EUR/USD Technical analysis Nov 24th - Nov 28th

With last week’s fundamental tsunami EUR/USD started the week with neutral bias. For the most part of the week the pair ranged between 1.2500 and 1.2575. On Wednesday the 19th the pair made its weekly high of 1.2598 however quickly fell back to its bearish channel boundaries. All eyes were on EUR for ECB President Mario Draghi’s speech on Friday, where he once again did what he is known for and created “Super” volatility in the market.

Mr. Draghi emphasized once again “Shorter-term inflation expectations ‘Excessively Low’ that ECB will use all means within mandate to return inflation to its target”.

For the week the pair found its resistance at 1.2598, made lower high and broke below 1.2400 support zone making a lower low as well at 1.2374 level towards the end of the trading week. As the pair broke below 1.2400 support zone we have bearish momentum has once again increased over the pair.

On the daily chart, the price structure still remains lower peaks and lower troughs below both the 50- and the 200-day moving averages, and this keeps the overall down path intact with bearish targets on the way towards 1.2300 monthly support zone and the anticipated 1.2000 psychological barrier.

Overall the daily trend can be concluded as strong bearish based on Friday’s market movement and the weekly closing.

Expectations for the upcoming week (Nov 24th - Nov 28th):

From smaller time frame point of view, we can see the pair bouncing off the upper boundary of the bearish channel and getting below all the moving averages on H4 timeframe. Especially given that Mr. Draghi’s speech on Friday is rather negative on Euro-zone economy and the monetary divergence has increased and is expected to grow even larger by 2015, on the long-run we may expect to see EUR/USD moving lower than investors initially speculated.

Resistance levels: 1.2414 (R1), 1.2500 (R2), 1.2600 (R3) and 1.2635 (MPP)

Support levels: 1.2307 (S1), 1.2200 (S2) and 1.2020 (S3)

GBP/USD Technical analysis Nov 24th - Nov 28th

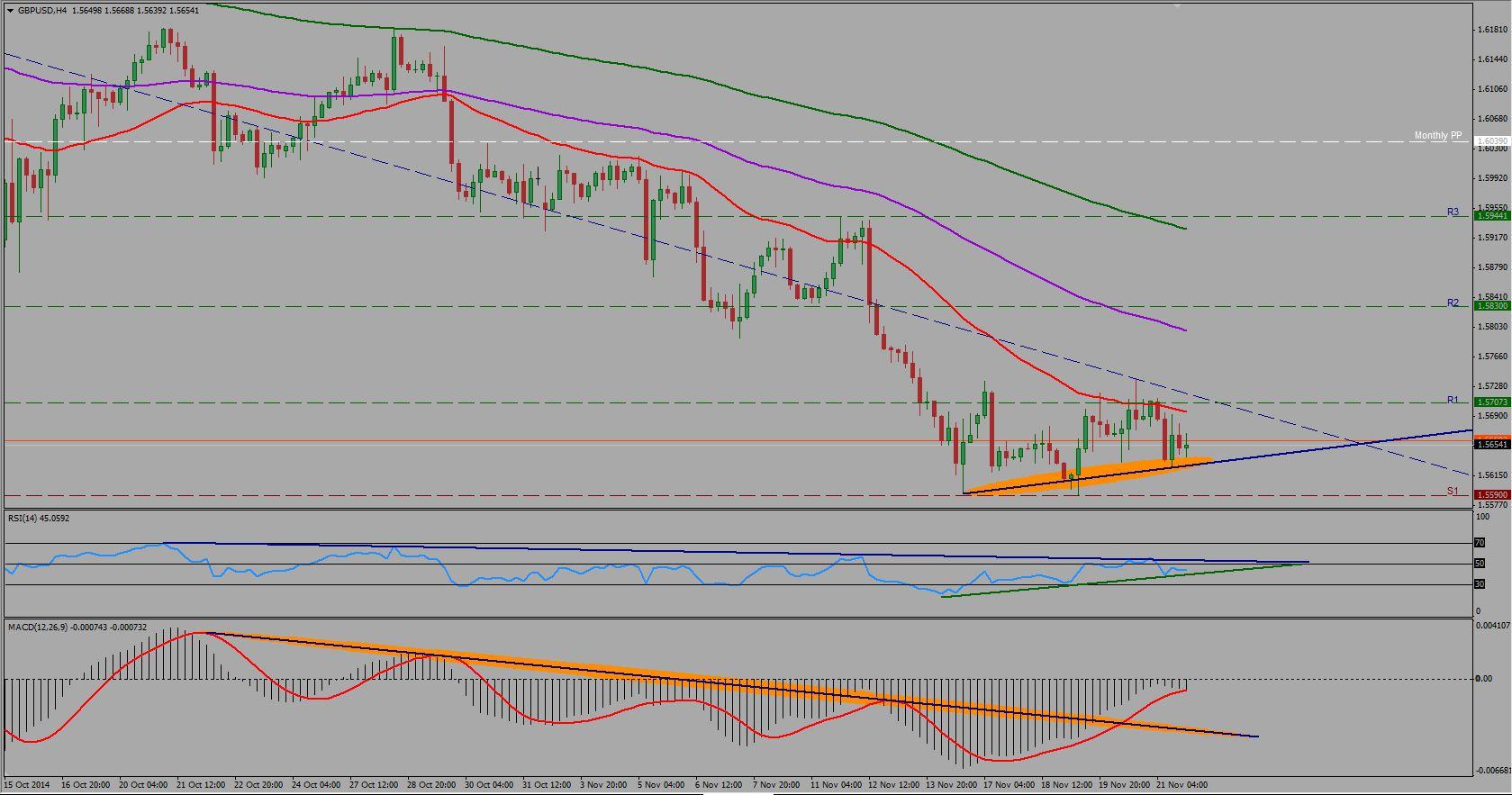

It was a close-range sideway week for the Cable last week. The pair opened the week with a 15 pip Gap at 1.5681 which was quickly closed during the 1st trading hour. As the bears and bulls kept colliding during the week the British pound bounced between 1.5730 and 1.5600 for the most part of the week.

The pound sterling found its weekly resistance at 1.5737 which was also 100 SMA on H1 timeframe as well as the boundary of the long-lasting trend line.

We may expect further bearish power as the pair’s main support is at 1.5590 level. However, the double bottom attempt of the pair at 1.5590 levels could potentially push the pair upwards.

Expectations for the upcoming week (Nov 24th - Nov 28th):

At the time of analysis the pair is trading at 1.5654 close to the short term bullish trend line and all three of our MAs are sloping downwards both on H1, H4, D1 (daily), W1 (weekly) and MN (monthly) timeframes. Meanwhile there is uncertainty in our oscillators. On H4 timeframe RSI indicates short term bullish divergence, however it is still below the 50 line, meanwhile MACD’s trigger line broke above its bearish trend line, indicating potential bullish movements however it is still below its 0 trigger line.

That being said, we have continued bearish bias below 1.5600 psychological and weekly support levels towards long-term support of 1.5300; however may the bearish trend line (blue resistance line) be broken, double bottom pattern hold and fundamental developments support the price-action we may see the pair rising towards 1.58 and 1.59 levels.

Resistance levels: 1.5707(R1), 1.5830(R2), 1.5945 (R3) and 1.6039(MPP)

Support levels: 1.5590 (S1), 1.5430 (S2), 1.5300 (S3)

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.