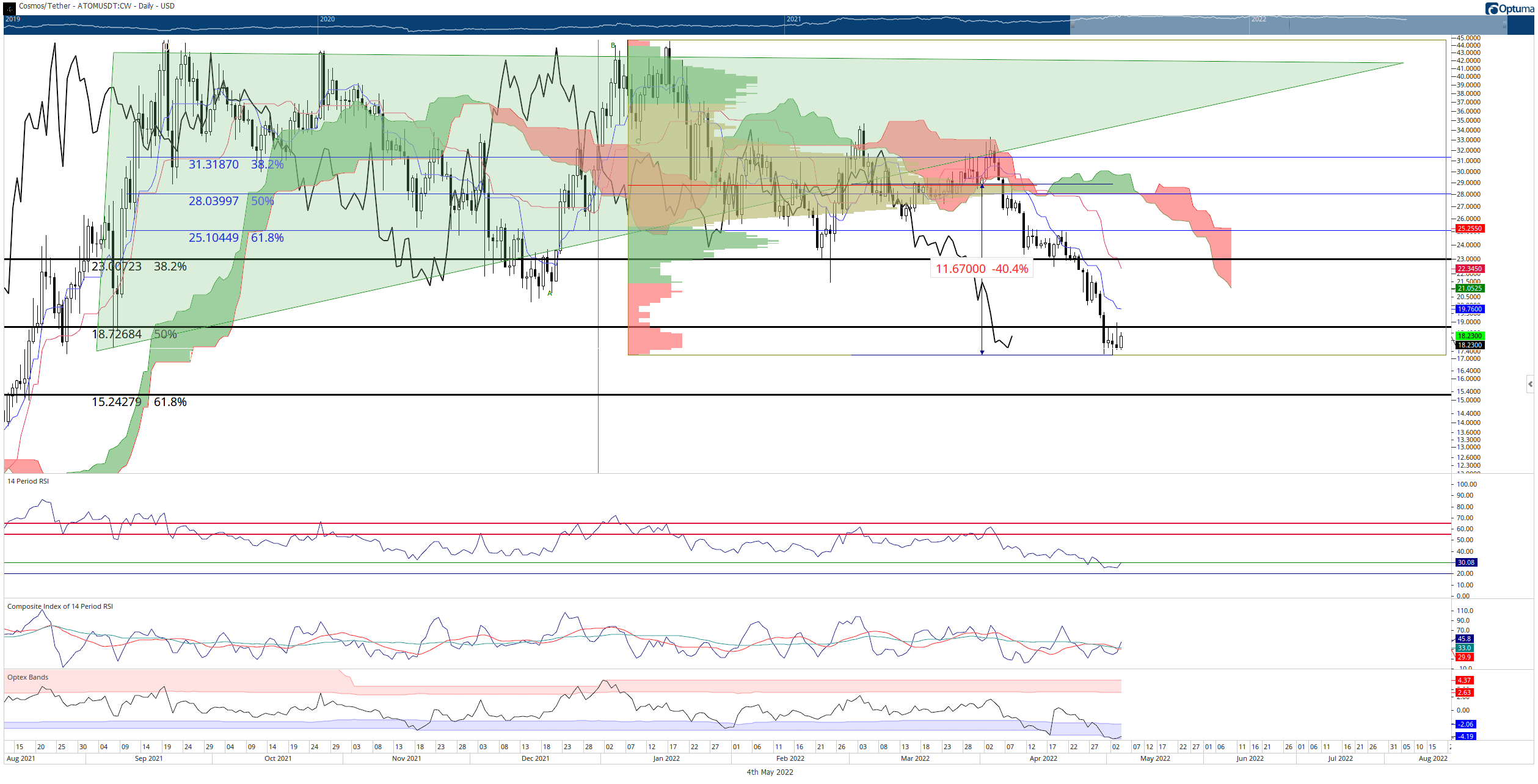

- ATOM price is resting near its 2022 lows and a major Fibonacci support level.

- Another 30% drop is likely if $18 fails to hold as support.

- In conjunction with time cycles, extreme oversold conditions indicate a bullish reversal may begin.

ATOM price action has faced the same selling pressure seen across all risk-on instruments. Cosmos lost nearly 40% of its value from the beginning of April to the close of April, and that trend may continue. But extremes in the oscillators may hint at some reprieve coming soon.

ATOM price may surprise with a major, albeit temporary rally

ATOM price and the broader cryptocurrency market have experienced some relief from the constant selling pressure. The relief rally before the US Federal Reserves meeting is not a surprise, but neither is the bounce itself.

ATOM/USDT Daily Ichimoku Kinkon Hyo Chart

The oscillators on the daily chart show clear signs that a bottom may be in. For example, the Relative Strength Index hit lows not seen since the Covid Crash in March 2020 - indicating extreme oversold conditions. Likewise, the Composite Index shows even more extreme oversold conditions after hitting new all-time lows.

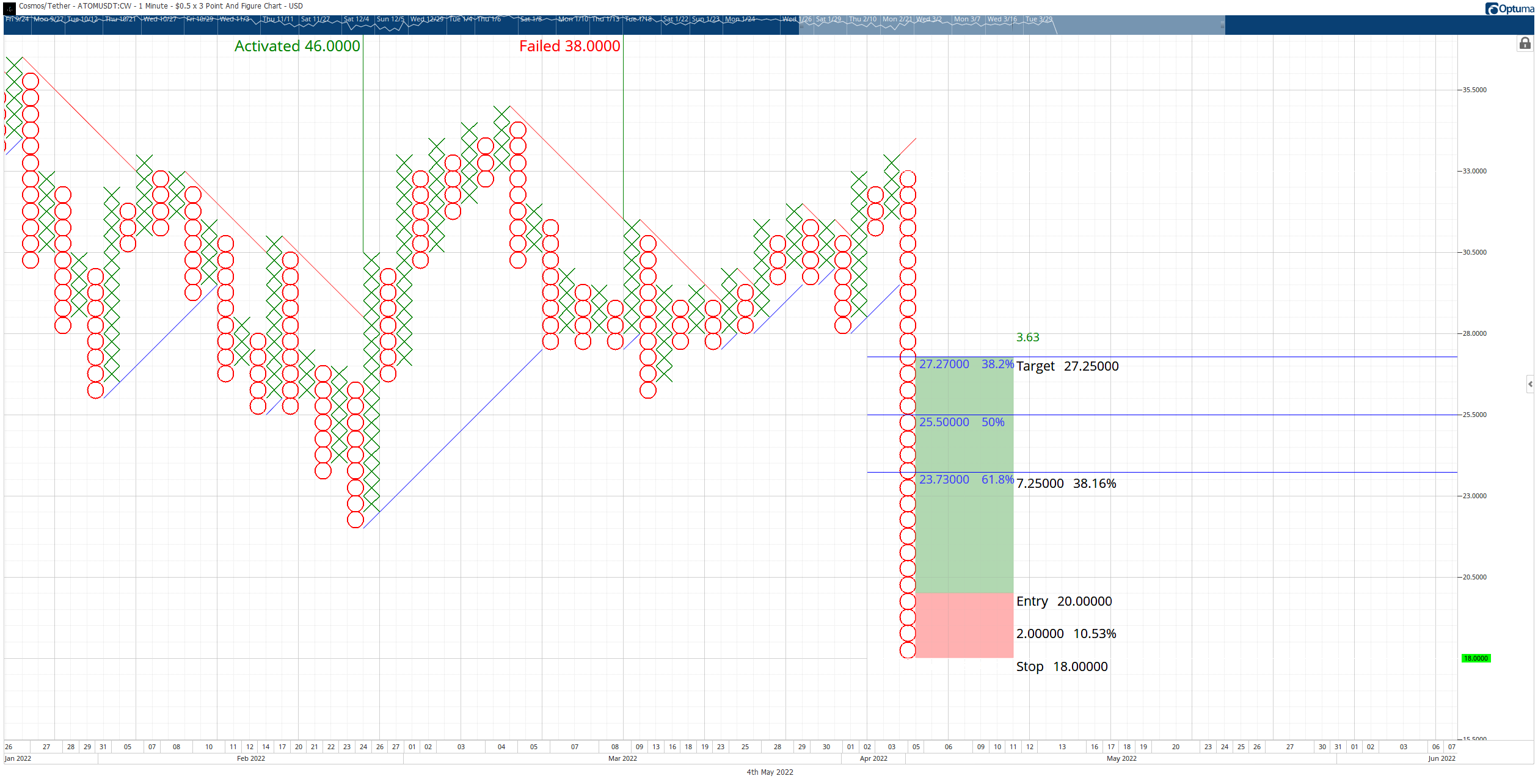

From a bullish perspective, there is a theoretical long opportunity for ATOM price on the $0.50/3-box Reversal Point and Figure chart. The long idea is a buy stop order at $20, a stop loss at $18, and a profit target at $27.25.

ATOM/USDT $0.50/3-box Reversal Point and Figure Chart

The theoretical buy opportunity is based on a pattern in Point and Figure analysis known as a Spike Pattern. The entry from the Spike Pattern is the 3-box reversal and, as such, has no invalidation point. As ATOM price moves lower, the entry moves lower as well.

However, downside risks remain substantial. There is a significant gap in the 2021 Volume Profile between the high volume nodes at $18 and $13. Any sustained period spent below the $18 value area increases the likelihood of a swift sell-off towards $13.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Top 3 meme coins price prediction Dogecoin, Shiba Inu, Bonk: Memes face steeper correction than Bitcoin

Dogecoin eyes February lows after nearly 23% decline in the past seven days. Shiba Inu could plummet another 13% amid the broader crypto market correction. Bonk price is likely to regain lost ground as technical indicators point at recovery.

XRP sustains above $0.50 as traders digest news of Ripple XRP Ledger entry in the Japanese market

Ripple (XRP) sustained above $0.50, a key support level, on Wednesday. XRP price is down nearly 6% in the past ten days. The altcoin is in a confirmed downward trend, and wiped out all gains since February.

Optimism OP struggles to gain momentum despite alleged $90 million OP purchase by a16z

Venture capital firm a16z has purchased $90 million in OP tokens under a two-year vesting period, Unchained crypto reports. Sources told Unchained Crypto that Optimism has done well and the project is still doing airdrops.

Sei price action forecasts an opportunity to accumulate SEI Premium

Sei (SEI) price is at a crossroads and could trigger a steep correction or potential bounce after setting up an all-time high (ATH) of $1.145 roughly a month ago. Based on the Bitcoin price action, a potential bounce will likely occur anytime now.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.