Algorand price set for bounce as tailwinds kick in on positive headlines

- Algorand price action is set to bounce off the monthly S1 support level.

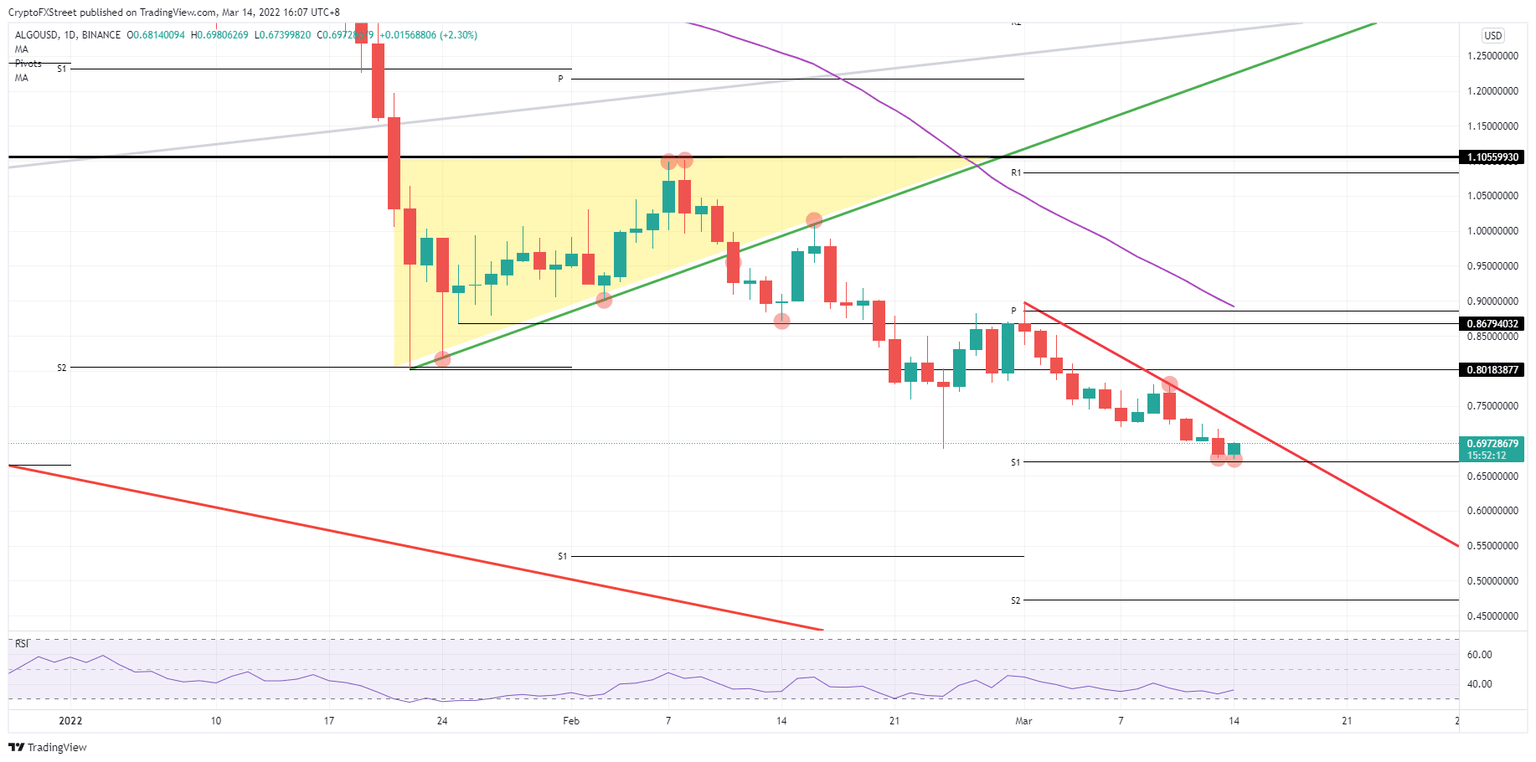

- ALGO set to test the red descending trend line at $0.7279.

- With more peace talks underway, tailwinds could gain strength, possibly breaking above the red descending trend line later this week.

Algorand (ALGO) price opens this week with a perfect bounce off the monthly S1 support level at $0.6705. Algorand price action sees a bullish lift as tailwinds have emerged over the weekend with more peace talks set to commence today and positive signals out of both Russia and Ukraine that progress has been made. It looks like diplomats are doing the groundwork for a final meeting between Zelenskyy and Putin to conclude everything and sign the peace agreement, which will unleash cryptocurrencies and spark a massive bull run for ALGO price towards $1.05.

Algorand price prepares for the first phase for a breakout trade

Algorand price action sees tailwinds coming in this morning on positive signals from both Ukraine and Russia on how peace talks are evolving. The ASIA PAC session jumped on this and has already returned a small 3% gain, with possibly more gains to come intraday. ALGO price action is likely to be capped for now with the red descending trend line towards $0.6705, but once more headlines hit the wires on a possible breakthrough, such as a meeting date being set between Zelenskyy and Putin, expect markets to potentially go euphoric.

ALGO price action will try and hit $0.6705 today, already a 13% move higher – so quite ‘chunky’. As the tailwinds continue throughout the week, expect bullish momentum to build to break through the red descending trend line and open up, to expand towards $0.8859, holding over 20% gains. Some form of pause or stall in the rally could come at $0.8018, falling in line with the low of January 22, and further up the 55-day Simple Moving Average (SMA) and the monthly pivot at $0.8859 could cap upside potential.

ALGO/USD daily chart

Although talks are ongoing, no real ceasefire breakthroughs have been made and several cities are continuously under heavy attacks with citizens unable to flee. The bombing Putin initiated just 10km outside the Polish borders, makes it more likely a NATO intervention could soon be triggered, if a missile were to hit Polish soil. Such a turn of events would see bears entering ALGO price action, pushing bulls out of their positions again like they did last week, and pushing price action below the monthly S1 at $0.6705, towards $0.4278, shedding 36% of its value in the process.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.