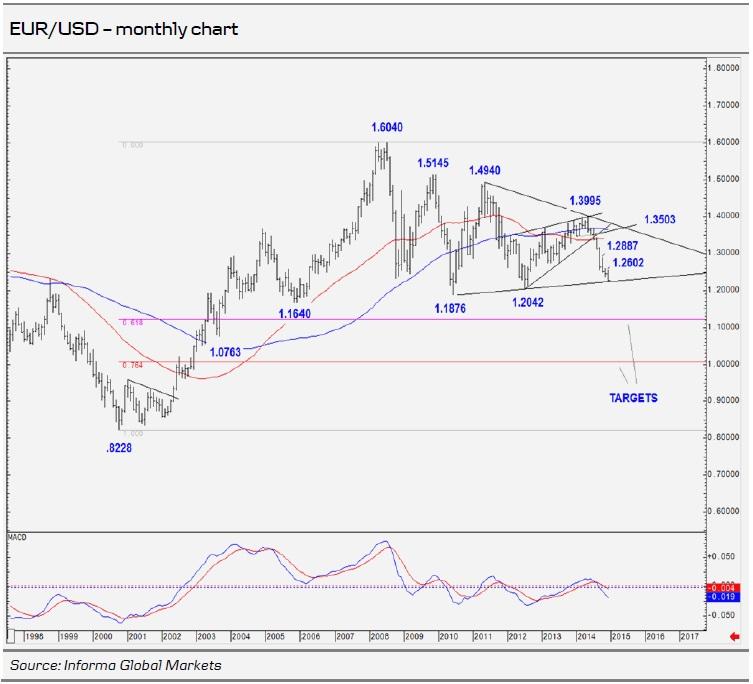

This week, we present one technical view: sub 1.2042 to confirm a complex top for 1.1212/1.0071.

EUR/USD – sub 1.2042 to confirm a complex top for 1.1212/1.0071

- Summary summary – technically, sub 1.2042 to confirm a complex top for 1.1212 and 1.0071. Resistance comes in at 1.2602/1.2887.

EUR/USD is pressuring critical support and the target region set earlier in the year, following the completion of a top area and major rising wedge.

MACD and Stochastic studies continue to point lower and a break under the 2012 low at 1.2042 would confirm a major multi-year complex top area. This signals/projects very significant downside over coming weeks and months. This also corresponds to projections we have made on the USD basket. Sub 1.2042 opens initial objectives/levels at 1.1876 and 1.1640. These mark the 2010 and 2005 lows. Further weakness is then anticipated to 1.1212, the 61.8% retracement level of the major .8228-1.6040 October 2000 to April 2008 cycle. The complex top area, however, indicates scope is likely, below here, towards the 76.4% retracement level at 1.0071.

To neutralise the current and immediate bear structure, recent lower ceilings at 1.2602 and 1.2887 must be reclaimed.

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

Fed statement language and QT strategy could drive USD action – LIVE

The US Federal Reserve is set to leave the policy rate unchanged after April 30 - May 1 policy meeting. Possible changes to the statement language and quantitative tightening strategy could impact the USD's valuation.

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 following the mixed macroeconomic data releases from the US. Private sector rose more than expected in April, while the ISM Manufacturing PMI fell below 50. Fed will announce monetary policy decisions next.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar stays resilient against its rivals despite mixed data releases and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold rebounds above $2,300 after US data, eyes on Fed policy decision

Gold gained traction and recovered above $2,300 in the American session on Wednesday. The benchmark 10-year US Treasury bond yield turned negative on the day after US data, helping XAU/USD push higher ahead of Fed policy announcements.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.