Axie Infinity price likely to land in the $20 zone

- AXS price is on a vertical decline.

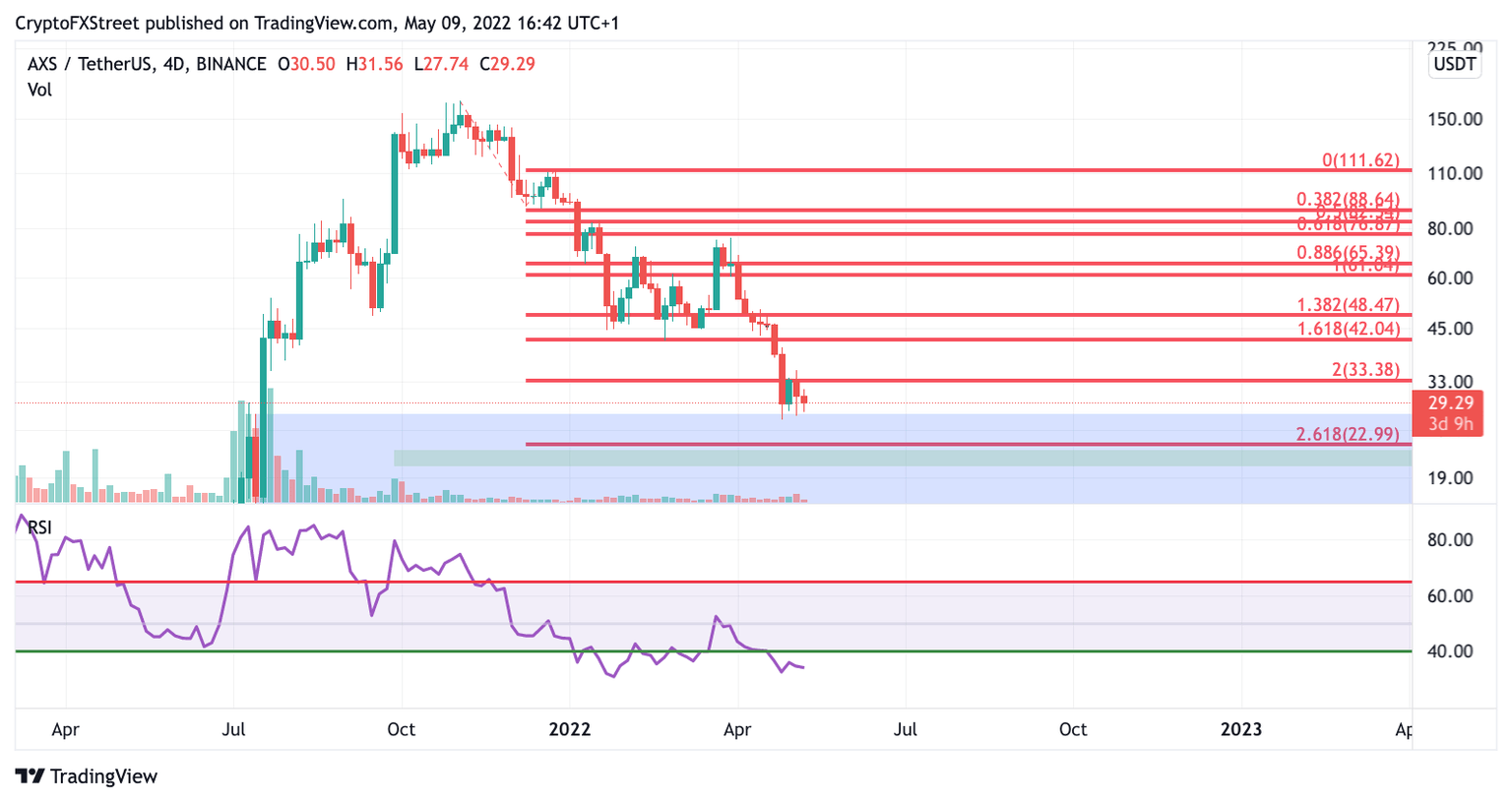

- Axie Infinity price action has Fibonacci levels coinciding with a $20 target.

- Invalidation of the bearish thesis is a breach at $44.42.

Axie Infinity price is looking more bearish than before as the slope of its decline is going vertical

More price drops are likely.

AXS price is falling fast

Axie Infinity price displays strong bearish momentum to start this week's trading session. At the time of writing, AXS price is on a brief pause following the weekend's sell-off as the price trades below $30. A Fibonacci projection tool surrounding the initial decline from November to December shows how strong the bears really are. Since the initial sell-off in December, the bears have managed to breach and close every target on their way down. Such price action spells a strong bearish presence and should not be taken lightly.

Axie infinity price is likely to breach the next target, the 261.8% Fib level at $22.99. Because the AXS price slope of decline is going vertical, traders should look for a capitulation event to occur before buying the lows. A bullish hammer on the 4-day chart coupled with divergence

from the Relative Strength Index could be a perfect scenario for a recovery of the AXS price.

AXS/USDT 4-Day Chart

Ultimately the best confirmation for the end of the downturn will be a breach at $44.42. If this price spike occurs, the bulls could invalidate the downward trend and send the AXS price back to $88, resulting in a 200% increase from the current AXS price

.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.