Algorand price looks oversold and set to rally by 30%

- Algorand price extremely oversold and overextended.

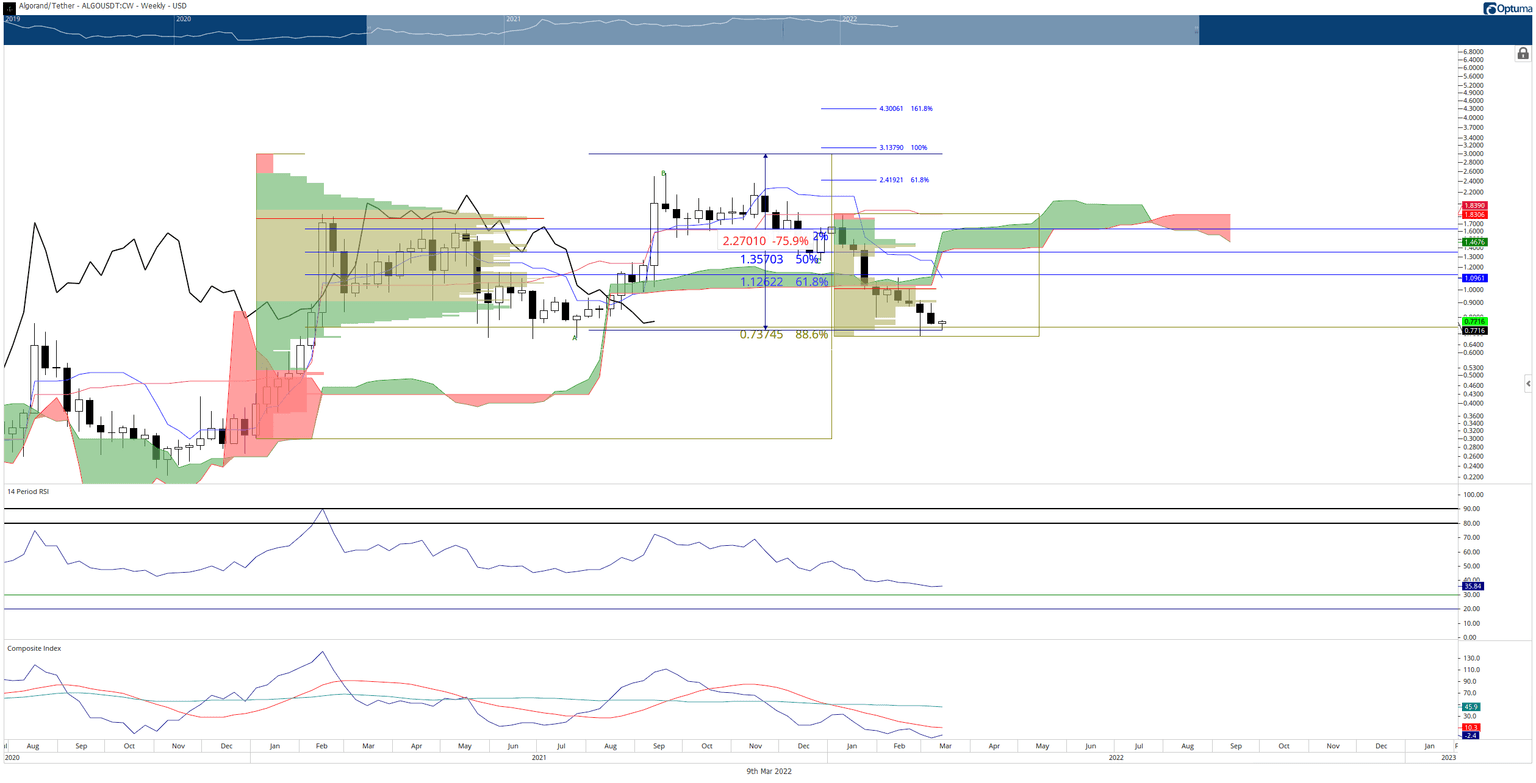

- Massive gaps and disequilibrium are now present within the Ichimoku Kinko Hyo system.

- Downside risks are extremely limited, while potential gains are significant.

Algorand price, like most altcoins, has suffered from an extended downtrend that has been exacerbated by general risk-off sentiment due to geopolitical saber-rattling by Russia's invasion of Ukraine. However, technicals indicated that a major rally would occur despite uncertainties.

Algorand price positioned for a return to $1.10

Algorand price action is a perfect example of what an extremely oversold and overextended instrument looks like. ALGO is currently trading at a discount of nearly 76% from its November 2021 all-time high of $2.99. A good chunk of that loss is likely to see some retracement very soon.

From an Ichimoku perspective, Algorand price has massive gaps between the weekly candlestick bodies and the Tenkan-Sen, indicating an imminent and swift mean reversion back to the Tenkan-Sen near $1.10. Additionally, ALGO has moved to such an extreme that it hit the max mean range from the Kijun-Sen, warning a violent snap-back to a value between $1.10 and $2.00.

The historical lows in the Composite Index oscillator indicate the likelihood of a major mean reversion rally. These new all-time lows have formed as the Relative Strength Index hits the first oversold level in a bear market at 30 and while Algorand price bounces off of the critical 88.6% Fibonacci retracement at $0.73.

ALGO/USDT Weekly Ichimoku Kinko Hyo Chart

Downside risks remain a concern, but the size and scope of any continued move lower are likely to be small. Algorand price has significant support near the top of the 3-week Ichimoku Cloud (not shown) in the $0.70 to $0.71 value area, helping establish a swing low and a limit to how much further ALGO can move when it is already so extended.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.