EURUSD – Is it an ABC Correction?

Last week the price has infirmed the Flag price pattern, by breaking above 1.1337. Bulls couldn’t get the price back up to the previous resistance (1.1437). The rally stopped around 1.1400 and fell all the way to the next local support from 1.1217.

The current corrective move seems to be an ABC pattern. This might mean that the price might come back on an up move, targeting a new high above 1.1465. From my point of view, such a scenario could be confirmed by another break above 1.1340. On the other hand, a break below the current support from 1.1217 could trigger drop towards 1.1050, or even lower to 1.1000.

USDJPY – Back Above111.00

USDJPY has broken the local resistance, as said in my alternative scenario from last week. After the break, the USD rallied against the Japanese yen, went over 111.00 and almost hit 112.00. Currently it has retreated to retest 111.00.

Looking on a four hour time frame, a big Descending Wedge was formed and the price broke outside. This could be a strong bullish signal. Another rally could start with a break above 112.00. This time the rally could get the price all the way back towards 114.50.

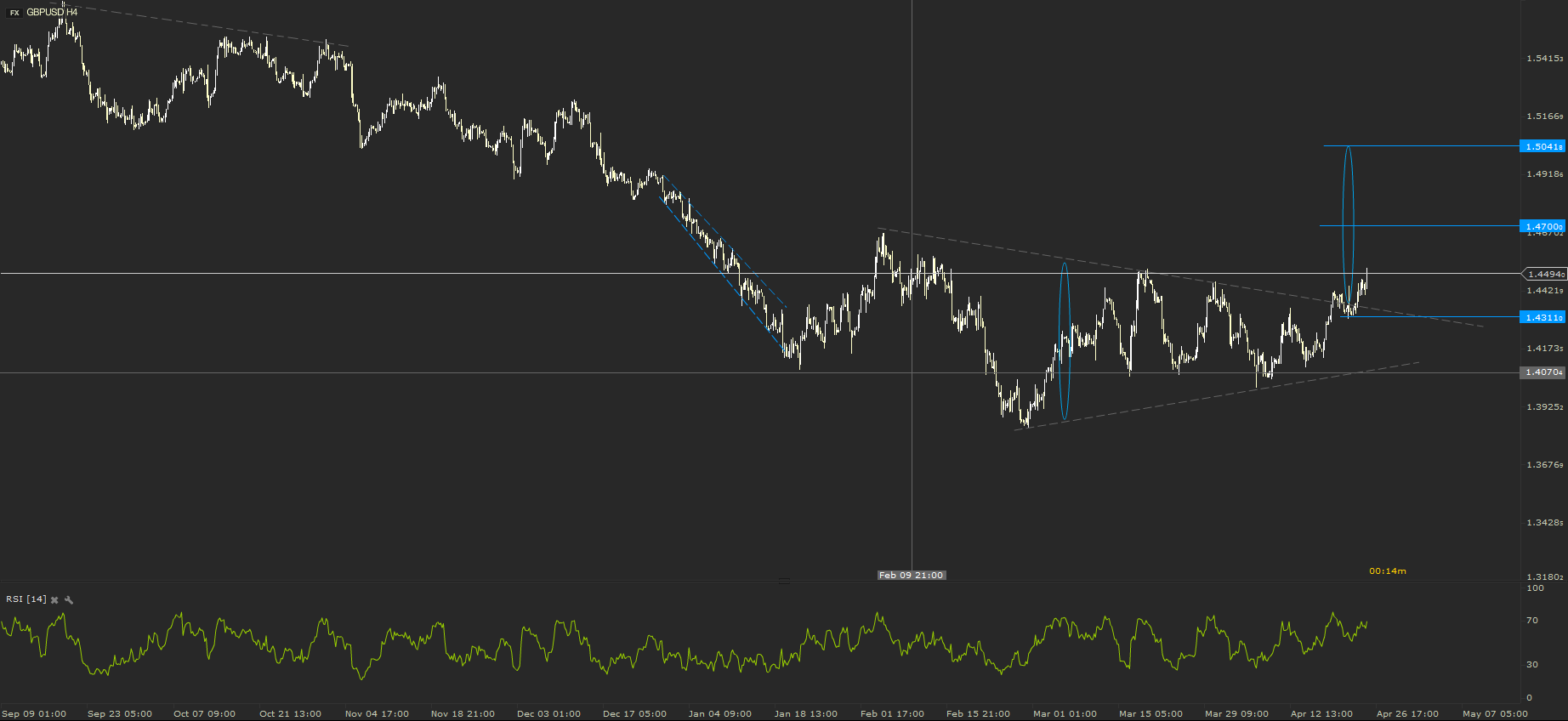

GBPUSD – Out of the Triangle

The price of GBPUSD has stood in a Triangle price pattern from the beginning of February all the way to last week, when it broke the upper line. For the moment it seems to have found a resistance at 1.4500,but might not resist enough bulls’ pressure.

A break above the current round number resistance could be another strong bullish signal. A future rally could get the price all the way to the half of the full target of the triangle. I would consider changing my view only if the price would come back towards the local support from 1.4311.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.