GBP/JPY – Potential for powerful surge towards 178.55/184.00

Strategy Summary – Stay long or buy at market for 178.55, 180.00 and then 184.00. Suggest a stop under either 169.35 or 167.80.

GBP/JPY is breaking through 173.95 to filter a topside break from a shallow two-month corrective channel. This follows another lower rejection in the 169.35/55 region. These downside failures continue to suggest that there is very significant longer-term upside scope and potential. Generally flat trade through 2014 to date, has stored up very significant energy levels to support this phase.

Just above 173.95 lies 175.35, the 2 July 2014 multi-year high. Clearance at 173.95/ 175.35 will confirm that a major new phase higher is under way. The first significant objective would be 178.55; this marks equality of the 169.35 to 173.95 cycle measured up from 173.95. A psychological barrier then rests at 180.00, ahead of 184.00, the key 50% retracement level of the major 241.10 to 116.85 decline (not shown).

Immediate support levels at 172.80 and 171.00 should now underpin any minor shortterms dips, while only clearance under the 167.80-169.55 region causes concern to the topside view.

US 2Y yield – Recovery to continue after short-term consolidation

Strategy Summary – Look to buy yields into any corrective dips for a rally extension targeting 0.704/0.730 then 0.766. Place a protective stop below 0.478.

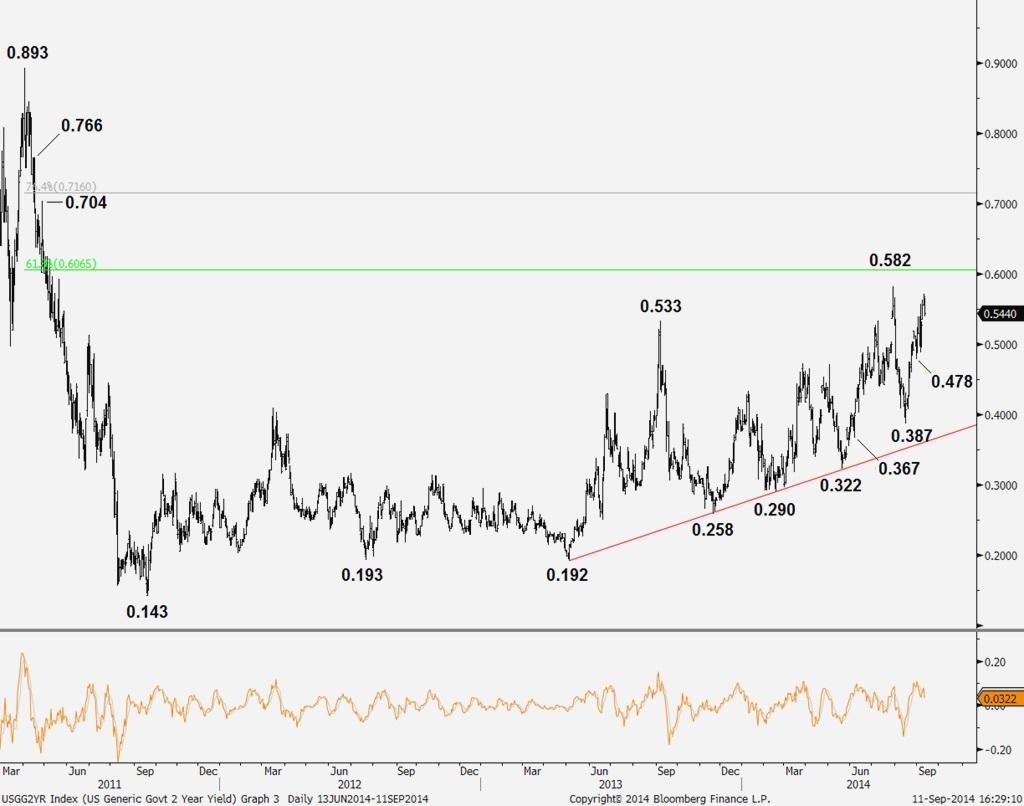

Yield bulls accelerated the recovery from 0.143 (20 September 2011 record low) to 0.582 (2014 peak – 30 July), before correcting to 0.387 (15 August low). Yield bulls have since resumed and given generally constructive daily/weekly/monthly studies; we await an eventual clearance of 0.582 exposing a cluster of Fibonacci levels between 0.599/0.625. This consists of 1x 0.192/0.533 off 0.258 at 0.599, 61.8% retrace of 0.893/0.143 fall at 0.606 and a 1.618 projection of 0.143/0.413 off 0.193 at 0.625.

Once 0.625 has been decisively cleared, a recovery extension would then be favoured towards 0.704/0.730 zone. This consists of 27 April 2011 lower high at 0.704, 76.4% of 0.893/0.143 fall at 0.716, 2x 0.143/0.413 off 0.192 at 0.727 and 1.382x 0.192/0.533 off 0.258 at 0.730. Further out, scope is seen to 0.766 (13-15 April 2011 highs), which guard 0.811 (1.618x 0.192/0.533 off 0.258).

Some daily studies are beginning to roll over, (which is indicative of a near-term correction), but this is seen as short term in nature and should be limited to 0.478 (29 August low). Only below there would caution yield bulls and re-open 0.387 (15 August low). Below ends the sequence of rising highs/lows and risks tests of a multi-tested 16- month rising trendline at 0.362 (near 6 June low at 0.367).

USD/TRY – Room for further advance towards 2.2590/2.2645

Strategy Summary – Buy upon any near-term corrective dips for a rally, extension towards the 2.2590-2.2645 region, then possibly 2.3195. Place a stop below 2.1625.

Since early April the USD/TRY has constructed a base above 2.0615 – the 14 May 2014 low and near a 50% of the entire 2013-14 (1.7455-2.3900) advance. The base was confirmed last month upon the break above the 2.1535 resistance. That prompted an initial advance to 2.1890 – close to a 38.2% of the 2.3900-2.0615 decline.

After some healthy consolidation, the market has resumed its advance and the broader chart structure remains highly positive. The rate has been holding well above the key, yearly and quarterly, moving averages. The MACD is in a bullish territory and exhibiting a fresh buy signal. All these conditions suggest a rally extension. Initially, look for a clearance of 2.2260, a 50% retracement of the January-May easing. Above the latter prompts a rise into the 2.2590-2.2645 region. This consists of the March highs, and a 61.8% retracement – both close to an approximate target of the four-month base. Above 2.2645 would open 2.3195/2.3900.

Look for the seven-week trendline support near 2.1625 to contain any dips. Only a break below the 2.1465 higher low concerns.

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.