Axie Infinity price to rally 20% as AXS tags familiar support level

- Axie Infinity price is retesting the $48.60 support level, anticipating a move higher.

- Investors can expect AXS to rally 20% before tagging the $58.22 to $69.22 supply zone.

- A daily candlestick close below $44.27 will create a lower low and invalidate the bullish thesis.

Axie Infinity price has been consolidating around a support level since January 22. The recent retest of this barrier is likely to trigger another uptrend for AXS.

Axie Infinity price to kick-start an upswing

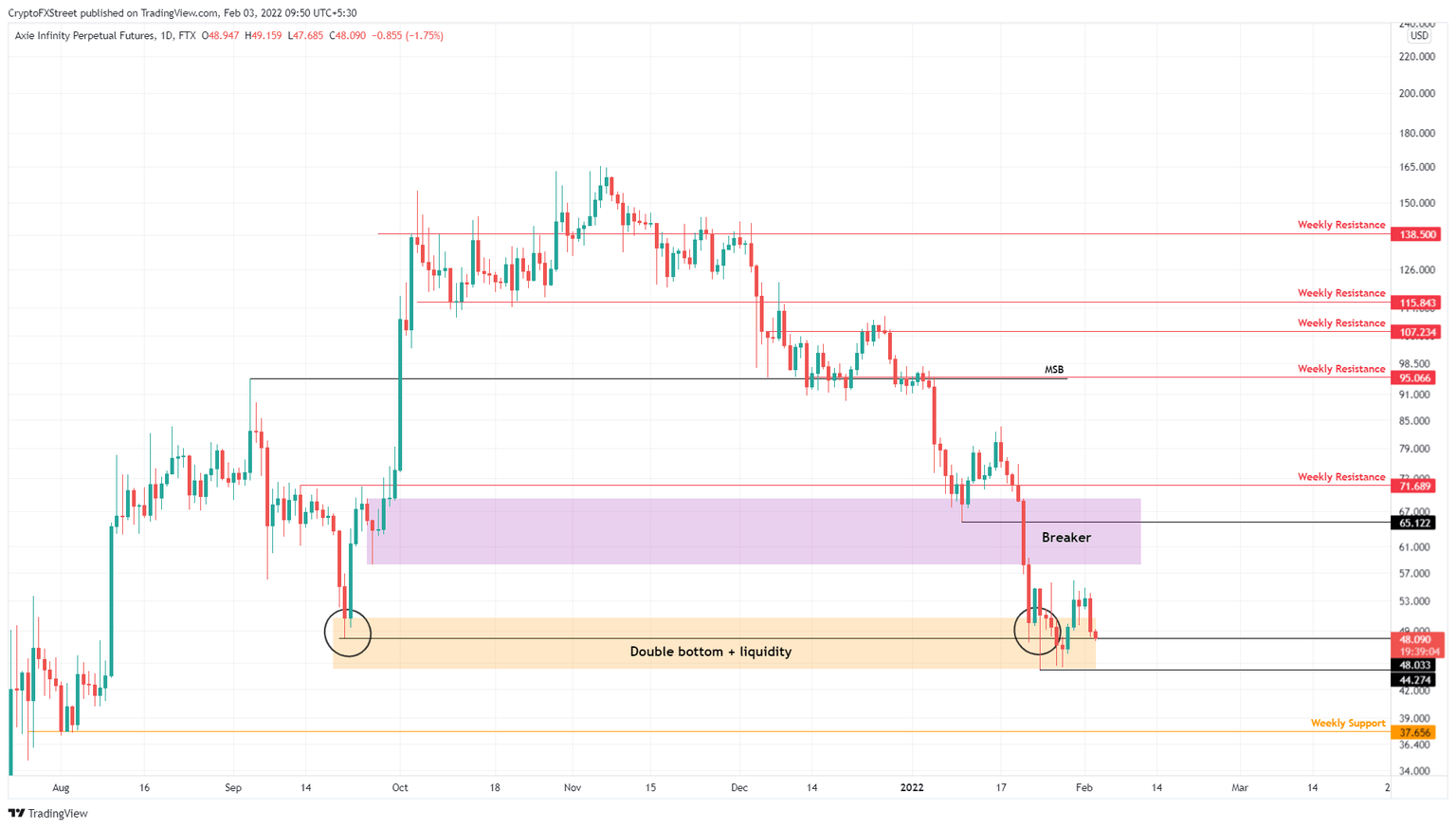

Axie Infinity price set a swing low at $48.06 on September 21, 2021, and retested the same level on January 21. This development created a double bottom with sell-side liquidity resting below it.

The market makers pushed Axie Infinity price below this barrier multiple times over the past ten days. As AXS retests this level again, investors can expect a liftoff that may kick-start a new uptrend.

This new trend could propel Axie Infinity price by 20% to retest the supply zone, extending from $58.22 to $69.22. While the lower limit is where the upside is likely to be capped, there is a good chance AXS could wick above it.

In some cases, Axie Infinity price could retest the $65.12 hurdle, bringing the total gain to 35%.

AXS/USDT 1-day chart

Regardless of the current outlook, a breakdown of the $48.03 support level will dent the optimism of Axie Infinity buyers. A daily candlestick close below the immediate support level at $44.27 will create a lower low and invalidate the bullish thesis by skewing the odds in the bears’ favor.

This development could see Axie Infinity price crash by 15% before retesting the weekly support level at $37.66.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.