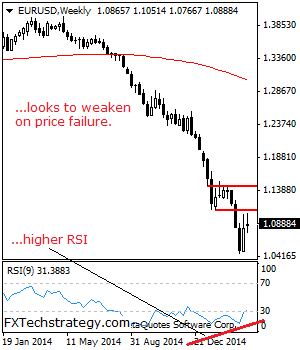

EURUSD: With EUR closing almost flat the past week, it faces downside risk as long the 1.1051/96 levels cap. Resistance is seen at 1.0950 level with a cut through here opening the door for more downside towards the 1.1000 level. Further up, resistance lies at the 1.1050 level where a break will expose the 1.1096 level. Its weekly RSI is bullish and pointing higher supporting this view. On the downside, support lies at the 1.0800 level where a violation will aim at the 1.0750 level. A break of here will aim at the 1.0700 level with a turn below that level targeting the 1.0766 level, its Mar 23’2015 low . All in all, EUR remains biased to the upside on correction though seen hesitating on Tuesday.

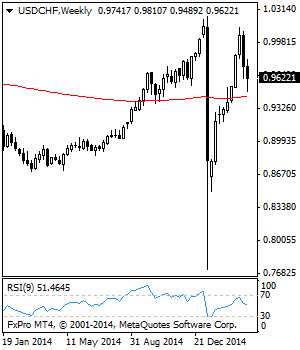

USDCHF: Looks To Keep Recovery Tone

USDCHF: With USDCHF still facing recovery higher risk, a move higher could occur in the new (see daily chart) although closing lower the past week. On the downside, support comes in at the 0.9550 level. A turn below here will open the door for more weakness to occur towards the 0.9500 level and then the 0.9450 level. Conversely, resistance resides at the 0.9700 level with a breach targeting the 0.9750 level. A breather may occur here and turn the pair lower but if taken out, expect a push higher towards the 0.9800 level. All in all, the pair remains biased to the downside in the short term.

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the currencies referred to in this report.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.