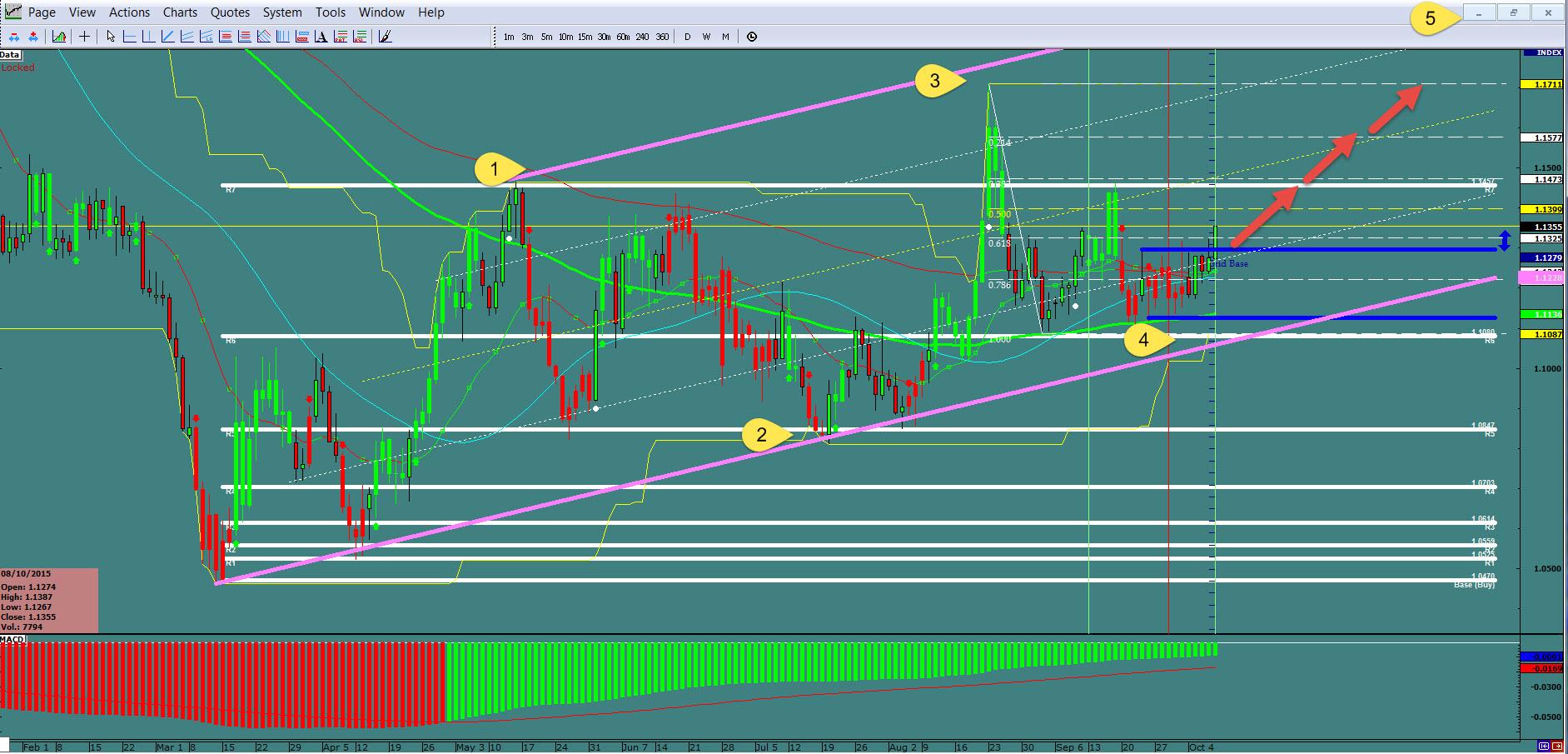

What ProAct Forex Target Traders See: We are currently sitting @ 1.1355 breaking a sideways move. We are looking for a move to start the 5th wave with the overall target @ 1.1711 this week. The average daily true range (ATR) for the pair currently is 93 pips.

————————————————————————--

$USDJPY

What ProAct Forex Target Traders See: We are currently @ 120.23 and still ranging and also in a wedge. A couple of different scenarios: 1: Bullish: a move to the top of the range and a bounce – look to the 125.00 and 2: Bearish: A break down to the support @ 118.15/ 166.21. The average daily true range (ATR) for the pair currently is 75 pips.

——————————————————————————–

$GBPUSD

What ProAct Forex Target Traders See: Sterling is correcting in a 4th wave to the 1.5447-1.5500 area before a resumption to the downside. After a correction, look to the 1.5158 area. The average daily true range (ATR) for the pair currently is 88 pips.

——————————————————————————–

$AUDUSD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: Aussie is @ 0.7326 and needs a 4th wave correction to get to the target. Look for that to the 0.500 Fibo @ 0.7256. Target now is up to 0.7443. The average daily true range (ATR) for the pair currently is 71 pips.

ProAct Traders™ (hereafter, PAT) assumes no responsibility for errors, inaccuracies, or omissions, nor does it warrant the accuracy or completeness of the information in the materials that comprised the text, graphics or other items contained in the ProAct Charts as a result of computer or power failures or interruptions in the electronic delivery systems via the Internet. PAT shall not be liable for any special, indirect, incidental or consequential damages including without limitation losses, lost revenue, or lost profits that may result from these materials.

Foreign Currency Trading carries a level of risk / reward that may not be suitable for all considering participation in the market known as Forex. The Forex is a "zero sum" market and its end effect is that there are an equal number of winners and losers. Consequently, the possibility exists that you could sustain an eventual loss of some or all of you initial investment. Therefore, you should never invest money that you cannot afford to lose. Before deciding to trade the Forex, you should become thoroughly educated in how the market works, have a sound money management plan and then carefully consider your investment objectives, level of experience, and risk appetite. If you have any doubts, seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

EUR/USD remains on the defensive near 1.0680 on Dollar strength

The solid performance of the Greenback keeps the price action in the risk-associated universe depressed so far on turnaround Tuesday, sending EUR/USD to multi-day lows in the 1.0680 region.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold stable below $2,300 despite mounting fears

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.