These altcoins could yield massive gains after Cardano and XRP prices rally this alt season

- Cardano and XRP price rallies are the beginning of Bitcoin and Ethereum gains spilling over into altcoins, according to experts.

- While Bitcoin and Ethereum prices hold steady, analysts are hunting the next altcoin that yields double-digit gains against these assets.

- Experts predict that Cosmos Hub’s token ATOM and Solana could yield massive gains in the alt season.

While large market capitalization assets Bitcoin and Ethereum hold steady, altcoins like Cardano and XRP have yielded double-digit gains overnight. Crypto experts believe Bitcoin’s rising dominance signals the popcorn effect is close, gains will continue spilling over in altcoins like Cardano (ADA) , XRP and Cosmos Hub’s ATOM.

Also read: XRP price tags $0.49 as Ripple bulls make a comeback

These altcoins could yield double-digit gains in the alt season

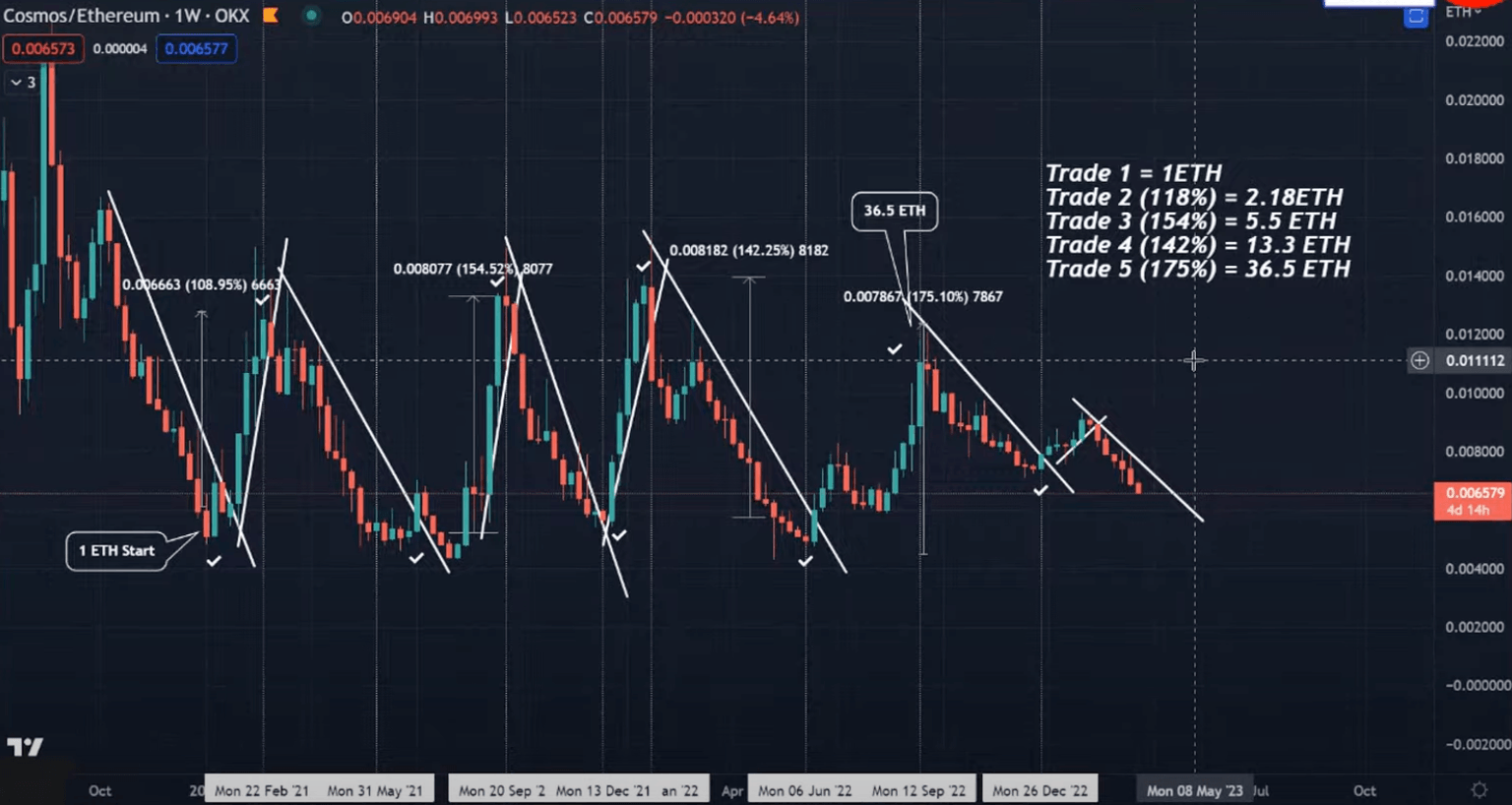

After price rallies for the Ethereum-killer Cardano and XRP, crypto market participants are hunting for the next altcoin that yields double-digit gains overnight. Cosmos Hub’s ATOM token has yielded between 118% to 175% gains in similar trade setups for holders between February 2021 and December 2022.

Sheldon, a YouTuber at Crypto Banter and a crypto analyst, identified these trade setups and marked them in the chart below, predicting the next massive surge in ATOM price against Ethereum.

ATOM/ETH 1W price chart

The target for ATOM is an average of 150% gains in a three-month time frame, similar to previous trades in the chart. Similarly, while Ethereum holds steady above the $1,800 level, ETH alternative Solana’s price chart presents a setup for 114% gains against Bitcoin.

SOL/BTC 1W price chart

Solana price has been in a downtrend since the beginning of 2022. The Ethereum alternative is poised for a 114% rally to hit the $0.000897 target in the short-term, as alt season narrative gathers momentum.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.