Binance Coin Price Forecast: BNB needs to breach this crucial supply barrier to set up record levels again

- Binance Coin price shows a short-term rejection around the supply zone’s upper layer at $594.32.

- A close above the said level is a must if BNB bulls want to scale to new highs.

- Supply distribution shows that whales holding between 100,000 to 1,000,000 BNB are accumulating.

Binance Coin has seen a massive downfall after recently erecting new all-time highs. Now, BNB stands to retest this level and perhaps set up new ones shortly.

Binance Coin price at critical level

Binance Coin price hit a new high of $638.56 on April 12 and retraced nearly 33% since then. After finding support at $428, BNB has created two higher highs and is now on the verge of toppling a supply zone that ranges from $556.40 to $594.32.

If successful, Binance Coin price will retest the local top after a 7% surge and target a leg-up to the 127.2%, 141.4% and 161.8% Fibonacci extension levels at $695.84, $725.74 and $768.69, respectively.

BNB/USDT 4-hour chart

Supporting the bullish narrative is the addition of two new whales holding 100,000 to 1,000,000 BNB. This 5.3% increase indicates that these investors are optimistic about BNB price performance in the near future.

BNB supply distribution chart

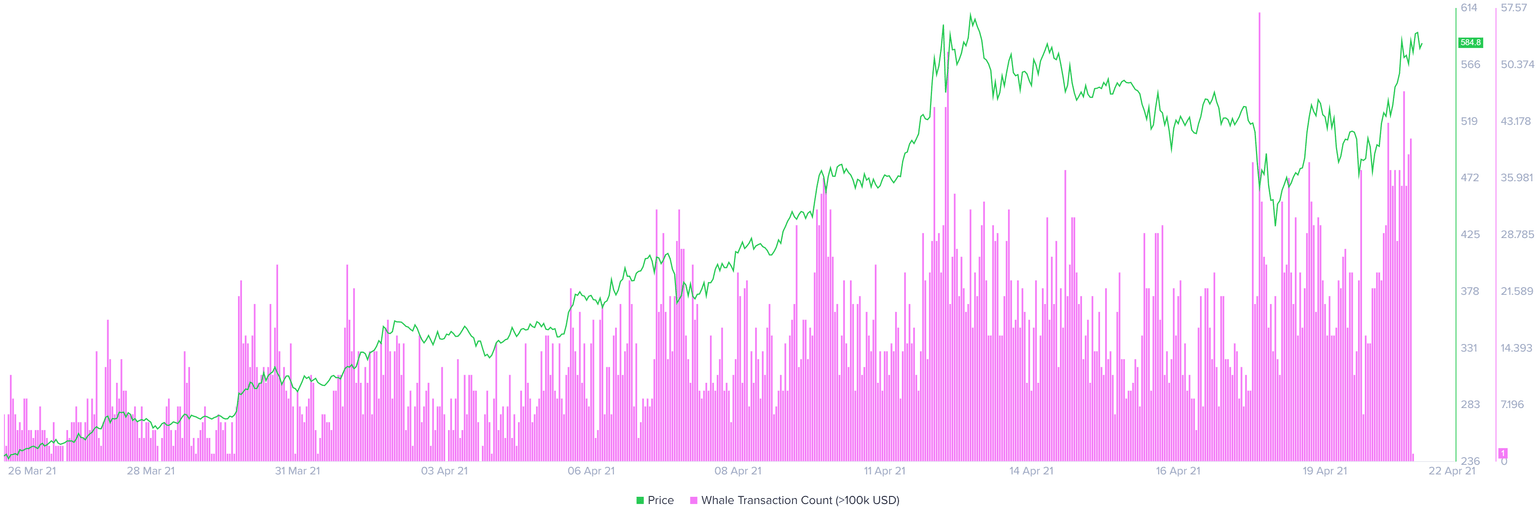

Whale transaction count is a metric that tracks transactions worth $100,000 or more. A surge in this metric serves as a proxy to high net worth individuals’ investment interest and is often followed by a spike in the market value.

At the time of writing, the count of such transactions increased by 275% since April 20, painting a bullish picture for BNB.

BNB whale transaction count chart

While the upside scenario seems straightforward, it is dependent on the breach of the said supply zone. A potential spike in selling pressure that leads to a decisive close below $550 will invalidate the bullish thesis.

Under these conditions, Binance Coin price could slide 9% toward the upper band of the demand zone at $508.96.

If sellers persist, $470.20 can likely be retested as well.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.