Axie Infinity could drop another 30% as profit-taking intensifies

- Axie Infinity price experiences profit-taking that is likely to continue amid broader cryptocurrency market weakness.

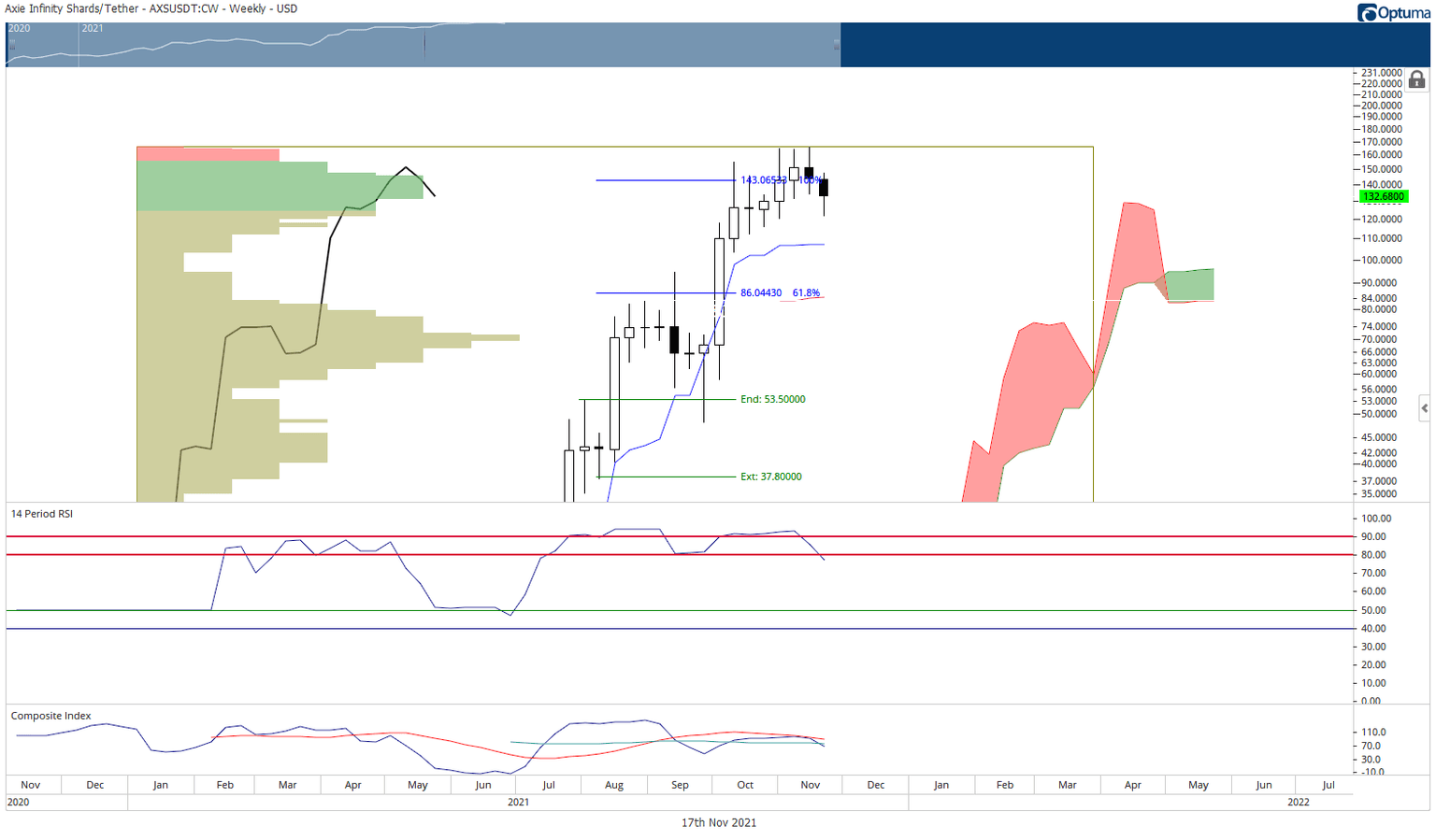

- The rounded top pattern threatens a deeper retracement.

- A greater than 30% correction could occur.

Axie Infinity price remains one of the best performing cryptocurrencies of 2021. Its all-time high of $166 was formed last week and now faces profit-taking and a pullback.

Axie Infinity price to experience Ichimoku mean reversion

Axie Infinity price action is very similar to Bitcoin’s and Ethereum’s current price action. The similarity is the large and persistent gaps between the bodies of the weekly candlesticks and the weekly Tenkan-Sen.

Because gaps between the candlestick bodies and the Tenkan-Sen often resolve within four to six periods, Axie Infinity is primed for a near-immediate drop. The weekly Tenkan-Sen on Axie Infinity’s chart is at $106.50. A return to that level would represent a 30% drop from the current weekly open. However, there is a strong possibility of an even deeper decline.

The Volume Profile shows that a drop below $120 could trigger a fast move to the $85 value area. The indicator is extremely thin between those two price levels. When price falls below the high volume node at $120, Axie Infinity price is likely to get pulled lower, like a vacuum to the next high volume node near $84 – which is also near the Kijun-Sen.

AXS/USDT Weekly Ichimoku Chart

While gaps between the bodies of the weekly candlesticks and the Tenkan-Sen often resolve with price moving to the Tenkan-Sen, that is not always the case. Therefore, Axie Infinity price could consolidate and wait for the Tenkan-Sen to move up to price to fill the gap slowly. That would invalidate the current projected 30% drop.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.