Circle CSO account compromised after USDC depeg

- Circle’s Chief Strategy Officer Dante Disparte’s Twitter account announces a one time USDC bonus for holders, experts consider it suspicious.

- Recent tweets by Disparte thank USDC users for their continued trust in the stablecoin, while USD Coin price holds steady at $1.

- Experts on crypto Twitter urge USDC holders to stay away from the likely scam and avoid clicking on the link.

Circle’s stablecoin USD Coin (USDC) made headlines with its depeg after the collapse of the Silicon Valley Bank. Since then the stablecoin has recovered from its price drop and re-established its $1 peg.

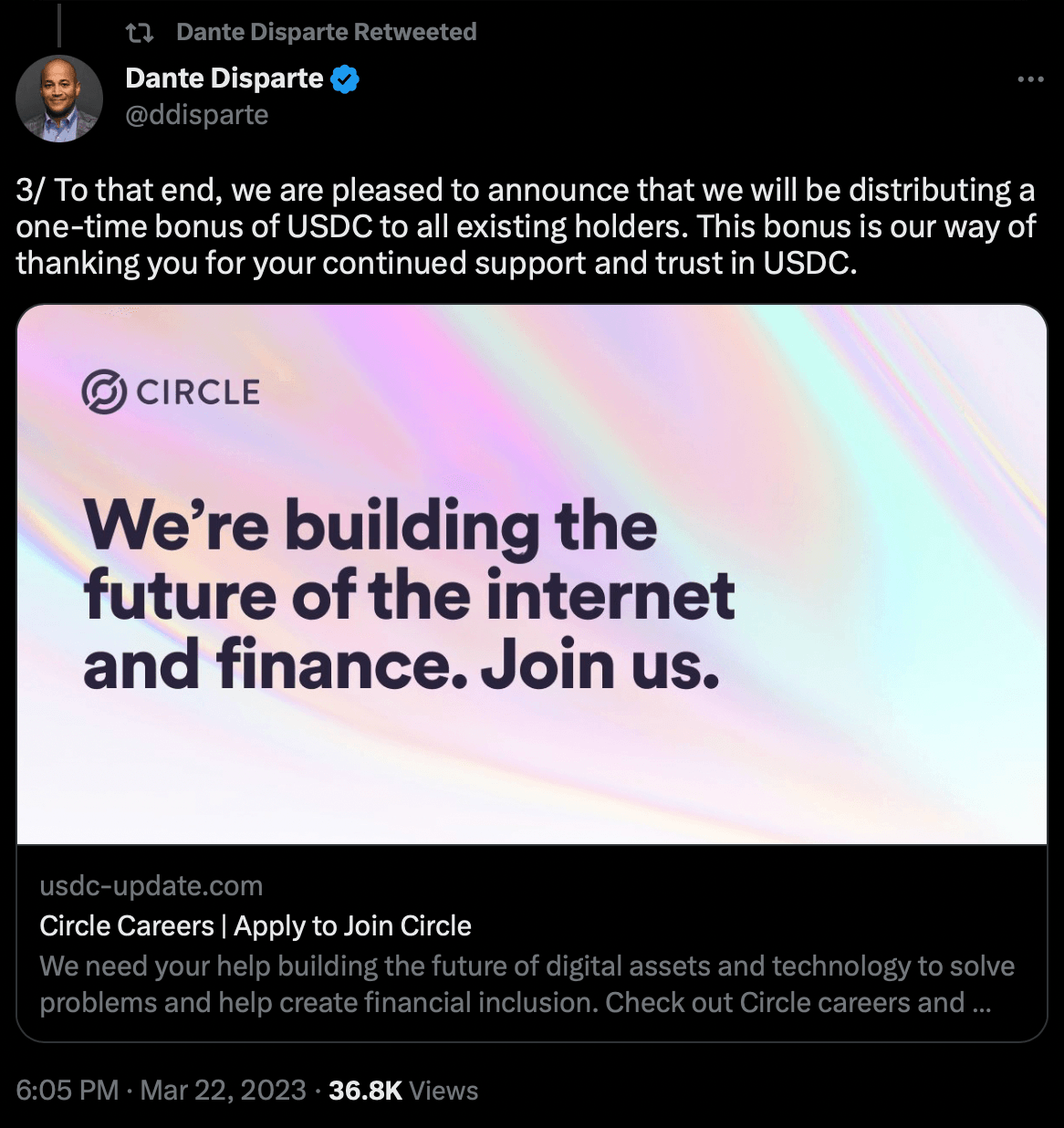

Earlier today, Circle’s Chief Strategy Officer Dante Disparte announced a one time USDC bonus for users. The link shared in the tweet thread leads users to a page with a call to action to “Get USDC.”

Also read: These altcoins could yield massive gains after Cardano and XRP prices rally this alt season

Is Circle giving away USDC bonus to holders?

From Circle CSO Dante Disparte’s tweet it may seem that the firm is giving away free USDC to its holders as a bonus. However, digging deeper raised suspicion among experts and influencers on crypto Twitter.

While Disparte’s tweet affirms USDC’s price stability and thanks holders for their continued support, the link shared redirects users to a page that urges them to click on “Get USDC.”

Circle’s official website and social media handles have mentioned the re-establishment of USD Coin’s $1 peg and addressed the decline in the stablecoin’s price. However, there is no mention of a giveaway or bonus for holders.

Tweet announcing giveaway

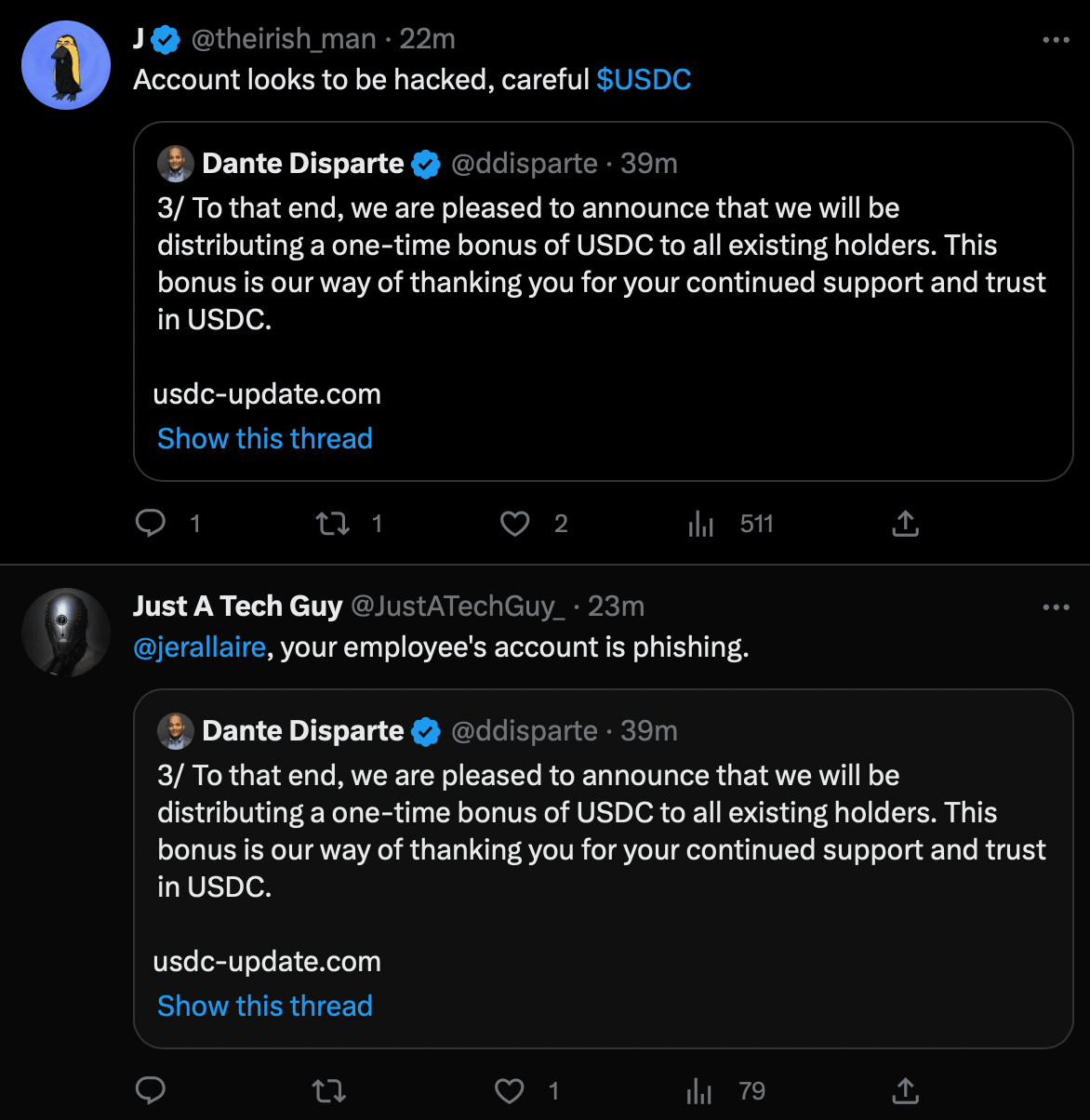

Analysts and experts on crypto Twitter reacted to the tweet and asked traders to stay away from the unconfirmed USDC giveaway. There is no official confirmation or a statement from Circle yet, therefore the USDC bonus/ giveaway scheme could be a scam.

Crypto Twitter response

Update: Circle confirms USDC giveaway was a scam

Circle shed light on the mysterious USD Coin giveaway and tweeted to affirm that the bonus giveaway was indeed a scam.

This Twitter account (@ddisparte) has been taken over by a scammer. Any links to offers are scams. We are investigating the situation and taking action accordingly.

— Circle (@circle) March 22, 2023

The firm is set to take legal action against the scammer once identified.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.