Avalanche Price Prediction: AVAX set to book 40% gains as this technical signal could expand demand

- Avalanche price is trading up near 4% as bullish sentiment picks up.

- AVAX sees a big technical signal nearly being triggered, which could induce a massive inflow.

- With price action pushing higher, expect to see this double whammy unfold before a 40% gain is granted.

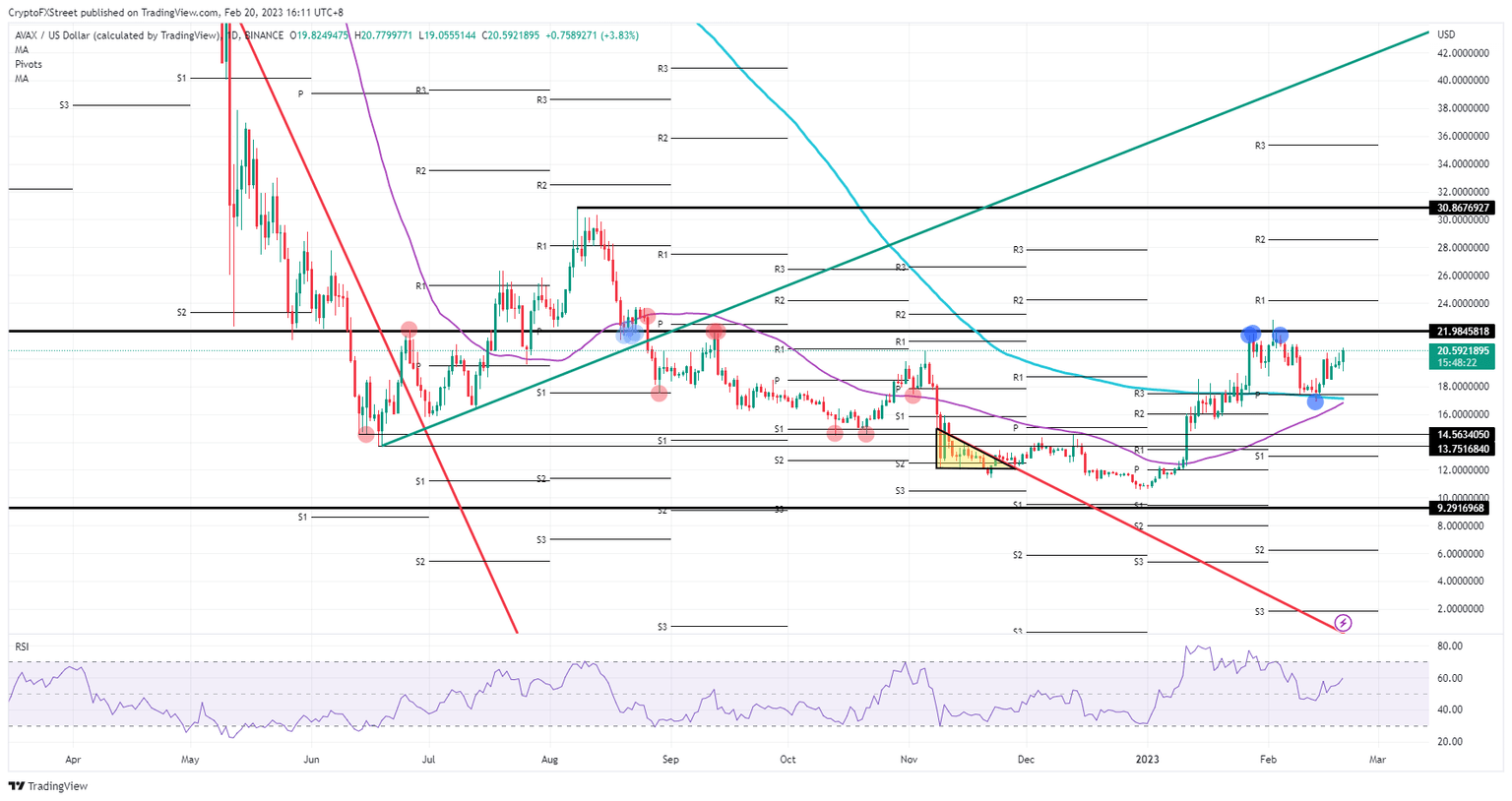

Avalanche (AVAX) price is seeing bulls storming out of the gate this Monday morning after what appears to be the best-performing week of the month at least. A big bullish signal is nearly in motion as the 55-day Simple Moving Average (SMA) is set to cross the 200-day SMA and form a Golden Cross. Expect that grand bullish formation to fall in line with AVAX crossing above $22 and breaking out of the cap residing there since last September .

Avalanche price ready to enter spring mode

Avalanche price is starting the week on a high note as bulls are already breaking above last week's high. The bullish tilt comes as the US equity market will be closed this Monday for an official holiday, which should send some trading volume to crypto. All these elements could trigger the end of the crypto winter as a bullish technical signal is just a few ticks away.

AVAX could see massive demand flying in once the Golden Cross is activated, with the 55-day SMA moving firmly above the 200-day SMA. That moment looks to be falling together with a break above $22 and could see a quick rally higher. As bulls finally trade away from the area that marks the crypto winter, another 40% gains could be granted with $30 as the next hurdle to take in the longer-term recovery trade.

AVAX/USD daily chart

It would not be the first time that the cap at $22 keeps its strength with bears not yet ready to let go. Expect a simple rejection and a return to $18 should the tail risk inflate once again.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.