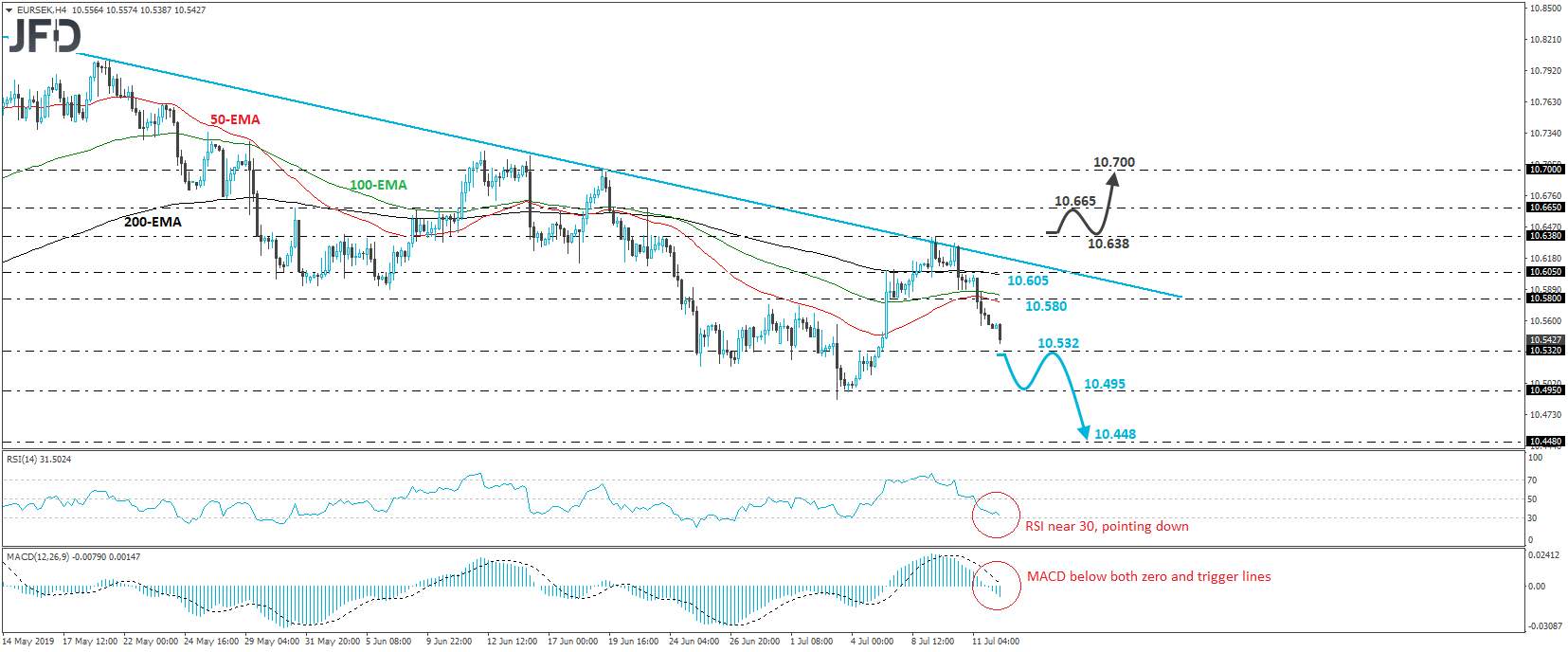

EUR/SEK has been trading in a tumbling mode since Wednesday, when it hit the downside resistance line drawn from the peak of May 21st. Yesterday, the rate fell below the support (now turned into resistance) of 10.580 and at the time of writing, it looks to be heading towards the 10.532 barrier, defined by the inside swing high of July 4th. As long as the rate continues to trade below the aforementioned downside line, we will hold a bearish stance with regards to this exchange rate.

If the bears are willing to overcome the 10.532 barrier soon, then we may see them driving the battle lower, towards the 10.495 zone, which is near the low of July 4th and slightly above the low of the day before. That said, we would like to see a clear break below that hurdle before we get confident on further declines. This would confirm a forthcoming lower low on the daily chart and could see scope for larger bearish extensions, perhaps towards the 10.448 area, defined by the lows of April 19th and 22nd.

Taking a look at our short-term oscillators, we see that the RSI drifted south and now appears ready to touch its 30 line. The MACD lies below both its zero and trigger lines, pointing down as well. These indicators detect strong downside speed and support the case for EUR/SEK to continue sliding for a while more.

On the upside, we would like to see a strong recovery above 10.638 before we start examining whether a positive reversal has taken place. Such a move would, not only bring the pair above the pre-mentioned downside line, but also confirm a forthcoming higher high. The bulls may then get encouraged to push towards the peak of June 21st, at around 10.665, the break of which may set the stage for advances towards the 10.700 territory, near the high of June 19th.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.