Binance Coin price ready for new all-time highs, according to technicals

- Binance Coin price had a V-shape recovery after a 20% crash in the past 48 hours.

- The digital asset remains heavily bullish in the long-term according to various metrics.

- The number of large holders of BNB continues increasing rapidly.

Binance Coin price had a 20% dive in the last 48 hours amid overall market weakness. However, the Ethereum rival has managed to recover faster than other coins and aims for new all-time highs.

Binance Coin price is only one key resistance level away from new highs

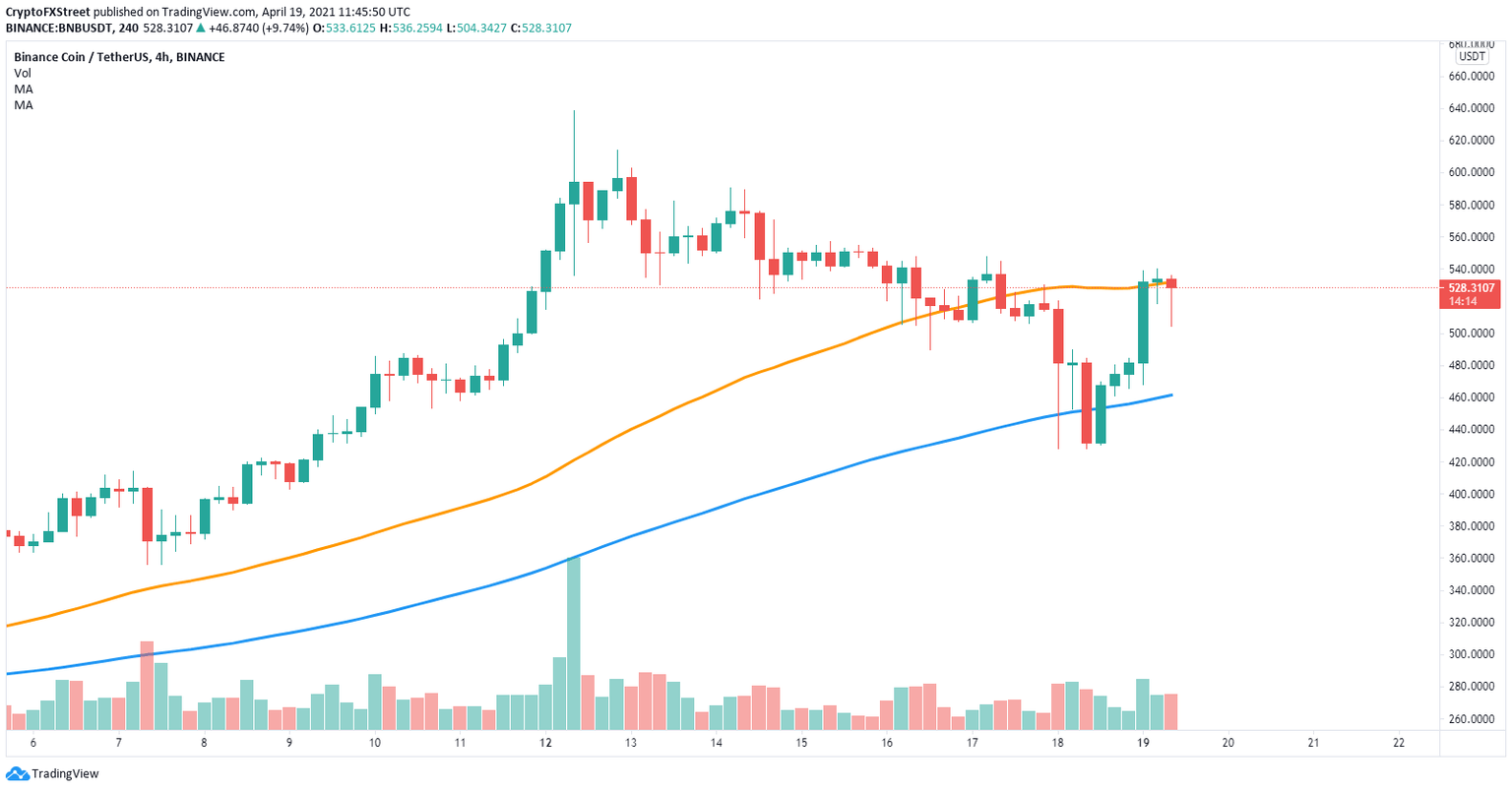

On the 4-hour chart, Binance Coin price had a massive bounce from a low of $428 and is trading at $528 at the time of writing. The digital asset needs to climb above the 50-SMA at $532 to regain short-term bullish momentum.

BNB/USD 4-hour chart

One of the strongest metrics in favor of BNB is the number of large holders which continues to rise. The number of olders with 100 to 1,000 coins and 1,000 to 10,000 coins has been in a massive uptrend since the beginning of 2021, the first group rising by almost 100%.

BNB Supply Distribution

This metric shows that large investors are extremely interested in BNB even at current prices. Additionally, the Market Value to Realized Value, MVRV (30d), shows the average profit or loss of BNB tokens moved in the last 30 days has cooled off to almost 0%.

This displays that BNB has a lot of room for more upside price action and is not at risk of another correction.

BNB MVRV ratio (30d)

Furthermore, the network activity of Binance Coin continues to explode as the number of active addresses in the last 24 hours has hit a new all-time high at 113,000 indicating that the current bullish momentum has a lot of strength behind it.

BNB Network Growth

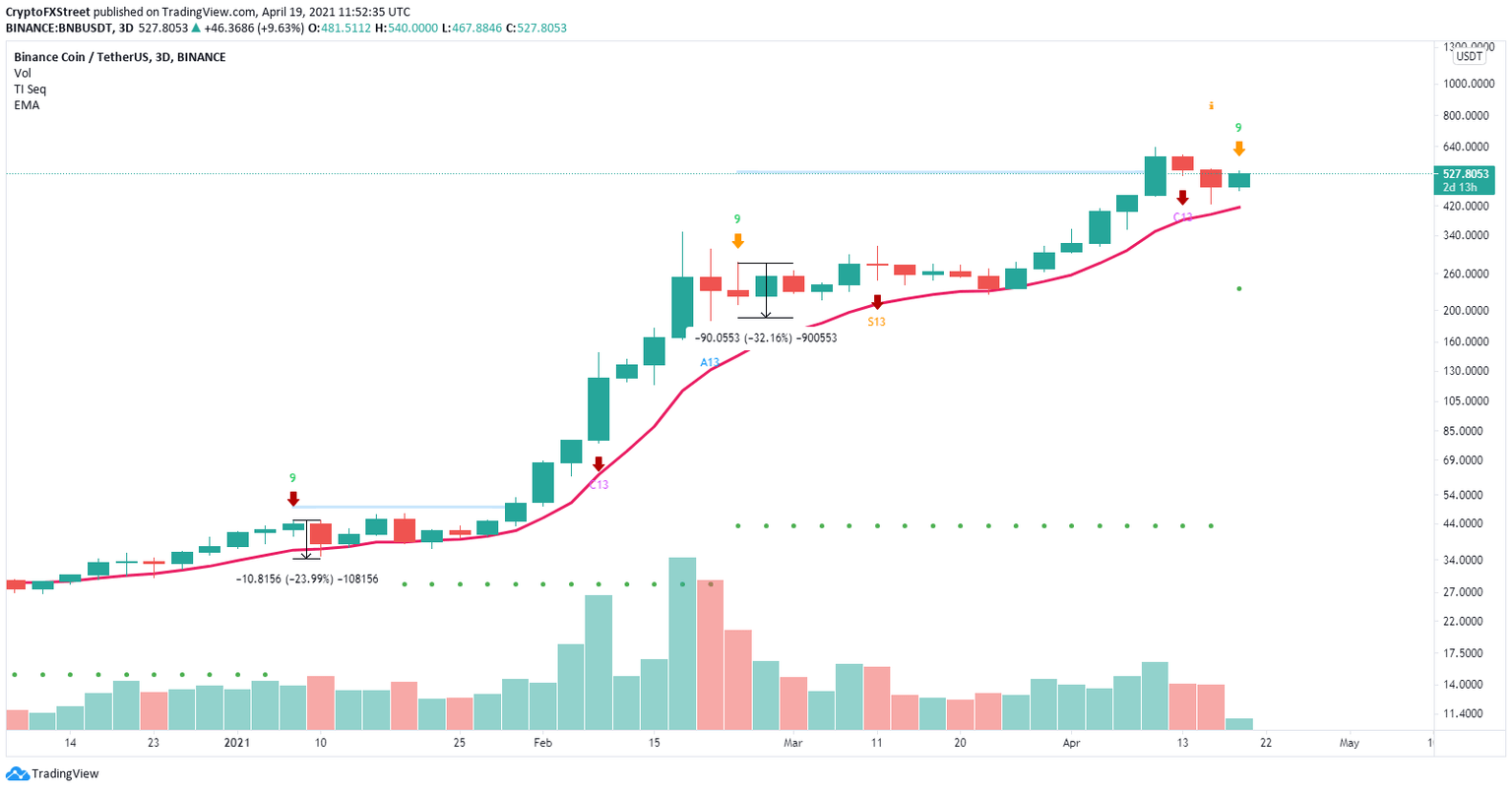

However, on the 3-day chart, the TD Sequential indicator has just presented a sell signal, which has proven to be reliable in the past three months. The 12 EMA support has held Binance Coin price since the beginning of 2021 and will be the bearish price target at $420 if the signal is confirmed.

BNB 3-day chart

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B13.46.01%2C%252019%2520Apr%2C%25202021%5D-637544418489627664.png&w=1536&q=95)

%2520%5B13.47.50%2C%252019%2520Apr%2C%25202021%5D-637544418638915813.png&w=1536&q=95)

%2520%5B13.50.28%2C%252019%2520Apr%2C%25202021%5D-637544418796378018.png&w=1536&q=95)