Avalanche price has AVAX bulls doubting support with ECB set to unwind portfolio

- Avalanche price is starting to show signs of a correction ahead.

- AVAX sees traders pricing in the ECB entering the market to sell off assets.

- With ample supply hitting the market on both sides of the Atlantic now, a lower price is valid.

Avalanche (AVAX) price and other risk assets such as altcoins, cryptocurrencies and equities are due for a leg lower this week. The big motivation for that sell-off comes on the back of the European Central Bank (ECB), which is set to offload a big portion of its inflated balance sheet. The ECB balance sheet carries roughly 7.8 trillion Euros in assets that it bought to support the European economy since the subprime crisis.

Avalanche price set to nosedive as ECB begins quantitative tightening

Avalanche price and in general risk assets are set to take a nosedive with the ECB making its first steps in the market as a seller. The ECB has roughly 8 trillion Euros to sell in bonds and equities that it bought since the Subprime Crisis to support Europe through its sovereign debt crisis and the covid economic collapse. With the market set to be swamped with supply, prices will need to be readjusted with a lower valuation for equities and cryptocurrencies as a final result.

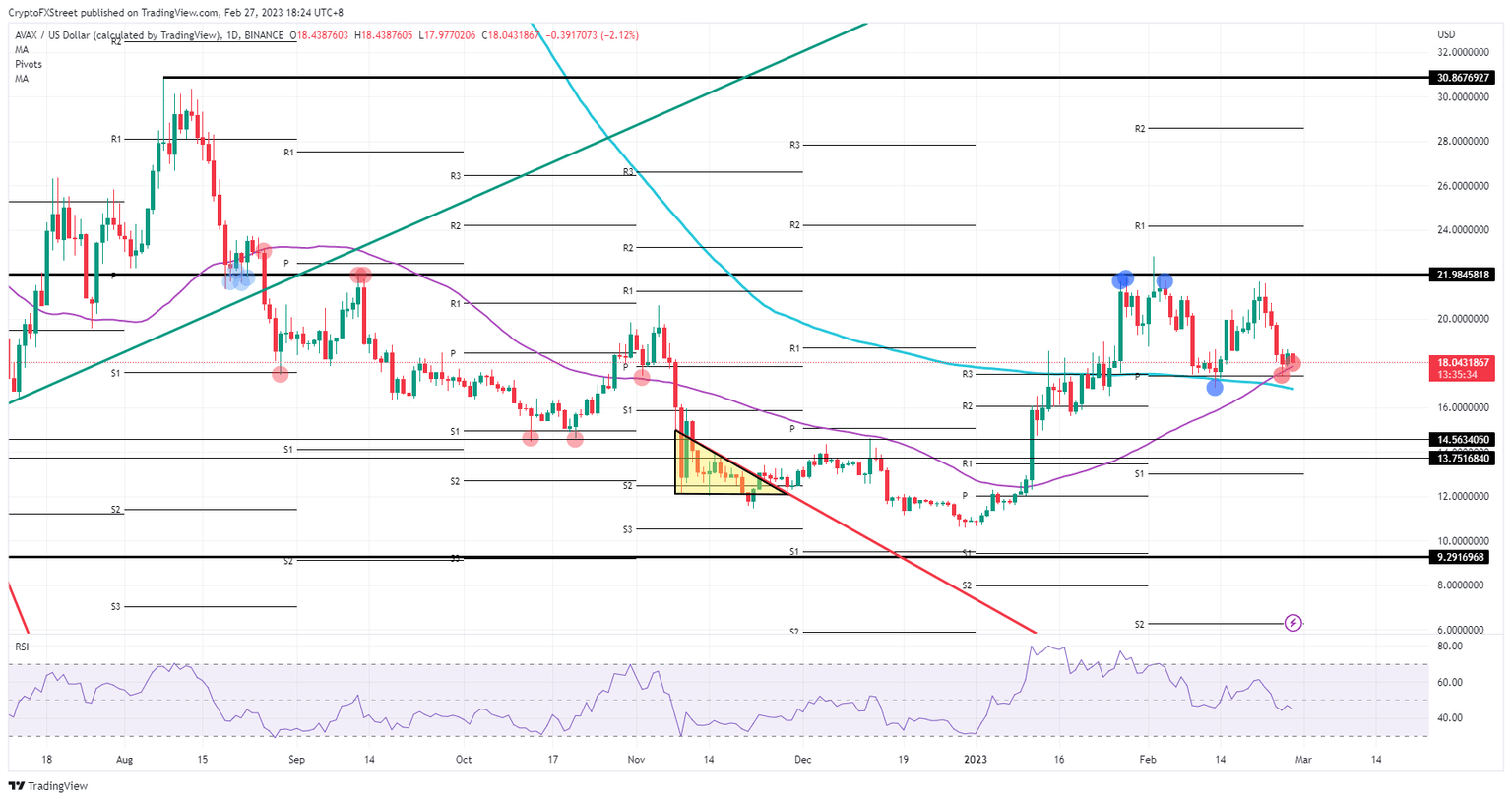

AVAX thus is set to break below the area between $17.80 and $16.80, which offered quite some supportive elements. Once those break under pressure a rundown toward $14.50 looks to be the only possible outcome. If traders thus need to put a number on the ECB unwinding its portfolio, this means that a rough 20% decline is pricing in the excess supply that will be hitting the market.

AVAX/USD daily chart

Should bulls decide to be stubborn and keep underpinning AVAX, a squeeze could be underway. That would mean that price action would quickly and quite steeply jump higher toward $22. In general, that means a 23% jump in just a few days in case bulls are able to seize control of the price action.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.