EURUSD – Weak PMIs deliver another blow to EU sentiment

Once again, the EURUSD encountered another volatile week. Comments at the beginning of the week from ECB President Mario Draghi indicating any extension to its Asset Purchase Program could include government bonds opened the doors for QE speculation, sending the Eurodollar to the lower 1.24s as a result. The Eurodollar then recovered its losses on Tuesday and rallied above 1.25 following the latest German ZEW Survey surpassing forecasts. Caution was shown among investors ahead of the FOMC Minutes release on Wednesday, which resulted in the Eurodollar appreciating as high as 1.2598 through risk appetite. The rally came to a halt there though, with the weakest PMIs in 16 months on Thursday reigniting fears over stagnant economic growth. Comments again from Mario Draghi on Friday hinting that the ECB are ready to act again led to the EURUSD concluding the week around 1.2390.

With the next ECB meeting less than two weeks away, speculation is heightening that the introduction of further stimulus from the ECB will likely encourage investors to price in further action and subsequently, send the Euro lower. Although the pressure is on the ECB to act once again, I maintain a stance that the EU economic problems go beyond ECB policy and could also be linked to reduced global demand for EU products. Optimism that the weaker exchange rate would improve economic fortunes was swept aside by Thursday’s weak PMIs, but I remain upbeat it can help data. The improved German ZEW Survey suggests Europe’s largest economy might be entering the final stretch of the year with some momentum and if the weaker Euro helps German exports (Tuesday), it would represent a chance for the Eurodollar to recover losses.

From a technical standpoint on the Daily timeframe, the Eurodollar is continuing to trade in the same bearish direction it has done for months. If the pair chooses to recover some of last week’s losses, resistance can be found at 1.2418, 1.2426 and 1.2445. If the ECB continue to tease the prospect of more stimulus in less than two weeks, EURUSD support can be found at 1.2374 and 1.2358.

GBPUSD – Cable drops to a new yearly low

After a rollercoaster couple of weeks, the twists and turns on the GBPUSD journey finally showed some signs of slowing down last week. Saying that, the GBPUSD still dropped to another yearly low on Wednesday morning at 1.5589 as investors priced in a dovish Bank of England (BoE) Minutes release. On Thursday, the pair received a boost when UK Retail Sales increased by an annualised 4.6% and this resulted in the GBPUSD climbing as high as 1.5721. Although expectations for an upcoming interest rate rise have been pushed back for up to a year and there are signs of UK economic momentum slowing as the BoE previously suggested, the robust retail sales performance is a reminder to investors that the UK fundamentals remain strong.

The problem with the GBPUSD at the moment is that with optimism for an interest rate hike next Spring now appearing to be nothing other than wishful thinking, and with the UK general election campaigns for next May are starting to get attention, investor attraction towards the GBPUSD is limited. In order for the pair to continue its decline, it would either require further signs of UK economic momentum slowing down or increased demand for the USD. Although both shouldn’t be ruled out, some sort of consolidation for the pair after such a period of heavy selling seems more likely. With investor attraction to the GBP being low, USD weakness would be required for the pair to move to the upside.

In reference to the technicals on the Daily timeframe, the GBPUSD is continuing to trade in the same falling wedge pattern it has found itself inside recently. If profit-taking on the USD encouraged the pair to move to the upside, resistance can be found located around 1.5712 and 1.5736. Downside movement can find support around 1.5626 and 1.5589.

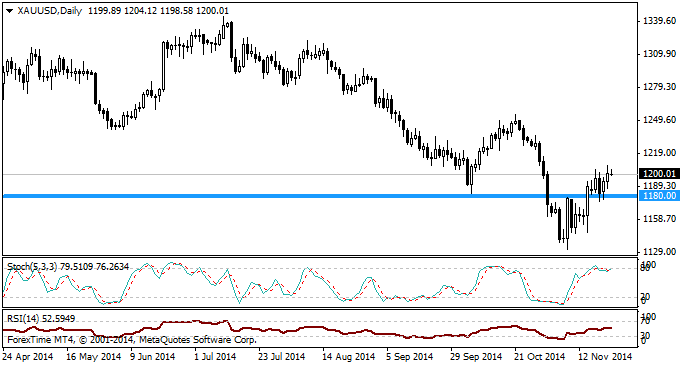

Gold – $1180 support comes back into play

Compared to previous weeks, volatility in the Gold markets was quieter than what we have noticed recently. Gold largely traded between $1177 and $1205, with the latter being seen as resistance. The precious metal withstood pressure on Wednesday evening when the latest FOMC Minutes largely hinted that the first US interest rate rise would occur between the middle and latter 2015 – increasing demand for the USD. However, the widely spoken about $1180 psychological support level came to the rescue once again, with Gold touching $1177 before concluding the week as high as $1207.

Although Gold has spent the majority of the latter half of 2014 trading strictly in accordance with US economic news, it might be worth investors keeping an eye out on economic news elsewhere. For example, the early Monday morning news has already suggested that global business confidence is at a five-year low and with the People’s Bank of China (PBoC), European Central Bank (ECB) and (Bank of Japan) (BoJ) all easing to stimulate their economies, further global economic concerns could push investor attraction towards Gold. In regards to US economic data, attention should be paid towards US GDP and Consumer Confidence (Tuesday), Durable Goods (Wednesday) Initial Jobless Claims (Thursday). Further signals of the US economic outlook continuing to improve this week would likely pressure metals.

In reference to the technicals, Gold has currently found resistance around the $1205 area and would need to surpass this level if it were to make a move towards future resistance around $1215 and $1223. Support can be found at $1190, with critical support being located around the $1180 support level. If the value of Gold was to decline back to the $1150 area, a solid break below $1180 would be required.

Brent Oil – Continuing to decline

After sliding steeply through the charts recently, Brent Oil found some support around $77.50 last week. Speculation regarding major central banks easing monetary policy further to stimulate its economy encouraged Brent Oil to advance above $78 with Brent moving as high as $81.58 following Friday’s rate cut from the People’s Bank of China (PBoC). In regards towards why monetary easing would increase an upturn in valuation, the moves from the central banks are widely seen as decisions to reinvigorate the global economy, which in turn should lead to increased demand for Oil.

Looking ahead, investors will be solely concentrating on the outcome of Thursday’s OPEC meeting before determining which direction Brent Oil will trade next. If a major oil producer indicates that it would be willing to reduce its oil production, it would represent an opportunity for Brent to either continue consolidating around $80, or progress further. Whether Brent Oil could progress further would really be dependent on who is willing to cut supply, and for what duration.

However if the outcome to the OPEC meeting indicates no major producer is willing to cut supply, it would pressure the oil markets and likely lead to a return below $80.

Comparebroker is a comparison site and we spend hundreds of hours to keep the information up to date. However, users are advised to do their own due diligence and nothing can be perceived any advise. The content on the website is purely for education purposes only

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.