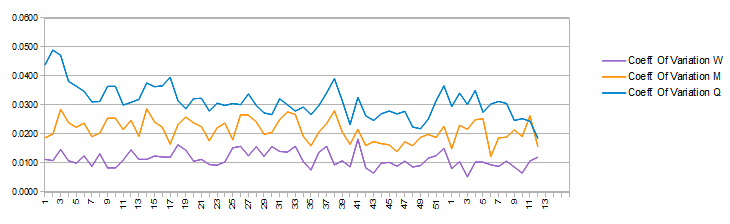

The EUR/USD closed last week with a negative close-to-close performance of -0.85% (-118 pips), the largest weekly performance seen in six weeks. Add to this the fact that the performance was the first negative one in seven weeks, and the conditions become ripe for a shift in sentiment. Contrary to what we would expect, the turn in the tide didn't cause a lot of dispersion among poll participants. With the expectation of a little rise in the shorter-term horizon, the mid- and longer-term coefficient of variation of the forecasts show a certain degree of consensus, specially the longer-term (3 month ahead) which is at historical lows.

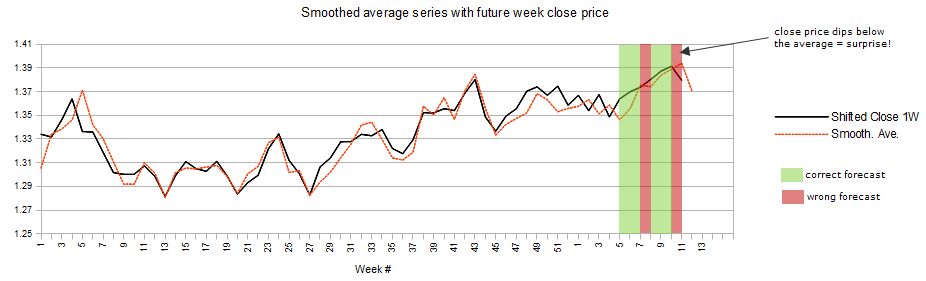

In the short-term: the central tendency measures, when smoothed together, are pointing below the weekly close (1.3796) at 1.3704. Interestingly, they were pointing at 1.3940, that is above the weekly close (1.3914) in the previous release, failing to predict the following weeks' performance. The result was -as seen in other times- when expectations are not met, there is a shift in the average forecast, this time of 240 pips to the downside.

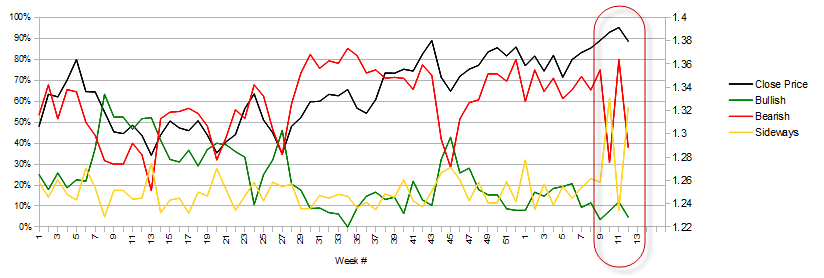

Remember that markets are able to discount future scenarios in the present price: therefore, more than being a predictive tool, the longer-term distribution of the participant's values is the one reflecting better the current sentiment. The correlation between the three-month forecasts and the actual close price at the future date stays at 6.38%, that is too low to make it a predictive tool in the long-run. But not in the short-term due to the discounting mechanism.

In the longer-term we see a migration of many participants from sustaining a bearish bias towards showing a sideways stance. This migration may be due to the lower weekly close which may have turned into “sideways” some of the bearish forecasts from the weeks before. But fact is that there was a surprise.

What does it mean for traders? Markets were caught by surprise by the hawkish comments from the Fed governor Yellen, following last week’s FOMC meeting, a fact which contrasted with the more dovish than before ECB. In that sense the USD is expected to out-perform the EUR in the long run based on the difference in Central Bank policies (hence the changes in the 3-month forecasts). But we cannot rule out more surprises in the form of economic data from the Euro-zone out-muscling that of U.S., for instance, in which case the euro could climb to 1.40 U.S. dollars and potentially beyond.

To summarize: the combination of low dispersion with a sideways tilted bias is not the best technical situation in sentiment analysis to make us change our minds just yet. Therefore, I remain cautiously bullish in the short to mid-term awaiting for more surprises telling me that after all we over-reacted last week.

Note: The Weekly Sentiment Report provides a breakdown of the data published in the Currencies Forecast Poll through the use of descriptive statistics. The Currencies Forecast Poll is published every Friday at 17:00 Central European Time by FXStreet and aggregates the forecasted values from individuals and companies that were reported from Wednesday to Friday of the same week.The data represents what direction members feel the market will be in the next week, one month and three months.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.