Fundamental Forecast for Euro: Bearish

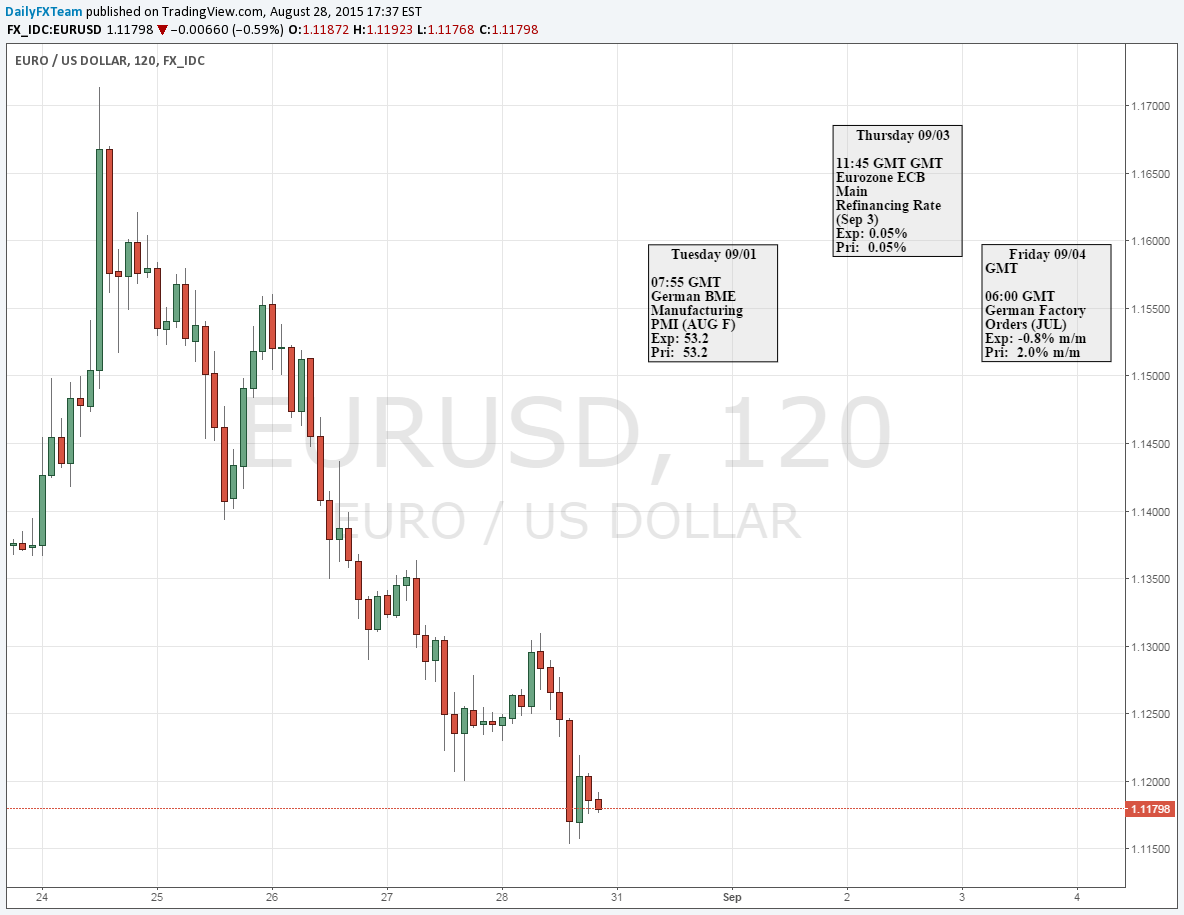

EUR/USD Downside Levels to Watch Ahead of ECB, NFP

The Weekly Volume Report: Volume Spikes With Spot

For Real-Time SSI Updates and Potential Trade Setups on the Euro, sign up for DailyFX on Demand

The sharp pullback in EUR/USD may gather pace in the week ahead should the European Central Bank (ECB) signal a further expansion of monetary policy, while another 200K+ U.S. Non-Farm Payrolls (NFP) print may boost expectations for a September Fed rate hike as the committee largely retains an upbeat outlook for the world’s largest economy.

Even though the ECB is widely expected to retain its current policy at the September 3rd meeting, the Governing Council may show a greater willingness to expand/extend the scope of its quantitative easing (QE) program as the slowdown in global growth accompanied by the renewed decline in energy prices dampens the central bank’s scope to achieve its one and only mandate to achieve price stability. As a result, a more dovish statement delivered by ECB President Mario Draghi may fuel speculation for additional monetary support, and the Euro remains at risk giving back the advance from late-July should they key developments highlight a growing deviation in the policy outlook.

With only so much data prints remaining ahead of the Fed’s rate decision, the August NFP report may play an increased role in shaping market expectations, and a further expansion in U.S. job growth paired with a downtick in the unemployment rate may boost bets for a rate hike as Fed Vice-Chair Stanley Fischer argues that September remains on the table for liftoff. However, recent comments from New York Fed President William Dudley appears to be highlighting a growing dissent within the committee as the permanent voting-member sees a ‘less compelling’ case of higher borrowing-costs, and the fundamental developments due out in the coming days may set the near-term outlook for EUR/USD as the central bank remains ‘data dependent.’

In turn, the key event risk due out next week may produce a further decline in the euro-dollar, and signs of a greater divergence in the monetary policy outlook may ultimately produce a resumption of the long-term downward trend should the Fed remains on course to remove the zero-interest rate policy (ZIRP). Moreover, the euro-dollar may continue to give back the advance from late-July amid the recent series of lower highs & lows in the exchange rate along with the failure to hold above former resistance around 1.1180 (23.6% expansion) to 1.1210 (61.8% retracement).

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.