Scottish "No" picks up momentum

Sterling try's to fill in plummeting gap

Russian Bear is not endangered

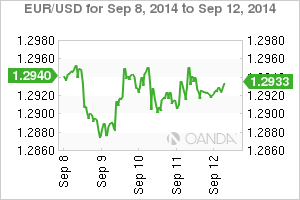

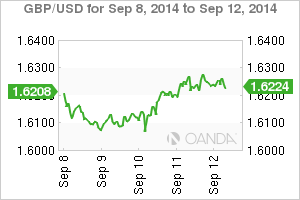

Sterling is closing out the week holding on to its late Thursday's gains (£1.6250) after another poll on Friday morning revealed a stronger "No" count for Scottish independence.

The September 11 Survation online poll for the Daily Record & Sunday Mail happens to be the same pollster that sent the pound plummeting (£1.6053) at the beginning of the week when pro-separatists took the lead. With independence odds being slashed, the short-term dump-sterling panic seems to be over for now. Currently, investors look more comfortable and willing to buy the pound on dips.

Pound Bulls Have Problems Closing the Gap

Nevertheless, the GBP bulls are struggling to close the downside gap (initial overshoot down to lows) at £1.6287 that dominates almost anyone's daily charts. The previous two-day bullish outlook, from the pound's 10-month low (£1.6053), will technically come under renewed pressure if the gap fails to be filled. At the moment, GBP's £1.6307 remains a key upside psychological barrier, while through £1.6146 the downside should be capable of handily opening up again to test the 10-month low in a hurry.

Even European bourses have found some fresh legs (FTSE 100 +0.2%, DAX +0.1%) ahead of the North American handover. Exchanges snapped a five-session losing streak after Thursday's soft U.S. economic data (unemployment claims +315k versus +304k) and the introduction of further European Union-U.S. sanctions against Russia. Perhaps next week's Federal Open Market Committee's (FOMC) outcome may again put global equities under pressure. Investors are anticipating that the Federal Reserve may soon signal a rise in its interest rate policy. If the lack of clarity remains an issue, investors will need to take it upon themselves to set the tone despite the current uptick in geopolitical pressures. Remember, Scottish voters go to the polls next Thursday, and the results will be known on Friday.

Russia's Ruble Remains on the Back Foot

There is still no reprieve for the Russian ruble after the Bank of Russia kept its benchmark rates on hold this Friday morning. The dollar again has managed to hit a new record high -- USD/RUB 37.727 -- supported by a fresh round of E.U.-imposed sanctions introduced last Monday that the U.S. reportedly matched yesterday. Details of the U.S. sanctions will be revealed later today. Obviously not helping the RUB's cause is the broad-based emerging market currency selloff in anticipation of U.S. interest rate divergence. The Fed is expected to highlight the potential change in its monetary policy next week.

What to Expect Next Week

Investors should expect the current uptick in intraday volatility to remain intact supported by geopolitical events, a few central bank meetings, and the Scottish referendum.

The Reserve Bank of Australia will kick-start the week with its Monetary Policy Meeting minutes being released on Monday. A less dovish Fed has been persecuting the carry trades despite a supporting Aussie jobs number. Investors will also attempt to decipher interest rate clues from a speech Bank of Japan Governor Haruhiko Kuroda will make. Currently, they are looking for any sign that Prime Minister Shinzo Abe is pushing for further monetary stimulus.

Scottish referendum fever continues to grip market price action, and though the odds for the country to vote to leave the U.K. has lessened, sterling's fate rests on next Thursday's Scottish independence vote. Along with the vote, expect U.K. retail sales to also occupy the Bank of England's Governor Mark Carney.

A fear of the Fed taking a more hawkish stance at its two-day meeting that ends next Wednesday is keeping both European and U.S. bond yields elevated. U.S. policymakers are expected to shed some light on plans to raise interest rates. The market will be focusing intently on the FOMC press conference after the federal-funds rate decision.

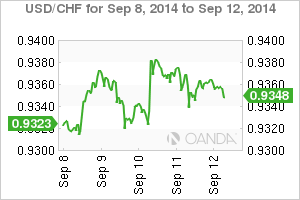

On Thursday, the Swiss National Bank (SNB) will set its Libor (London Interbank Offered Rate) though no changes are expected. However, Swiss authorities could be put to the test if the EUR's downfall escalates and encroaches on the two-year-old EUR/CHF floor at €1.2000. There is no reason to assume the appetite for SNB intervention is diminished at this point. In fact, the pressure for action has intensified.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.