What ProAct Forex Target Traders See: We are currently sitting @ 1.0590. We are looking for a break of the support and then a move to the S6 support @ 1.0462 with an overall target of 1.0378. The average daily true range (ATR) for the pair currently is 76 pips.

————————————————————————--

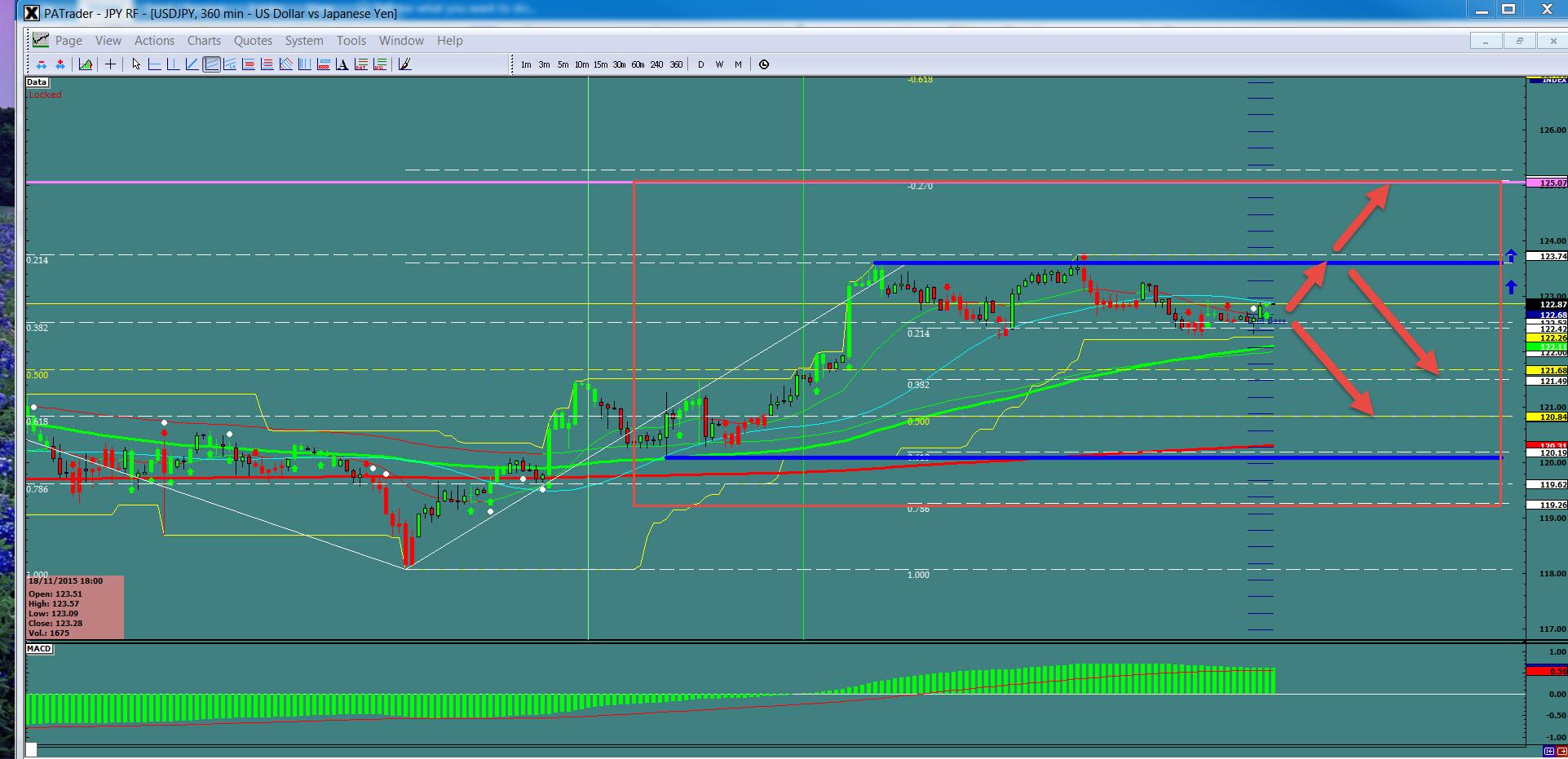

$USDJPY

What ProAct Forex Target Traders See: We are currently @ 122.86 in a sideways move AGAIN. We are WAITING for direction! A couple of different scenarios: 1: Bullish: a move to the upper day chart top @ 125.07 area) and 2: Bearish: A break down to the 0.500 Fibo support @ 120.84. The average daily true range (ATR) for the pair currently is 52 pips.

——————————————————————————–

$GBPUSD

What ProAct Forex Target Traders See: Sterling is currently @ 1.5033. We said last week “We are looking for a move to the support @ 1.5028”. A continuation here targets the 1.4905 with a continuation to the 11.4869 support. The average daily true range (ATR) for the pair currently is 72 pips.

——————————————————————————–

$AUDUSD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: Aussie is @ 0.7130 in a large box. A couple of different scenarios: 1: Bullish: a move to the upper range @ 0.7686 area) and 2: Bearish: A break down to the support @ 0.7013. The average daily true range (ATR) for the pair currently is 61 pips.

ProAct Traders™ (hereafter, PAT) assumes no responsibility for errors, inaccuracies, or omissions, nor does it warrant the accuracy or completeness of the information in the materials that comprised the text, graphics or other items contained in the ProAct Charts as a result of computer or power failures or interruptions in the electronic delivery systems via the Internet. PAT shall not be liable for any special, indirect, incidental or consequential damages including without limitation losses, lost revenue, or lost profits that may result from these materials.

Foreign Currency Trading carries a level of risk / reward that may not be suitable for all considering participation in the market known as Forex. The Forex is a "zero sum" market and its end effect is that there are an equal number of winners and losers. Consequently, the possibility exists that you could sustain an eventual loss of some or all of you initial investment. Therefore, you should never invest money that you cannot afford to lose. Before deciding to trade the Forex, you should become thoroughly educated in how the market works, have a sound money management plan and then carefully consider your investment objectives, level of experience, and risk appetite. If you have any doubts, seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.