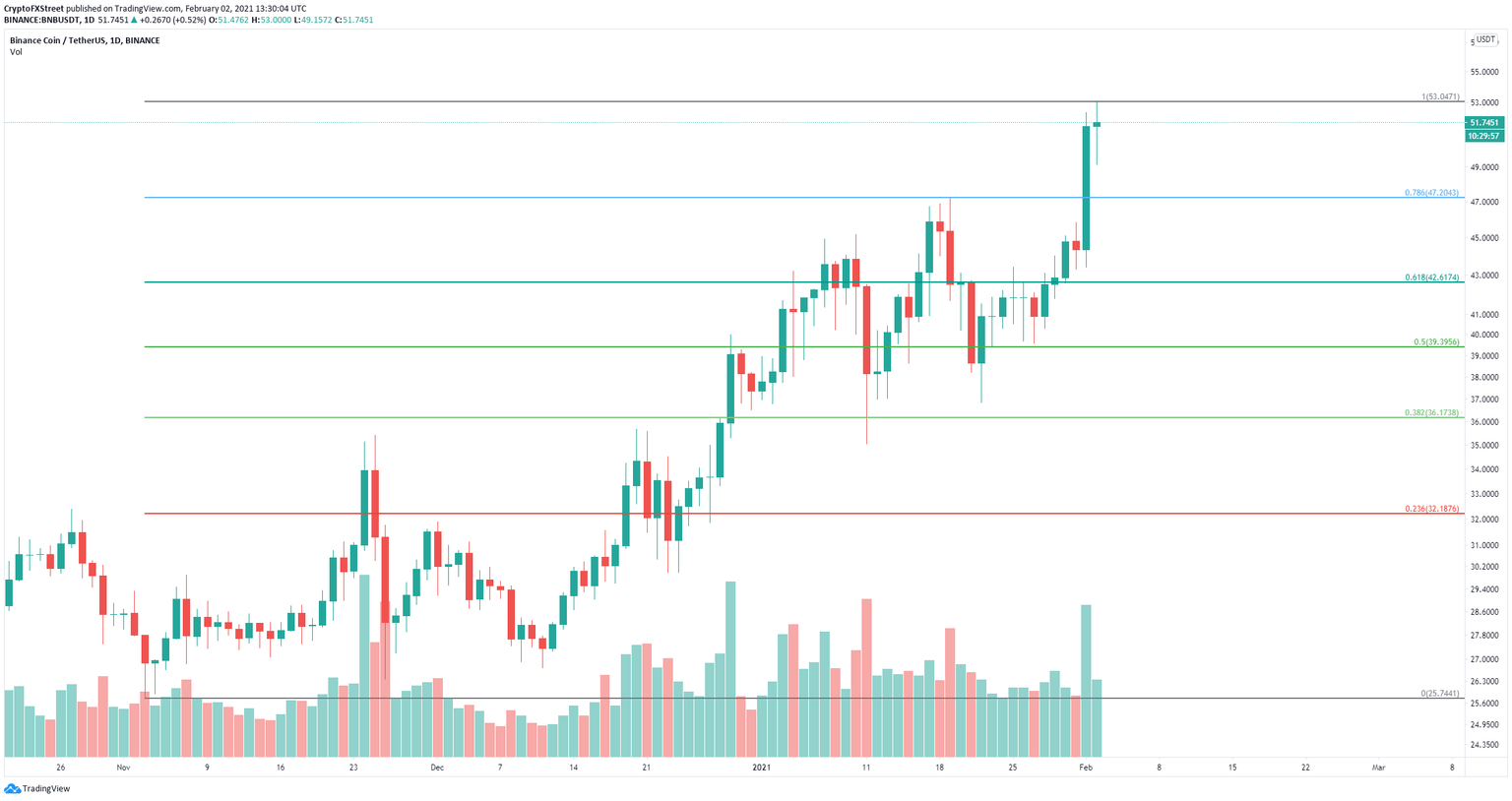

Using the Fibonacci Retracement tool, we can identify several key support levels for BNB. The nearest is located at the 78.6% Fib level ($47.2). If the bears can push Binance Coin below this point, they will likely drive the digital asset down to $42.6 at the 61.8% level.

BNB/USD daily chart

However, the number of large holders with 10,000 to 100,000 BNB coins ($520,000 to $5,200,000) has increased by seven since the beginning of 2021, which indicates they believe the digital asset can continue to climb higher.

BNB Holders Distribution chart

If BNB cracks the last resistance level at $53, it will likely rise towards $60, which is a psychological level and the 127% Fibonacci level.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B14.26.32%2C%252002%2520Feb%2C%25202021%5D-637478695888166398.png&w=1536&q=95)

%2520%5B14.33.32%2C%252002%2520Feb%2C%25202021%5D-637478696193658415.png&w=1536&q=95)

%2520%5B14.31.40%2C%252002%2520Feb%2C%25202021%5D-637478695955514223.png&w=1536&q=95)