Axie Infinity eyes support, but downside pressure for AXS remains

- Axie Infinity price may buck the trend of any broad recovery and continue to move lower.

- On the weekly and daily charts, extreme oversold levels warn of a relief rally.

- On the weekly chart, bulls need a 100% gain to return AXS to bullish conditions.

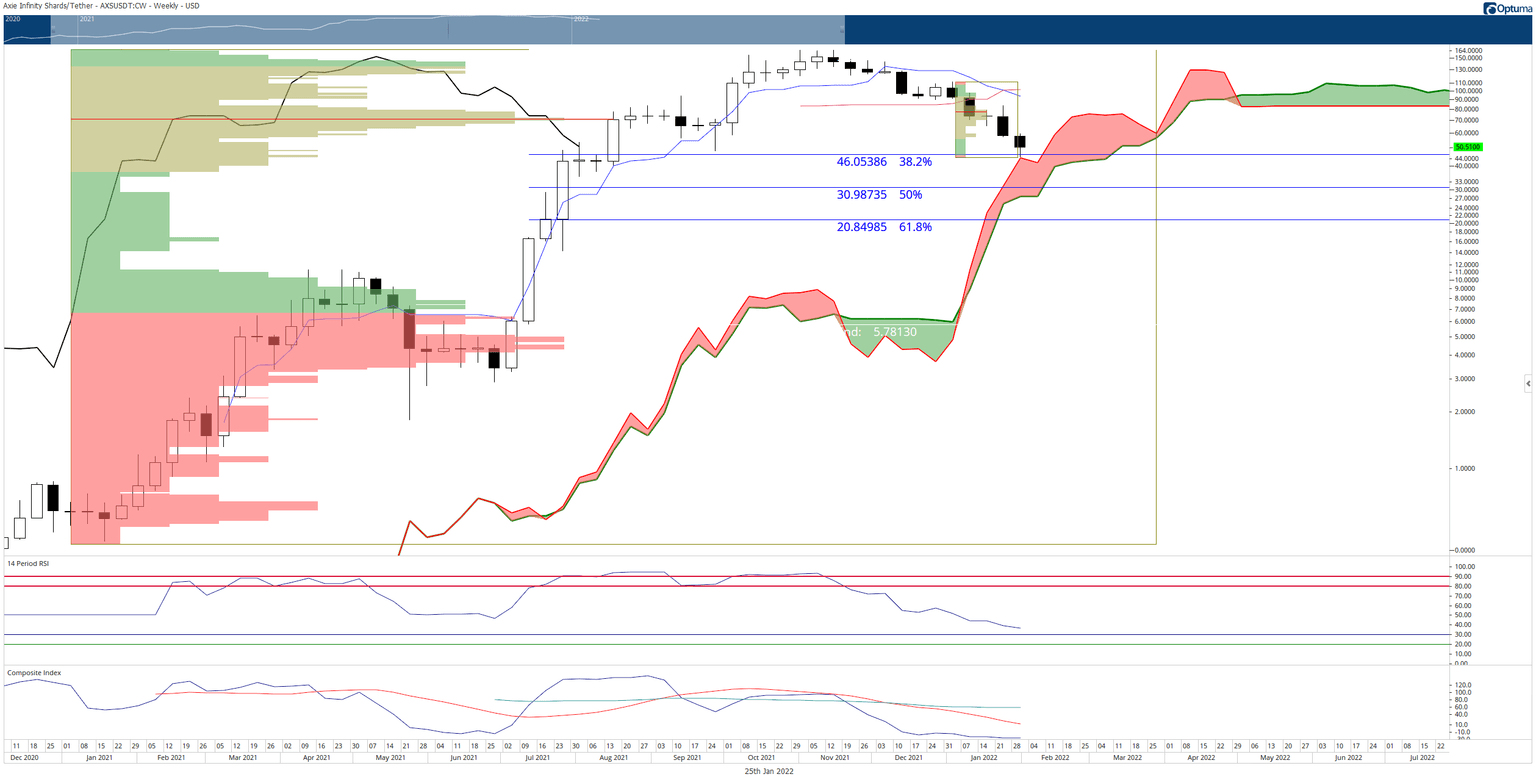

Axie Infinity price has been hammered since the beginning of 2022. It has fallen more than 52% this year and is down over 73% from the all-time high made in November 2021. Despite the 73% loss, a 50% logarithmic Fibonacci retracement has yet to trigger.

Axie Infinity may bounce and retest $90, but a drop to $31 is also likely

Axie Infinity price has found some support against the top of the weekly Cloud (Senkou Span B) at $44.25 and the 38.2% Fibonacci retracement at $46. A bounce from these lows should be expected, especially given the extreme oversold conditions on the weekly chart.

The Relative Strength Index remains in bear market territory and is slightly above the first oversold level at 30. More importantly, however, is the Composite Index. The Composite Index has essentially flat-lined and created new all-time lows, pursuing lower lows every other week. Combining these major oversold oscillator levels and the price support levels indicates a bounce to the Tenkan-Sen at $90 this week or, roughly, the $70 zone next week.

However, Axie Infinity price could move lower. Amongst its peers, AXS is the only remaining primary crypto in its peer group that has yet to make a 50% retracement based on a logarithmic Fibonacci measurement. GALA, MANA, ENJIN, and others have all completed their deep retracements, except AXS.

AXS/USDT Weekly Ichimoku Kinko Hyo Chart

The downside target for Axie Infinity price is $46. If AXS bulls want to invalidate any further bearish outlook, then they have the difficult task of pushing Axie Infinity to a weekly close above the Kijun-Sen, currently at $104.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.