Written by: Adam Narczewski, Financial analyst XTB Poland

The Eurozone is recovering. This statement can be heard among traders and investors in many countries. But is it really the case? The recovery in the Eurozone is very modest. Various economic indicators (including countries’ PMI reports) show the situation has improved since 2012. Nevertheless, one would be a crazy optimist stating the situation is under control. The European Central Bank (ECB) cut interest rates twice in 2013 – by 50bp in May and 25bp in November lowering the marginal lending facility to its historic low of 0,75%. Had these decision helped the economy? Looking just at the stats we can confirm. While experiencing negative growth for the whole 2012 and Q1 of 2013, Eurozone’s GDP increased by 0,3% in Q2 and by 0,1% in Q3. Progress is visible but the question is if in 2014 this tendency will be kept, or should we prepare for another downturn.

Currently, the ECB is forecasting GDP will decline by 0,4% this year but expects a 1,1% increase in 2014 and 1,5% in 2015. These numbers match the market consensus. There are risks for lower growth though that need to be taken into consideration. The prognosis is based on the assumptions that Asia (read: China) will keep growing at the current pace and that global trade will be increasing. Meanwhile, the instability of China's growth is a huge threat to the recovery in Europe. If Asia slows down, next year’s GDP for the Eurozone will certainly be below 1% for the whole year. As growth is affected mostly by Asia, European stock markets will be affected by the Fed cutting its quantitive easing program. I would like to see the U.S central bank acting now but it seems it will delay the process till next year. When the reduction of the buyback program will start we cannot expect such increases on stock indices as in 2013.

Low inflation is another problem of the public finance sector. Prices have been falling in the Eurozone for some time although we see a slight rebound since October (Pic.1). Still, such low inflation is expected to remain for some time and the ECB will have to deal with this problem. Lower inflation means that the income part of the budget in some Eurozone countries is already lower than in the previous year. This problem will build-up next year. It is a big risk, which the market is not noticing and discounting at this moment. I expect there will be pressure on the ECB to fight with too low inflation. That is why I believe the subject of negative deposit rates will return, and already in the first quarter, the ECB may lower its repo rate from 0.25% to 0.1%. The talks have been focused on the repo and deposit rates and it seems the main rate has been forgotten. I do not think Mari Draghi will want to lower it even further. If so, a 25bp cut in the first quarter of 2014 (the quicker the better, there is nothing to wait for) could happen lowering the marginal lending facility interest rate to 0.5%.

CPI inflation in the Eurozone. Source: Bloomberg

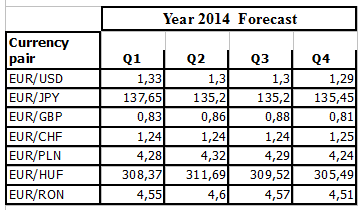

How in this situation Euro traders will find themselves? During 2013 the amplitude of the EUR/USD was 1000 pips (trading within 1.28 and 1.38) which was much less than in the previous years. In 2014 I expect this kind of volatility to stay, without any abrupt moves. The Euro should be under pressure due to the risks the Eurozone will be facing (low inflation, lower rates, risk of slower growth). Also, let’s keep in mind the Fed, which already started the reduction of the QE3 program and will continue to do so in 2014. This will certianly boost the USD. All this in mind, I expect a steady decline of the EUR/USD, all the way to 1.29 by the end of 2014. Similarly, the EUR should be depreciating against other major currencies. It should remain strong though against emerging market currencies, which will be under pressure (at least during the first half of 2014) when capital will start flowing out of the respective economies (due to the QE3 reduction). The forecasts for the Euro against major and emerging currencies I prepared in the table below (quotes expected by the end of each quarter of 2014):

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.