EUR/USD

The EUR/USD continued to decline down to 1.2828 in the past week, however it has also been a little above the 1.2990 level. That is why we can expect a rebound from wave A during this week. If EMA (50) is breached, we can expect a growth of EUR/USD up to wave D. If the macroeconomic news are positive, we can expect a stagnation of EUR/USD around wave A.

GBP/USD

Towards the end of last week the British Pound has adjusted its previous growth from wave B to wave A. This week we are expecting an imitation of the growth line above EMA (50) and growth between waves B and C. If the triangular level and wave A is breached, then we can expect a declining adjustment up to wave D.

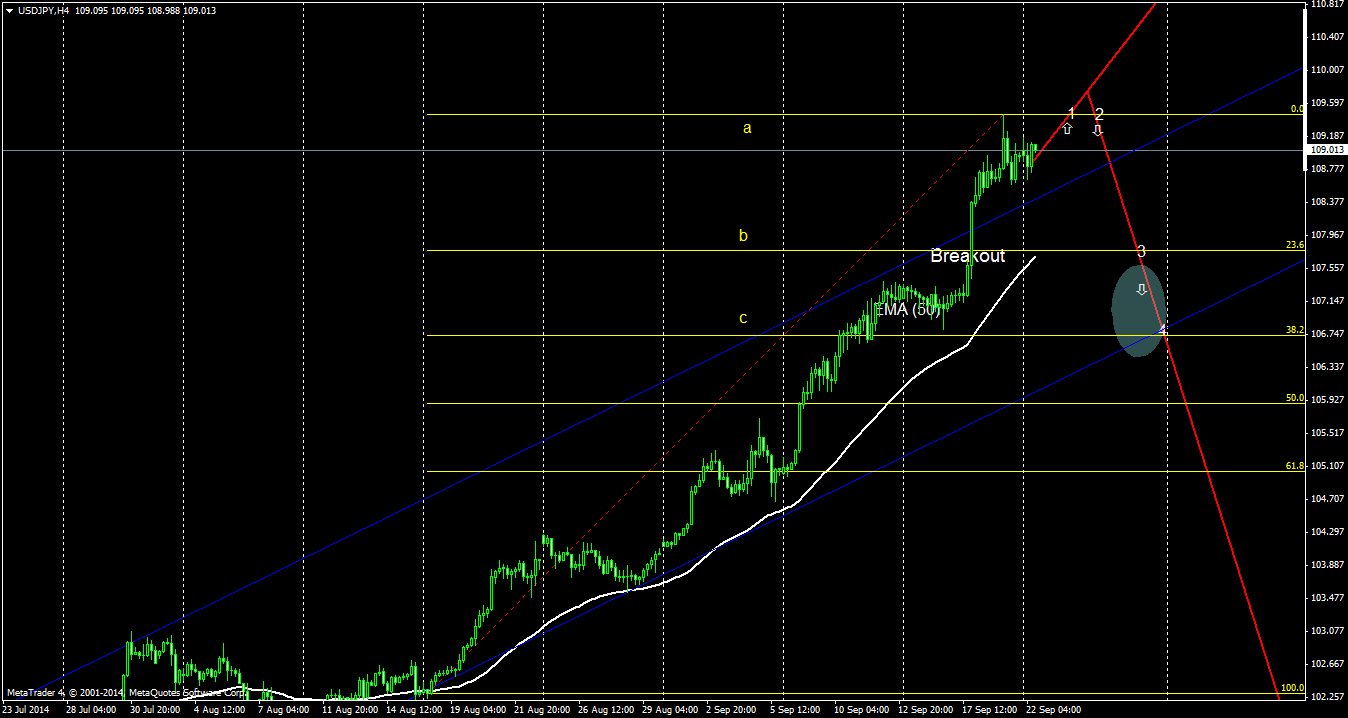

USD/JPY

Due to positive news from the American labor market the USD/JPY has grown and wave B was surpassed up to wave A. There is evidence of slight resistance forming close to wave A. If this resistance holds, then we can expect the USD/JPY to get back to the long-term growing channel and EMA (50) value. Consecutively if EMA(50) is breached, then we can expect a declining trend up to wave C.

GOLD

Gold has continued its decline towards wave A in the past week. It is currently floating below the EMA (50). This week we can expect an adjustment towards wave C. The long-term prediction is one of steady decline, and if wave A is breached we can expect a fall below 1200USD.

By utilizing this website, you agree to be bound by these terms and conditions. This is a legal agreement (“Agreement”) between you and Leconte, sro.. (“Gurulines”) for use of the website, data, Gurulines electronic trading platform, and products and services which you selected or initiated, which may include the Gurulines trading platform and third party signal providers (“Products and Services”). If you do not agree with the terms of this Agreement, do not use this website or any of the Products and Services.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.