The World Health Organization has declared the coronavirus outbreak a global health emergency. What does it mean for the global economy and the gold market?

Will Coronavirus Kill Us All?

So it looks like not the recently feared nuclear war with the North Korea or Iran, but the virus outbreak will destroy humanity. Let it be, I won’t complain, I work from home, so I’m less likely to become infected!

OK, but jokes aside. The current outbreak of the novel coronavirus (2019-nCoV) that was first reported from Wuhan, China, on 31 December 2019, is a serious threat. Indeed, the World Health Organization (WHO) has declared the coronavirus outbreak a global health emergency. It is only the sixth declaration of international public health emergency since 2009. The previous cases included: the swine flu pandemic in 2009, a polio outbreak in 2014, the West Africa Ebola outbreak in 2014, the Zika virus outbreak in 2015 and another Ebola outbreak in the Democratic Republic of the Congo in 2019.

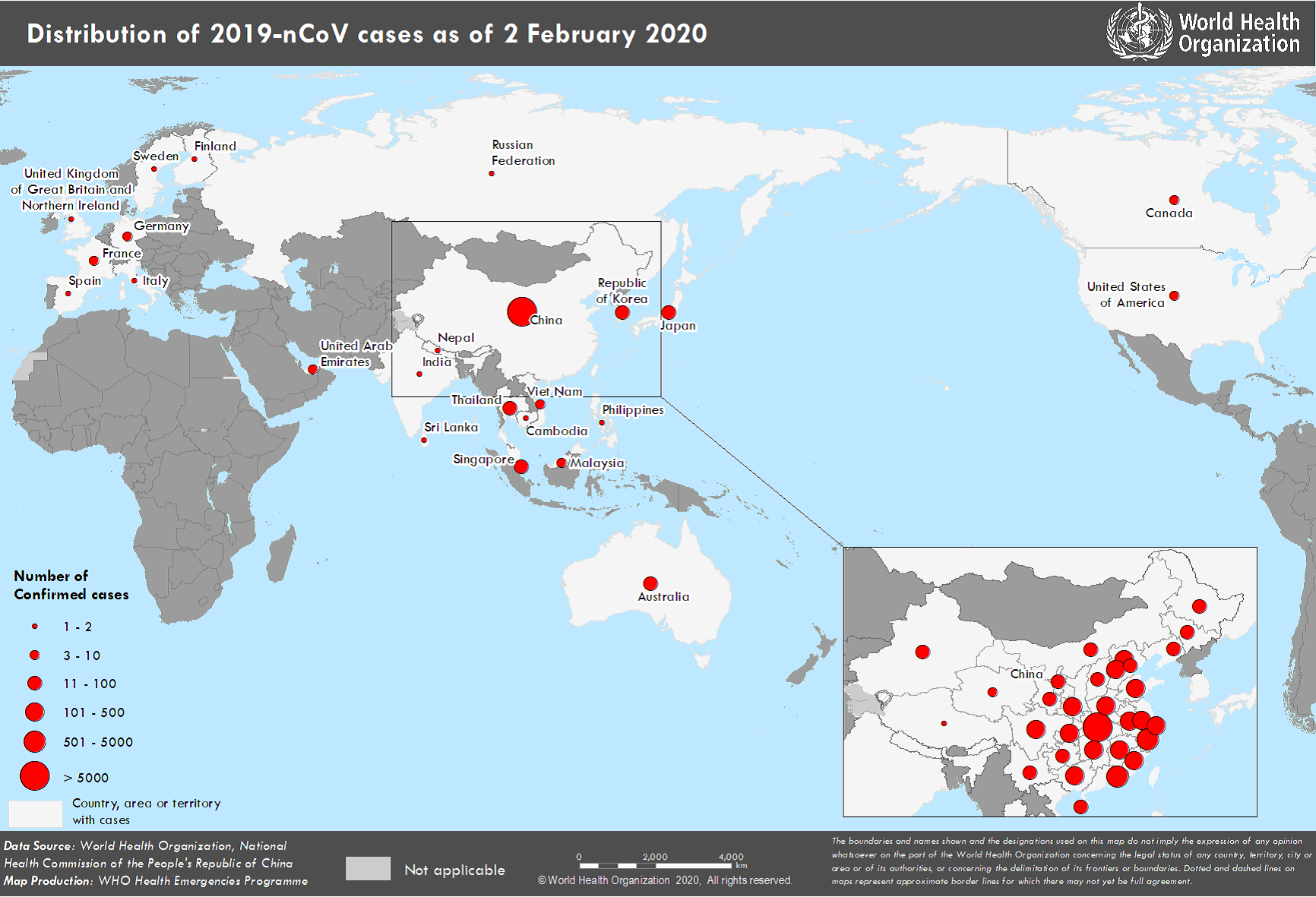

As of February 2, there were around 14,560 confirmed cases of coronavirus in 24 countries, according to the WHO. You can see the global distribution of these cases in the map below. Virtually all cases (more than 99 percent) were reported in China. The WHO reports 305 deaths, of which only one is outside China (in the Philippines).

As the name suggests, the new virus is part of the coronavirus family, the source of two previous deadly epidemics: the SARS and the MERS. However, the mortality rate of the new virus is far lower than in previous outbreaks, as it stands at about 2 percent right now. Please compare it to the 2002/03 SARS outbreak (Severe Acute Respiratory Syndrome) which killed 774 people out of a total 8,096 infected (9.5 percent mortality rate) or the 2012 MERS outbreak (Middle East Respiratory Syndrome) which killed 858 people out of the 2,494 infected (34.5 percent). So, the coronavirus is less deadly than SARS or MERS, but it is more contagious.

Implications for Gold

What does the coronavirus outbreak mean for the gold market? Well, gold will not protect you against the infection. But the yellow metal can act as a safe-haven asset which protects against the stock market volatility.

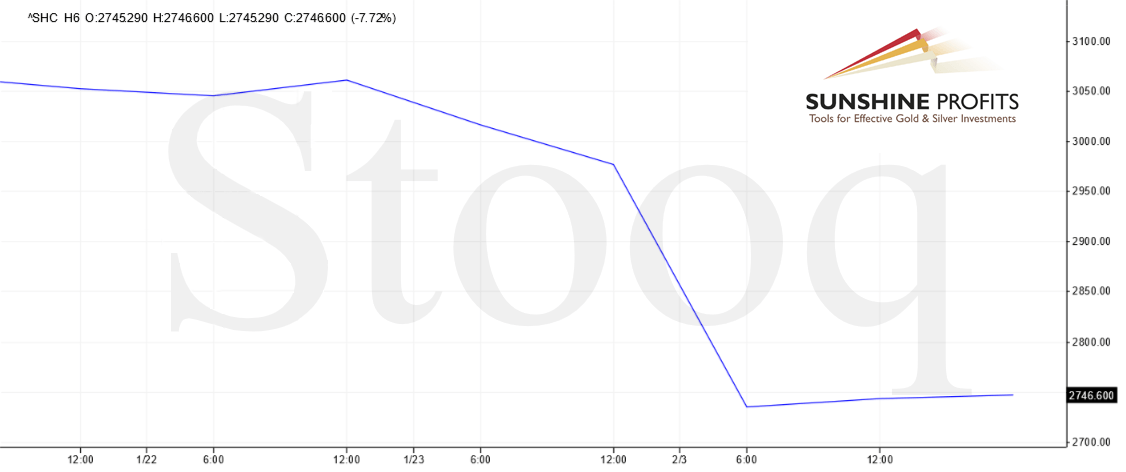

Today, Chinese stock and commodity markets plunged in the first trading session after an extended Lunar New Year break. As investors feared the spread of the new coronavirus, they abandoned risky assets. The Shanghai Composite Index dove 8 percent, as the chart below shows. It has been its biggest daily fall in more than four years.

Chart 1: Shangai Composite Index over the last two weeks.

The situation must be serious as the People’s Bank of China said it will inject 1.2 trillion yuan ($174 billion) worth of liquidity in a response to the stock market turmoil. Indeed, after SARS, China suffered several months of economic contraction. Now, with China playing a much more important role in the global economy, the economic impact of the new coronavirus might be greater (however, the country is also better prepared to fight the virus outbreak). The China’s GDP is expected to slow down from 6.1 percent in 2019 to 5.6 percent in 2020 because of the virus.

So, the plunge in Chinese equities is a good news for the gold bulls, as the fall in the Shanghai Stock Exchange during summer 2015 and later in January 2016 set off a global rout, pushing up the price of gold. So, although the coronavirus is not likely to cause an economic recession, it can mark a turning point. The US yield curve has inverted again for the first time since October…

However, investors should not buy gold counting on the pandemic. If you expect one, just get all the supplies such as food in, bar the door and don’t leave the house. We might be optimists, but let’s face the facts. Remember SARS? Remember Zika? Remember Ebola? People were terrified which each virus outbreak. But various public health actions have always stopped an outbreak, or it burned itself out. For example, SARS was basically gone by 2004. Of course, this time may be different, especially if the new coronavirus can be spread before symptoms manifest, but we believe that the risk so far still remains very low to the United States and other advanced economies.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.