Axie Infinity price to take 20% nosedive as AXS fails to hold

- Axie Infinity is firmly trading further away from $73.62.

- AXS price is like other cryptocurrencies under selling pressure in markets fleeing to safe-havens.

- AXS could shed another 20% of market value, with $50 being the level for a bounce.

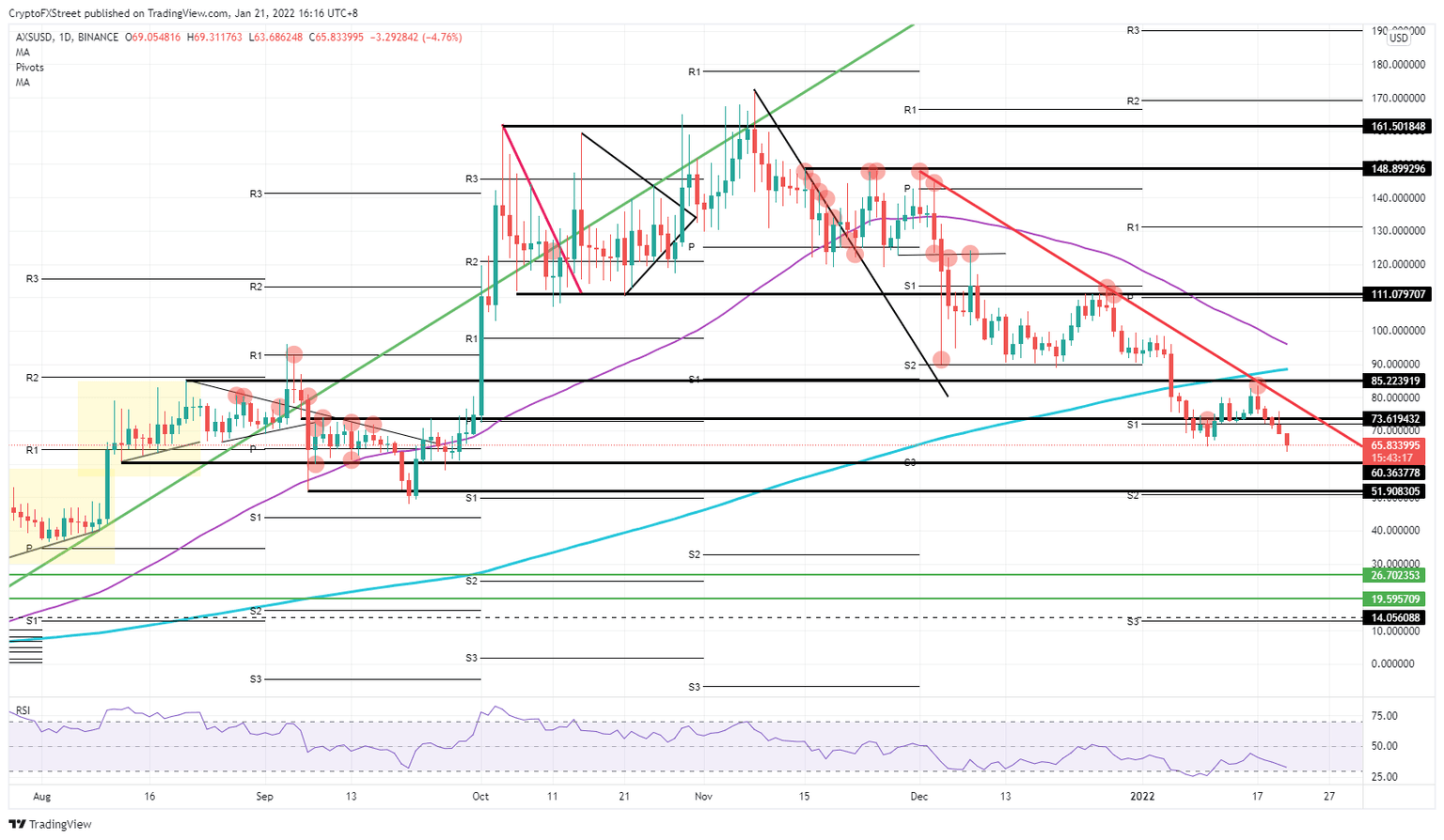

Axie Infinity (AXS) is no different from other cryptocurrencies today as global markets cannot make a fist against the bearish tone currently playing the lead in sentiment. After a false break above $73.62, AXS price action gapped lower and is on its way to touching $60.36 before possibly dipping another leg lower incurring 20% losses. A bounce off the $50 handle looks to be the next play for bulls, but as markets are in correction mode, it could well not be enough.

Axie Infinity sees bulls waiting for this storm to blow over

Axie Infinity made a false break higher, trapping bulls above $73.62 and squeezing them out of their positions with a sharp opening lower. Global market sentiment does not look to be in a good mood today, going into the weekend. This could further cripple cryptocurrency price action throughout the weekend.

AXS price has a few technical support levels nearby that could contain Axie Infinity losses. First up is $60.36, the low from August 12 which was also subject to some pivotal moves above and below throughout the last quarter of 2021. If that does not hold, another $10 could be lost towards $50, where a historical level and the monthly S2 support level will be able to do the trick and attract investors to stop this decline for now.

AXS/USD daily chart

Markets could make a new attempt to turn the tide and try to book some gains before heading out for the weekend. As several assets are quoting at interesting levels, investors could come in, in a broad scope, buying risk assets to preposition for the next leg higher in the overall uptrend. In such a scenario, AXS price would pop back up above $73.62 and test the waters near the red descending trend line, with a possible break above $85.22 thereby killing the current downtrend for now.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.