This week we present two strategies: Buy CAD/CHF, 2Y/10Y UST flattener

CAD/CHF – Trend higher set to continue

Strategy Summary – Buy at market (.8558) for an objective of .8855. Place stop at .8395.

Since posting a low of .7810 on 19 March this year, the market has rebounded strongly. Recent attempts to sell off have attracted fresh buying interest over the .9400 handle and the 100-Day MA has now turned higher, indicating a shift in wider trend momentum. Further gains are anticipated as bulls look to recover ground lost during the August 2012- March 2014 down move.

Clearance of the current yearly high at .8590 and the 38.2% retracement of the .9905- .7810 fall at .8610 (Not shown) will open .8690 (3 October 2013 low) next. Through here we will target the 7 November 2013 high at .8855, which also coincides with the 50% retracement level (where we will look to take profits).

Attempts to sell off are expected to hold over the recent .8405 reaction low (15 September). Below will delay the advance but bears need to breach trend-line support (drawn from the 19 March/8 August lows) at .8365 and the 100-Day MA (currently at .8320) to cause greater concern.

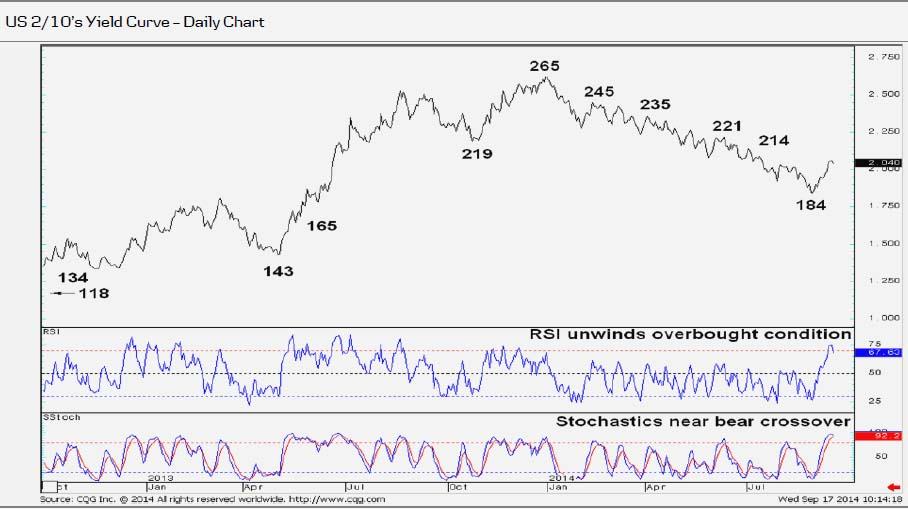

2/10’s UST Yield Curve – Lower peak potentially developing

Strategy Summary – Look to buy at 214bp ahead of flattening to retest 184bp with scope for a break towards 143bp. Place stops over 221bp.

US 2/10’s recovered sharply off 184bp (28 August trough), reversing a steady 9-month flattening campaign. That said, the unwinding of RSI from overbought territory, coupled with a possible bear cross on the daily stochastic chart, suggests that the recent recovery may be losing momentum. Also, since the current steepener has retraced only a small portion of the 265/184bp decline, it is still considered as a corrective up-move. A stochastic bear cross would allow 2/10’s to flatten back towards 184bp. Below this would highlight another lower peak within the medium-term down-trend. This would open minor support at 165bp (16 May 2013) ahead of a re-test of the 143/134bp region (1 May 2013 trough)/(November/December 2012 troughs). Sustained weakness at that point would expose the key trough located at 118bp (24 July 2012).

A clean break above the 214bp area (2 July peak), however, would signal an extended recovery phase with scope for 221bp (11 June, near 219 – 23 October 2013 trough) ahead of resistance in the 235/245bp region (2 April/12 February peaks). Above the latter would then shift focus to the key peak at 265bp (31 December 2013).

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.