Fundamental Forecast for Japanese Yen: Bullish

Static Domestic Landscape Puts External Factors in Charge of the Yen

Year-End Flows May Drive Yen Recovery Amid Carry Trade Liquidation

Help Identify Critical Japanese Yen Turning Points with DailyFX SSI

The outcome of Japan’s snap election passed without making much noise in the financial markets last week as expected. The LDP sailed to an easy victory and secured the super-majority it needed to ensure the continuity of “Abenomics”, at least through the near to medium term.

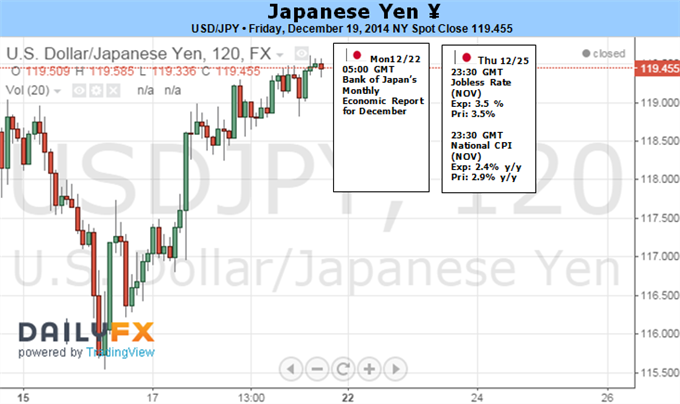

With the last Bank of Japan policy meeting of the year also behind them, investors have been left with external forces as the foremost driver of Japanese Yen price action. Seasonal capital flows stand out as the most potent potential driver on this front and may drive the unit higher in the final weeks of 2014.

Swelling risk appetite – embodied by a relentless push upward by US share prices – was a defining feature of the macro landscape over the past year. This seemed to reflect a response to Fed monetary policy: the steady QE tapering process defined a clear window in which policymakers would not withdraw stimulus.

The landscape probably won’t look as rosy in 2015. While the precise timing of liftoff for the Fed policy rate is a matter of debate, the commencement of stimulus withdrawal at some point in the year ahead seems to be a given. The prospect of higher borrowing costs may fuel liquidation of exposure reliant on cheap QE-based funding as market participants lock in year-end performance ahead of tougher times ahead.

For currency markets, such a scenario may take the form of an exodus from carry trades, which are usually funded in terms of the perennially low-yielding Japanese unit. That would imply a wave of covering on short-Yen positions, pushing prices higher.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.