Fundamental Forecast for British Pound: Neutral

The Weekly Volume Report: Cable Divergence

GBP/USD Risks Resumption of Bullish Trend as Positive U.K. Data Boost Bets for BoE Rate Hike

For Real-Time SSI Updates and Potential Trade Setups on the British Pound, sign up for DailyFX on Demand

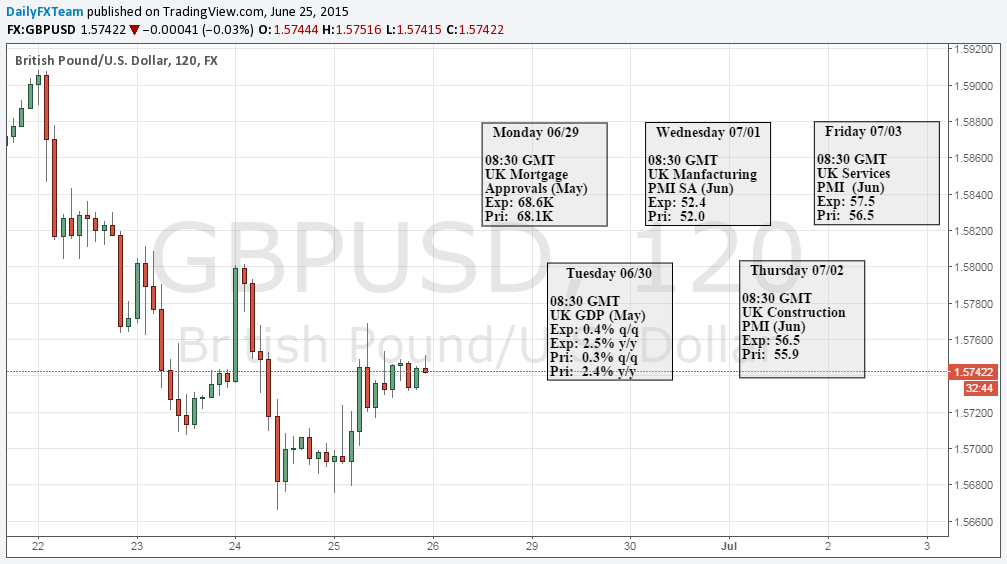

The fundamental developments coming out of the U.K. economy may spark another near-term rally in GBP/USD should the data prints boost expectations of seeing a Bank of England (BoC) rate hike in 2015.

A further expansion in U.K. Mortgage Applications paired with a meaningful upward revision in the final 1Q Gross Domestic Product (GDP) report may heighten expectations for a stronger recovery, and we may see a growing number of BoE officials adopt a more hawkish tone for monetary policy as the region gets on a more sustainable path. The fading margin of slack in the real economy may encourage a larger dissent within the Monetary Policy Committee (MPC) as board member Martin Weale sees scope to raise the benchmark interest rate as early as August, and Governor Mark Carney may prepare U.K. household and business for an imminent rise in borrowing-costs as the central bank head anticipates stronger growth and inflation in materialize in the second-half of the year.

At the same time, the BoE outlook remains at odds with the Federal Reserve as Janet Yellen and Co. remains on course to normalize monetary policy later this year, and market participants may increase bets for a September liftoff as the U.S. Non-Farm Payrolls (NFP) report is expected to show another 230K expansion in job growth. However, with Average Hourly Earnings projected to hold at an annualized 2.3% in June, subdued wages may become a growing concern for the Federal Open Market Committee (FOMC) as it undermines the central bank’s scope to achieve the 2% target for inflation. With the central banks in the U.S. & U.K. standing ready to shift gears, the outlook for GBP/USD largely hinges on the key data prints coming of both regions are likely to play an increased role in driving near-term volatility in the exchange rate amid the narrow race to remove monetary support.

With that said, the pound-dollar may face range-bound prices going into July, and signs of a stronger U.K. recovery may heighten the appeal of the sterling, while another series of mixed U.S. data prints may continue to drag on Fed expectations especially as the central bank curbs its economic projections for 2015.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.