Algorand lowest weekly close in over a year complete, ALGO may bounce to test $1

- Algorand price closed the week with the lowest weekly close in over a year.

- ALGO’s current downtrend has now existed for over 100 days.

- High probability of technical support near $0.71, but downside risks remain.

Algorand price action has shifted into an extreme low, bouncing off a key Fibonacci level but still uncomfortably close to the 2022 lows. However, ALGO’s weekly chart may point to a recovery occurring soon.

Algorand price positioned for a strong bounce to retest $1

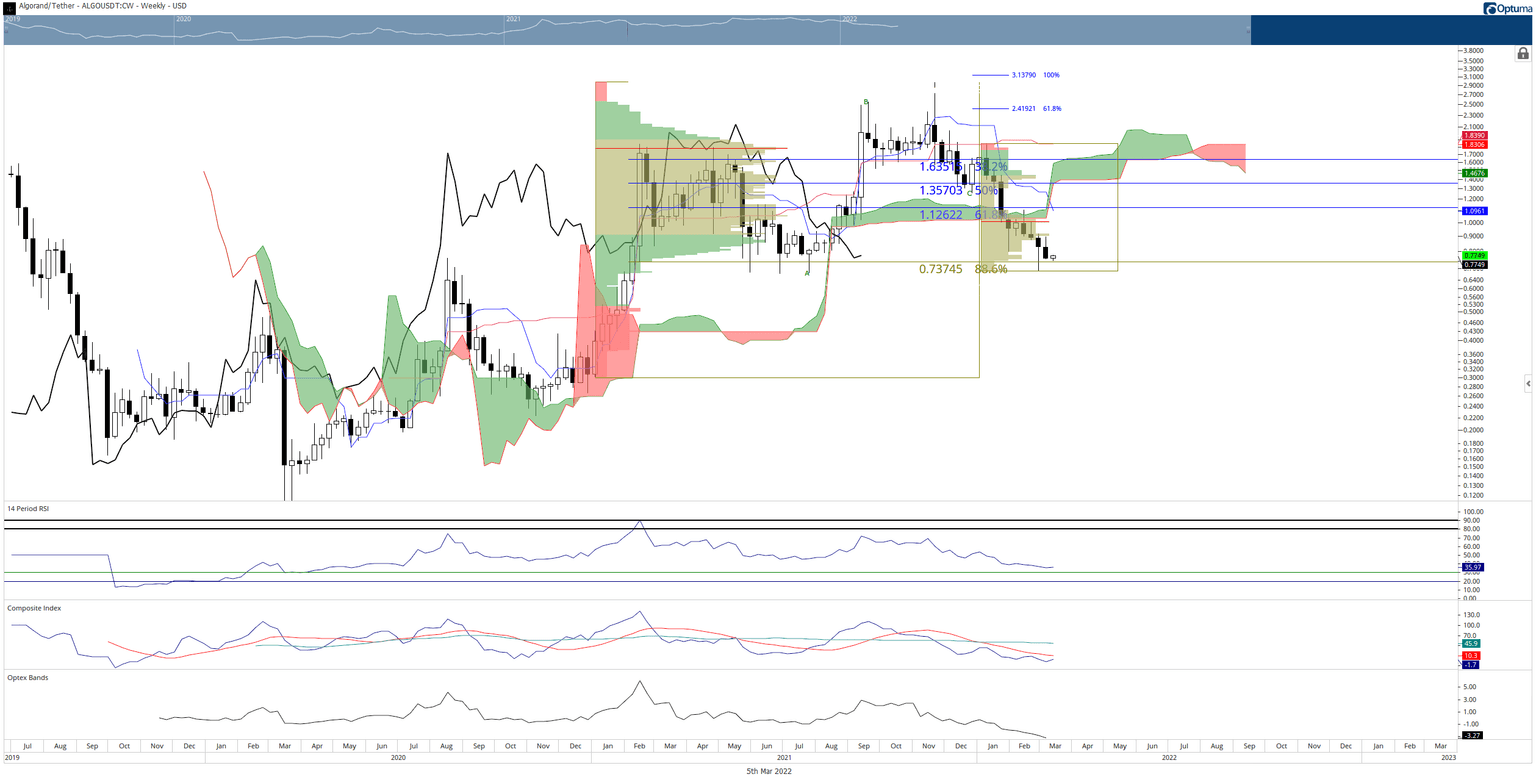

Algorand price is currently trading at a level where there is little to no support with the Ichimoku Kinko Hyo system or at any other technical price level. The closest support zone is the 88.6% Fibonacci retracement at $0.74; a level ALGO breached two weeks ago to hit new 2022 lows.

Algorand has not only made new 2022 lows in the past few weeks, but last week’s close was the lowest since the week of January 29, 2021. However, some relief may be developing on the current weekly candlestick as buyers appear to support Algorand price near the 88.6% Fibonacci retracement at $0.74.

On the weekly Ichimoku chart, Algorand price is in a confirmed Ideal Bearish Ichimoku Breakout, a condition triggered on February 11, 2022, weekly candlestick. However, the weekly oscillators now point to a probable and imminent bullish reversal.

ALGO/USDT Weekly Ichimoku Kinko Hyo Chart

The weekly Composite Index is now at the second-lowest level in Algorand price action history. A result of this extreme low is hidden bullish divergence. The Composite Index has a lower low than the trough found in October 2020, but the corresponding price action shows higher lows. Additionally, given the massive gaps between the bodies of the weekly candlesticks and the Tenkan-Sen, a mean reversion to $1 is extremely likely.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.