Avalanche price remains submerged, but bulls can come out on top if this happens

- Avalanche price fell by 44% in November and has since rebounded by 10%.

- AVAX currently hovers beneath a broken support zone.

- The bulls must conquer the $14 liquidity zone to prompt a potential rally toward $16.

Avalanche price may set up for one more decline targeting the halfway point of the 2020-2021 bull run. Despite this, the bulls are showing efforts to refute the bearish stronghold. The $14 price zone is crucial for defining the next directional rally.

AVAX price is submerged

Avalanche price has yet to recoup substantial losses following the 44% decline witnessed earlier in the month. Currently, the Ethereum-based gaming token is up a mere 3% on the day, bringing the total recovery of lost value to 10%. AVAX failure to prompt a significant countertrend move could spell bad news for December.

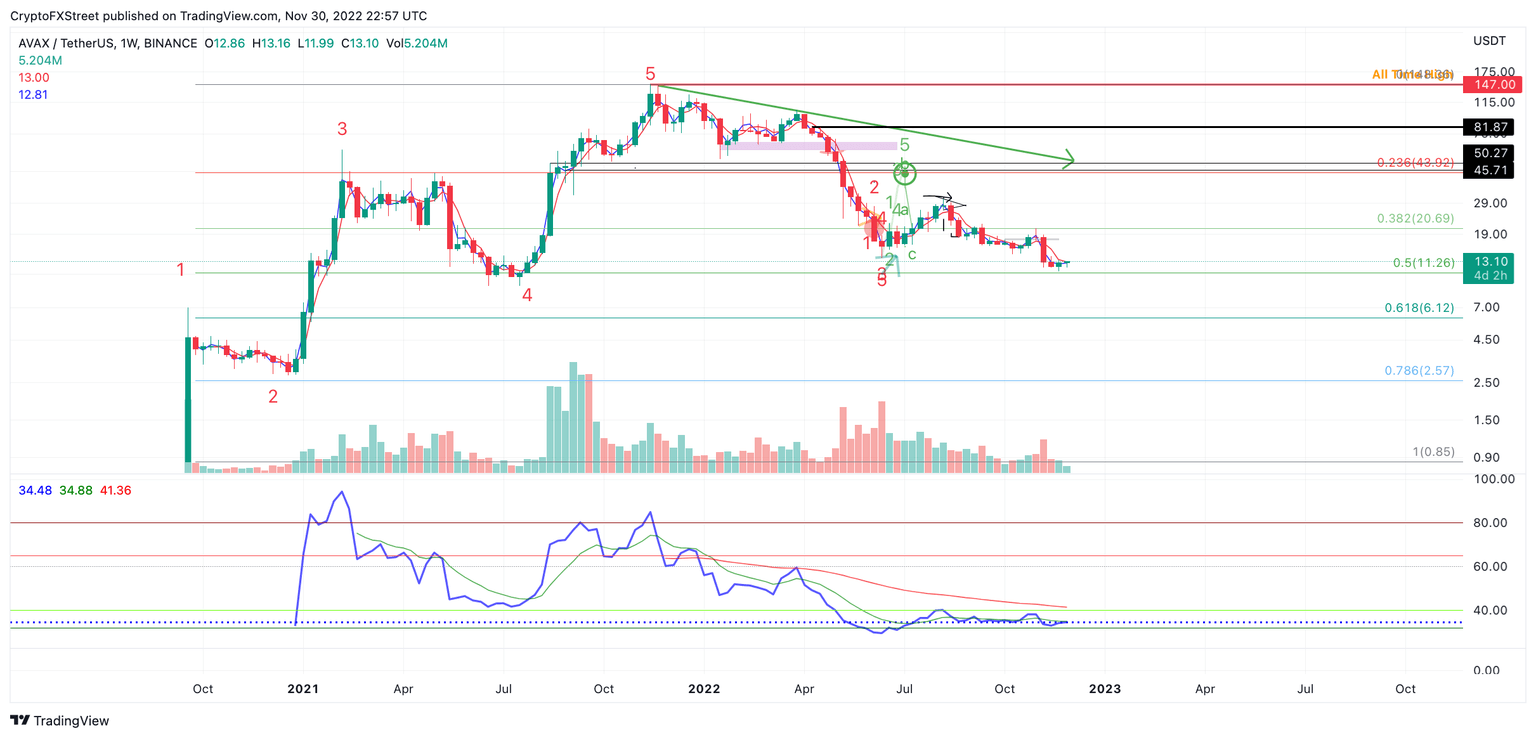

Avalanche price currently auctions at $13.01. The bulls and bears show a tug-of-war price action on smaller time frames near the 8-day exponential and 21-day simple moving averages. Traders should be cautious as the moving indicators could produce a bearish cross signal. A bearish cross is when the slower-moving average crosses over the faster-moving average while the auctioning price stays on or below both indicators.

A bearish cross would likely catalyze a sweep-the-lows event targeting the 50% Fibonacci retracement level at $11.26. The aforementioned level is the 50% mark between an all-time low at $0.85 and an all-time high at $147. It is worth noting that the Fibonacci levels are used by calculating exponential returns in logarithmic mode on Tradingview. AVAX will decline by 16% if said price action occurs.

AVAX/USDT 1-Day Chart

Invalidation of the bearish thesis targeting $11.26 could occur with a bullish surge through the $14 liquidity zone. In doing so, the AVAX price rally towards the northern side of the November range near $16.20, resulting in a 50% increase from the current market value.

Here's how Bitcoin price moves could affect Avalanche price

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.